Will last year's outperformance continue into 2023? S&P isn't so sure.

. Standard & Poor's is releasing its annual SPIVA report on the performance of active versus passive management. This is the gold standard for this long-running debate. On the plus side for active managers: for large-cap equity fund managers , 51% underperformed their benchmarks last year.

For example, S & P 500 Growth was down 29%, but S & P 500 Value was down only 5%. Huge differences like this provide opportunities for relative outperformance. The dispersal in returns among large-cap stocks was also unusually large. In 2022 the average stock outperformed the S & P 500 as a whole, while the largest cap companies underperformed. What this means is that managers who deviated from broad-based indexes had an unusually large opportunity to outperform.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Formula 1: Everyone is still chasing Max Verstappen after his easy win in BahrainThe first race of the 2023 Formula 1 season was a lot like 2022.

Formula 1: Everyone is still chasing Max Verstappen after his easy win in BahrainThe first race of the 2023 Formula 1 season was a lot like 2022.

Leer más »

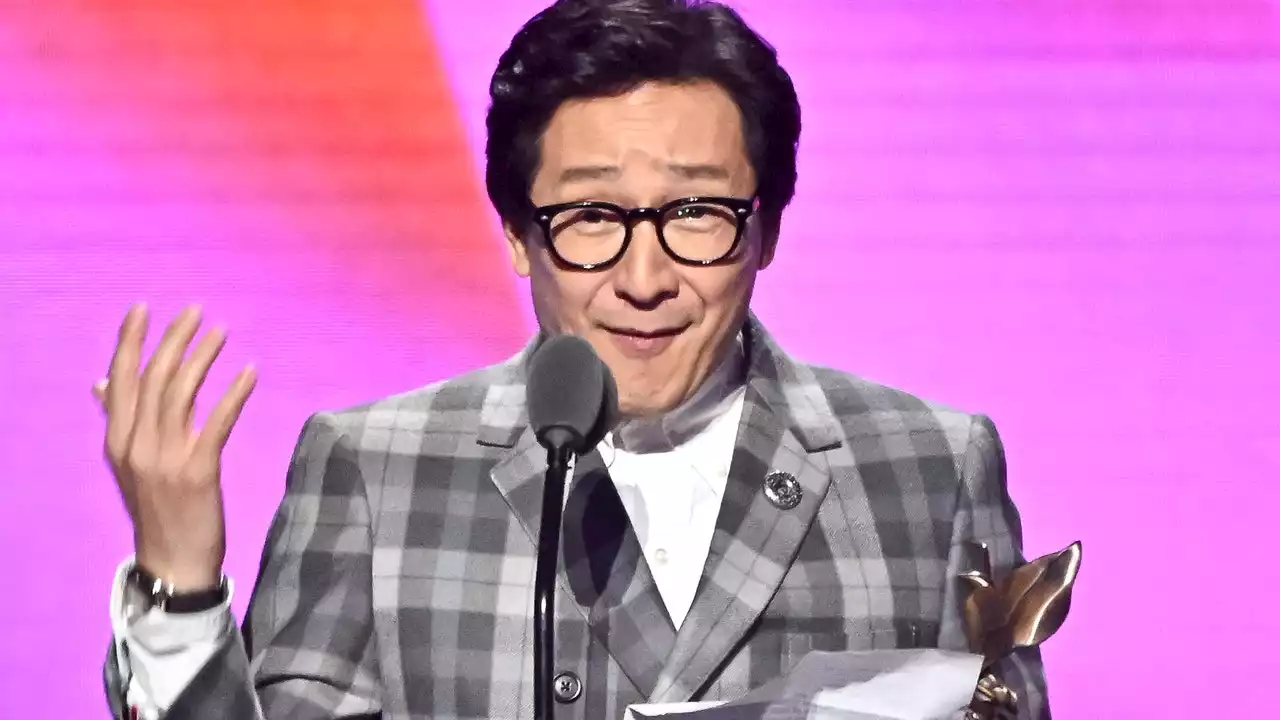

Independent Spirit Award Winners 2023: See the Full List HereThe awards that highlight some of the year’s outstanding smaller films have also nominated some Oscar heavyweights like Everything Everywhere All at Once and Tár.

Independent Spirit Award Winners 2023: See the Full List HereThe awards that highlight some of the year’s outstanding smaller films have also nominated some Oscar heavyweights like Everything Everywhere All at Once and Tár.

Leer más »

Scenes from CPAC 2023 - POLITICO

Leer más »