UBS shares its 5 top takeaways for investors from Berkshire Hathaway's 'best annual meeting in years' — including how Warren Buffett's successor will take over

, beating expectations of $5,244 and $3.50, respectively. The strong bottom-line results were due to a dramatic improvement in insurance underwriting and insurance investment income year-over-year, while investors were pleasantly surprised by a large share buyback of $4.4 billion in the first quarter.

Berkshire's insurance giant posted a convincing beat in its underwriting business in Q1 and should continue to be profitable this year, Meredith noted. However, the analyst shaved his 2024 earnings estimate for the business due to the daunting slate of challenges it still faces. If the state escapes hurricane season scot-free, Berkshire will see a $7 billion profit on that bet, Meredith noted. Otherwise, the firm's reinsurance division will suffer heavy losses.," Meredith wrote."In our view, Berkshire is the only company with the balance sheet that can take this amount of exposure in Florida."Precision-scheduled railroading is a strategy that's gained steam in recent years among railway companies.

Instead, the Oracle of Omaha prefers to maintain a diversified energy portfolio that includes Chevron .

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Berkshire Hathaway's Charlie Munger shares AI skepticism, Warren Buffett compares tech to 'atom bomb'Berkshire Hathaway's Warren Buffett and Charlie Munger shared their thoughts on artificial intelligence at the company's annual shareholder meeting, expressing skepticism and concerns about the technology.

Berkshire Hathaway's Charlie Munger shares AI skepticism, Warren Buffett compares tech to 'atom bomb'Berkshire Hathaway's Warren Buffett and Charlie Munger shared their thoughts on artificial intelligence at the company's annual shareholder meeting, expressing skepticism and concerns about the technology.

Leer más »

Stocks making the biggest premarket moves: PacWest, Berkshire Hathaway, American Airlines, AMC and moreThese are the stocks posting the largest moves in the premarket.

Stocks making the biggest premarket moves: PacWest, Berkshire Hathaway, American Airlines, AMC and moreThese are the stocks posting the largest moves in the premarket.

Leer más »

Berkshire Hathaway sells $58.9 mln worth of shares in China's BYDBerkshire Hathaway, the investment company owned by Warren Buffett, has sold 1.96 million Hong Kong-listed shares of electric vehicle maker BYD for HK$462.09 million ($58.9 million), a stock exchange filing showed.

Berkshire Hathaway sells $58.9 mln worth of shares in China's BYDBerkshire Hathaway, the investment company owned by Warren Buffett, has sold 1.96 million Hong Kong-listed shares of electric vehicle maker BYD for HK$462.09 million ($58.9 million), a stock exchange filing showed.

Leer más »

Berkshire Hathaway shares rise as investors cheer earnings beat and Geico's quick turnaroundBerkshire Hathaway rose Monday as Warren Buffett's conglomerate won over investors with strong earnings and an insightful weekend 'Woodstock for Capitalists.'

Berkshire Hathaway shares rise as investors cheer earnings beat and Geico's quick turnaroundBerkshire Hathaway rose Monday as Warren Buffett's conglomerate won over investors with strong earnings and an insightful weekend 'Woodstock for Capitalists.'

Leer más »

Stocks making the biggest moves midday: Berkshire Hathaway, Catalent, Tyson Foods, Zscaler and moreThese are the stocks posting the largest moves in midday trading.

Stocks making the biggest moves midday: Berkshire Hathaway, Catalent, Tyson Foods, Zscaler and moreThese are the stocks posting the largest moves in midday trading.

Leer más »

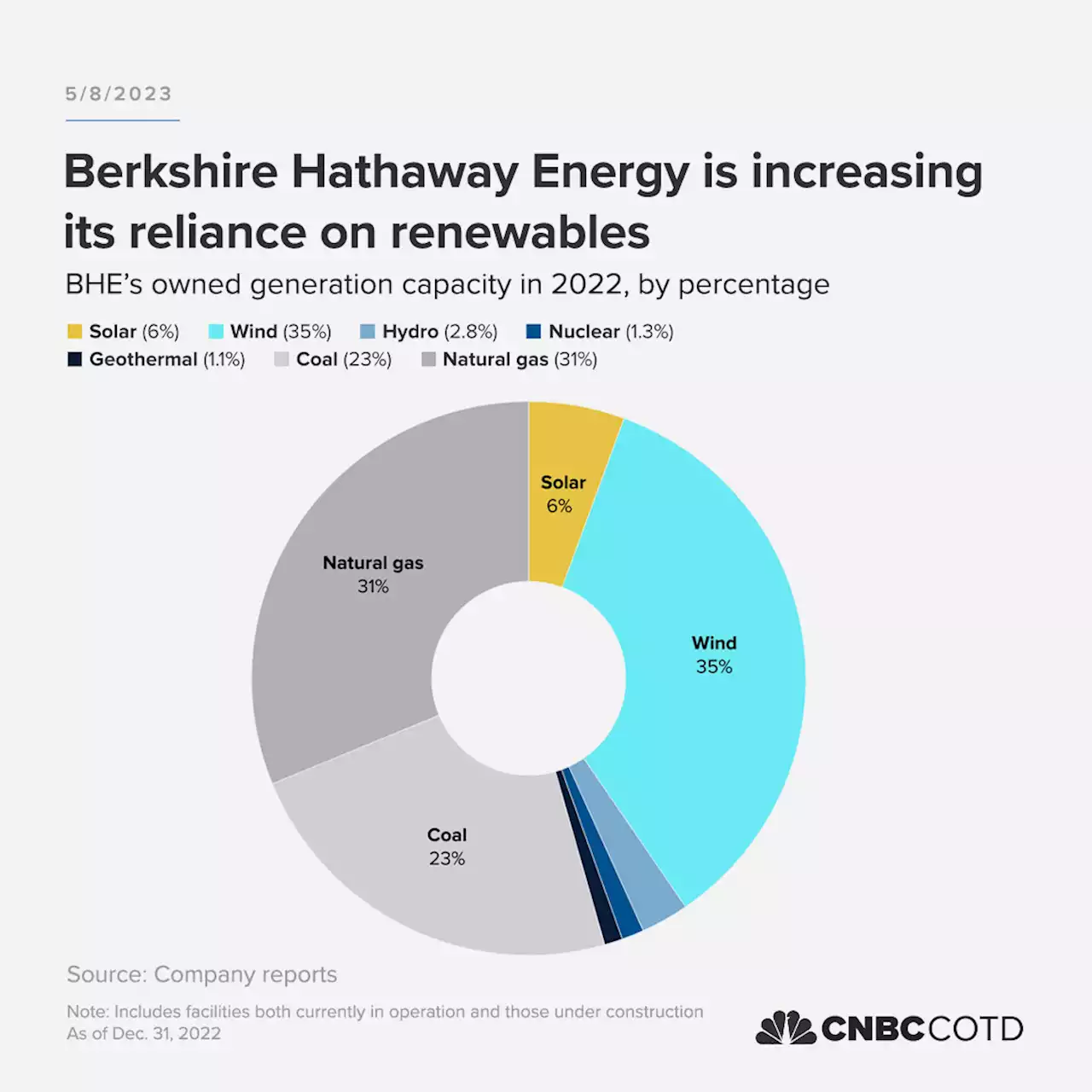

Berkshire Hathaway’s utility company is about to hit a major renewable energy milestoneBerkshire Hathaway's utility is at renewable energy power levels that surpass the national average. Climate investors still aren't happy with Warren Buffett.

Berkshire Hathaway’s utility company is about to hit a major renewable energy milestoneBerkshire Hathaway's utility is at renewable energy power levels that surpass the national average. Climate investors still aren't happy with Warren Buffett.

Leer más »