While mining stocks tend to outperform during periods of elevated inflation, gains may be curtailed by concern about China’s demand for metals.

Rampant inflation has been at the core of this year’s equities selloff and it’s not going away. Now comes the hard part: positioning for it.

In the circumstances, any signs of an easing in prices are likely to be taken positively. “It’s the direction of inflation that matters for share prices,” said Liberum Capital Ltd. strategist Joachim Klement. “Every decline in inflation reduces some of the cost pressures companies face.”Energy is the only European sector in the green this year, boosted by the surge in oil prices. And analysts aren’t ruling out further gains.

Bank of America Corp. analyst Alastair Ryan says the sector could see an 88 billion-euro boost to net interest income boost from expected rate hikes. “This very large revenue increment is why we remain positive on the banks in the face of troubles elsewhere,” he wrote in a note. “Investors appreciate the defensiveness of the sector, but at current valuation levels, many opportunities have become prohibitive,” they said.Retailers are the worst-performing industry group in Europe this year, and inflation has a lot to do with it. With budgets crimped by the cost of everything from food to energy to mortgages, consumers don’t have as much left for shopping, while rising costs are eating into profitability too.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

S&P 500 Slides Ahead of Massive “Quad-Witching” Options ExpirationS&P 500 slips after failing to break above resistance at 3980. August retail sales come in hotter than expected, 0.3% vs. 0.0% est. “Quad-witching” occurs Friday, options expiration totaling $3+ trillion.

S&P 500 Slides Ahead of Massive “Quad-Witching” Options ExpirationS&P 500 slips after failing to break above resistance at 3980. August retail sales come in hotter than expected, 0.3% vs. 0.0% est. “Quad-witching” occurs Friday, options expiration totaling $3+ trillion.

Leer más »

Asian markets follow Wall Street lower amid inflation pressureAsian stock markets followed Wall Street lower on Friday after higher-than-expected U.S. inflation dashed hopes the Federal Reserve might ease off more...

Asian markets follow Wall Street lower amid inflation pressureAsian stock markets followed Wall Street lower on Friday after higher-than-expected U.S. inflation dashed hopes the Federal Reserve might ease off more...

Leer más »

Global stocks, Wall St futures lower amid inflation pressureGlobal stocks and Wall Street futures are lower after higher-than-expected U.S. inflation dashed hopes the Federal Reserve might back away from plans for more interest rate hikes.

Global stocks, Wall St futures lower amid inflation pressureGlobal stocks and Wall Street futures are lower after higher-than-expected U.S. inflation dashed hopes the Federal Reserve might back away from plans for more interest rate hikes.

Leer más »

Bank of America warns of new lows for S&P 500 as 'inflation shock ain't over'The U.S. stock market is poised to tumble even lower in coming weeks as investors confront inflation that is still near a multi-decade high and rising interest rates.

Bank of America warns of new lows for S&P 500 as 'inflation shock ain't over'The U.S. stock market is poised to tumble even lower in coming weeks as investors confront inflation that is still near a multi-decade high and rising interest rates.

Leer más »

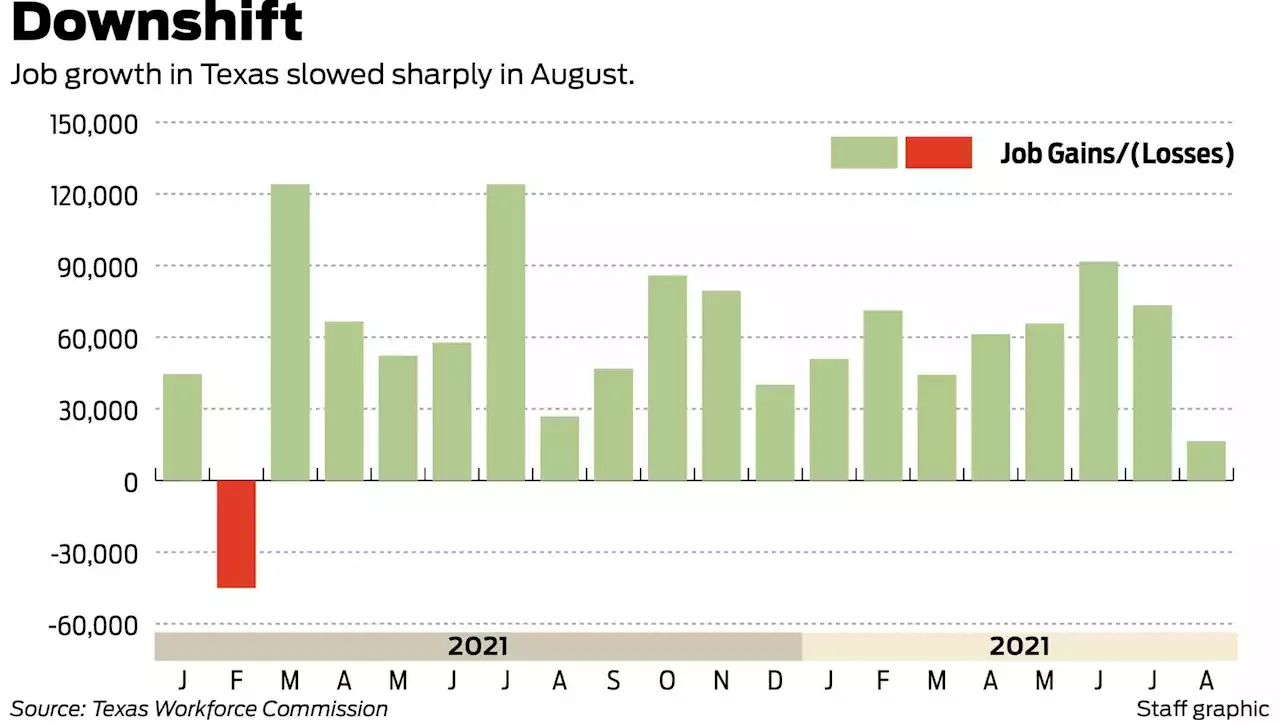

A sharp slowdown in Texas job growth suggests the labor market is normalizing as recession fears persistTexas employers added just 16,000 jobs in August, after months of scorching payroll growth

A sharp slowdown in Texas job growth suggests the labor market is normalizing as recession fears persistTexas employers added just 16,000 jobs in August, after months of scorching payroll growth

Leer más »