AAA will not renew the auto and home insurance policies for some customers in Florida, joining a growing list of insurers exiting the Sunshine State amid a growing risk of natural disasters.

Bankers Insurance and Lexington Insurance, a subsidiary of AIG, left Florida last year, saying recent natural disasters have made it too expensive to insure residents. Hurricanes Ian and Nicole devastated Florida in 2022, causing billions of dollars in damage and killing a total about about 150 people.

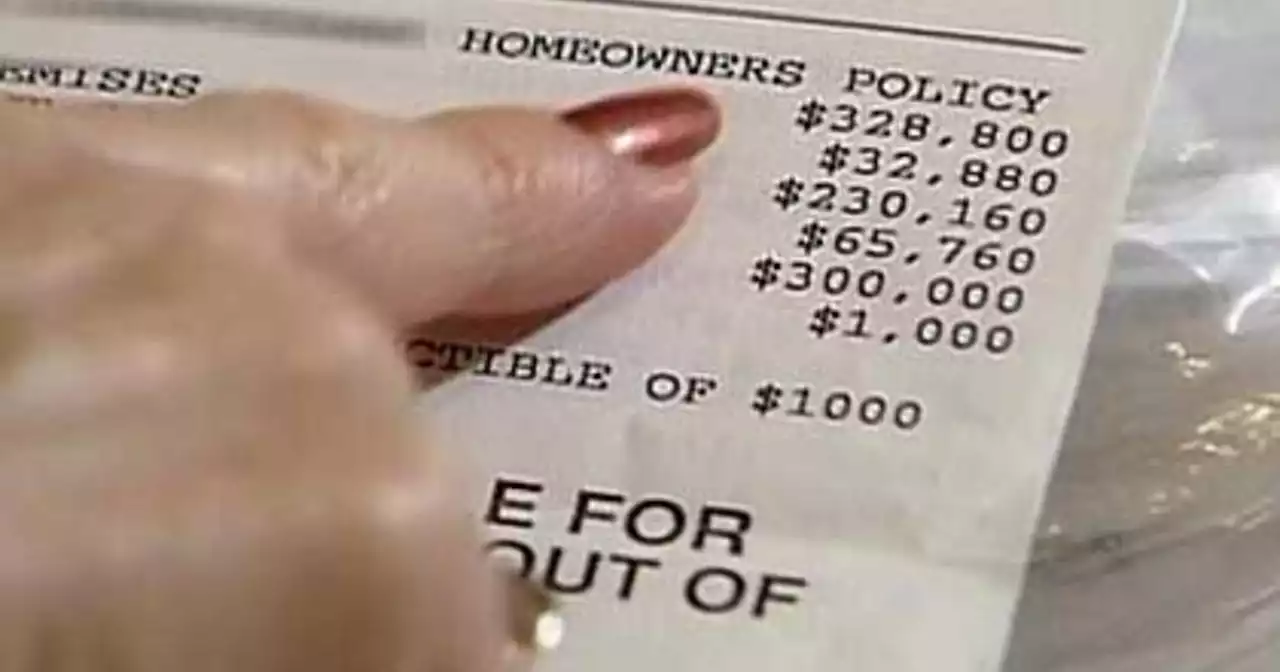

Under Florida law, companies are required to give three months' notice to the Office of Insurance Regulation before they tell customers their policies won't be renewed.Already, homeowners in the state pay about three times as much for insurance coverage as the national average, and rates this year are expected to soar about 40%.

Insurance companies are leaving Florida even as lawmakers in December passed legislation aimed at stabilizing the market. Last year, that, among other things, creates a $1 billion reinsurance fund and puts disincentives in place to prevent frivolous lawsuits. The law takes effect in October. AAA said it's encouraged by the new measure, but noted"those improvements will take some time to fully materialize and until they do, AAA, like all other providers in the state, are forced to make tough decisions to manage risk and catastrophe exposure."

Insurers are staging a similar exodus in California, where AIG, Allstate and State Farm have stopped taking on new customers, saying that

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Crisis continues: AAA Insurance set to drop ‘small percentage’ of Florida homeownersAAA Insurance says it will be issuing non-renewals for a select number of homeowners in Florida, adding to the ongoing property insurance crisis in the state.

Crisis continues: AAA Insurance set to drop ‘small percentage’ of Florida homeownersAAA Insurance says it will be issuing non-renewals for a select number of homeowners in Florida, adding to the ongoing property insurance crisis in the state.

Leer más »

Farmers Insurance Quits Covering Florida Property as Climate Crisis Worsens'As Farmers Insurance exits Florida due to concerns over increasing risk from severe weather, the insurance industry continues to prop up the fossil fuel industry,' notes Public_Citizen's CarlyFabian4.

Leer más »

‘Bud Light of insurance’: Florida official says Farmers left over ‘woke’ policiesFlorida CFO Jimmy Patronis laid blame on executives that he said care more about “woke” policies and “virtue signaling” than acting in the best interest of its customers.

‘Bud Light of insurance’: Florida official says Farmers left over ‘woke’ policiesFlorida CFO Jimmy Patronis laid blame on executives that he said care more about “woke” policies and “virtue signaling” than acting in the best interest of its customers.

Leer más »

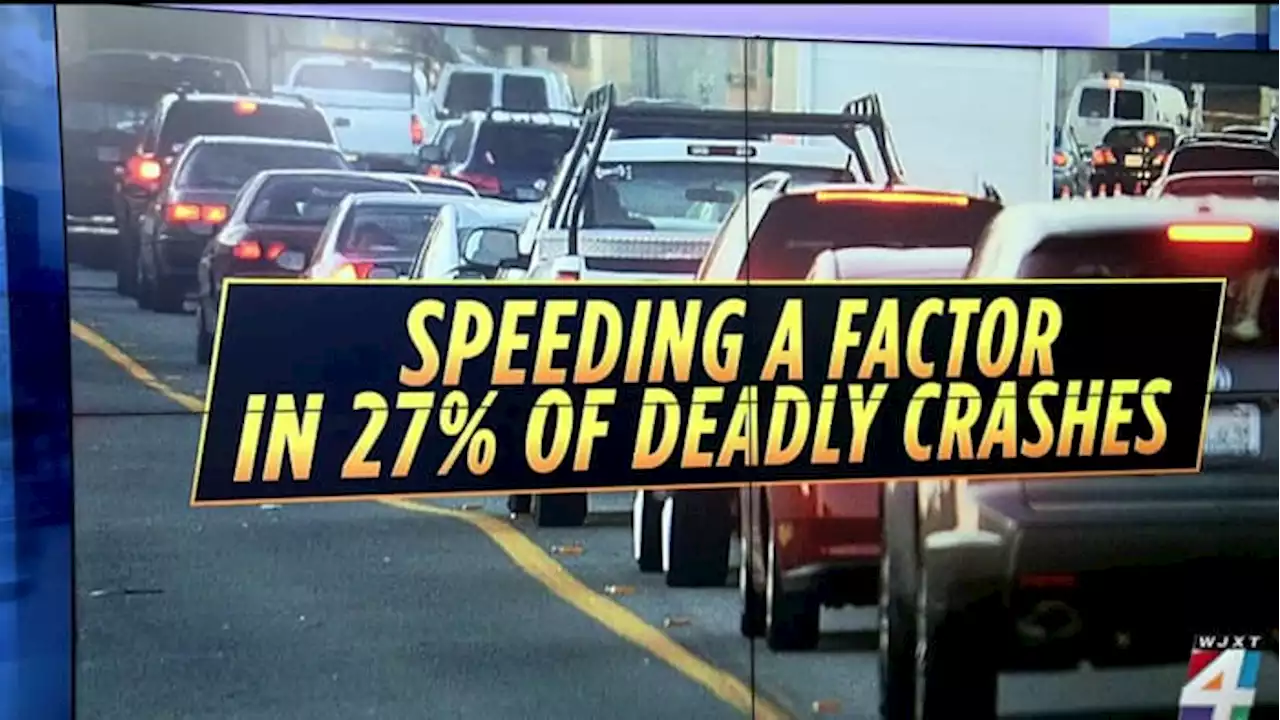

More crashes, fewer tickets: AAA tracks the impact of raising speed limits - AutoblogAAA's latest study of road and highway speed limit changes suggests that the biggest impact may be on your wallet.

More crashes, fewer tickets: AAA tracks the impact of raising speed limits - AutoblogAAA's latest study of road and highway speed limit changes suggests that the biggest impact may be on your wallet.

Leer más »

AAA: Raising posted speed limits saves little time, increases chances for deadly crashesA new study by the AAA Foundation for Traffic Safety finds that raising posted speed limits may do little to save time and increase traffic flow but could lead to more crashes, injuries, and deaths.

AAA: Raising posted speed limits saves little time, increases chances for deadly crashesA new study by the AAA Foundation for Traffic Safety finds that raising posted speed limits may do little to save time and increase traffic flow but could lead to more crashes, injuries, and deaths.

Leer más »