Australia's Central Bank (RBAInfo) is launching a number of CBDC pilot projects looking at various use cases, ranging from using USDC to streamline FX trades to securities trading. iamsandali nikhileshde report

Explore the policy fallout from the 2022 market crash, the advance of CBDCs and more.The Reserve Bank of Australia has revealed a set of projects that will develop use cases for a digital dollar, the eAUD, during its testing phase, currently underway.

The projects will look at use cases ranging from offline payments to bond settlement to securities trading, among others,In a statement, RBA Assistant Governor Brad Jones said the participants in the pilot projects include a wide array of industry representatives, from “smaller fintechs to large financial institutions.”

“The pilot and broader research study that will be conducted in parallel will serve two ends – it will contribute to hands-on learning by industry, and it will add to policy makers’ understanding of how a CBDC could potentially benefit the Australian financial system and economy,” he said.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Australian central bank to launch 'live pilot' of CBDC in coming monthsAustralia's central bank, the Reserve Bank of Australia, released its proposed use cases for a CBDC and said a live pilot would take place in the coming months.

Australian central bank to launch 'live pilot' of CBDC in coming monthsAustralia's central bank, the Reserve Bank of Australia, released its proposed use cases for a CBDC and said a live pilot would take place in the coming months.

Leer más »

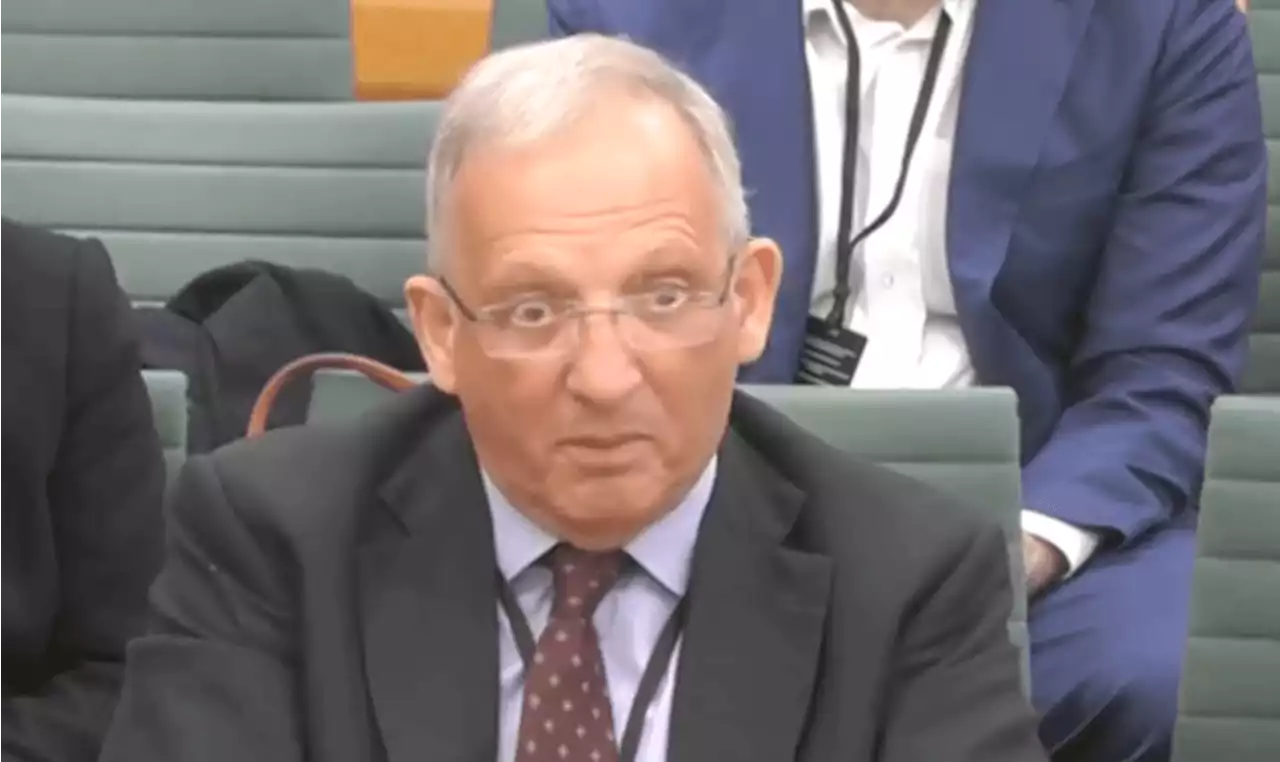

Bank of England has no tech skills to issue CBDC yet: Deputy governorThe United Kingdom is not ready to issue a digital pound just yet as the Bank of England doesn’t have enough technical expertise at the moment, according to a deputy governor.

Bank of England has no tech skills to issue CBDC yet: Deputy governorThe United Kingdom is not ready to issue a digital pound just yet as the Bank of England doesn’t have enough technical expertise at the moment, according to a deputy governor.

Leer más »

'Ambivalent and Half-Hearted': Bank of England Criticized over Approach to CBDC | CoinMarketCapIn front of MPs, Sir Jon Cunliffe refused to be drawn on the probability of a CBDC being launched. On a scale of 1 to 10, he said the likelihood was 'more than 5.'

'Ambivalent and Half-Hearted': Bank of England Criticized over Approach to CBDC | CoinMarketCapIn front of MPs, Sir Jon Cunliffe refused to be drawn on the probability of a CBDC being launched. On a scale of 1 to 10, he said the likelihood was 'more than 5.'

Leer más »

Brace for 'wrathful Old-Testament-style' central bank reaction to sticky inflationBrace for a 'wrathful Old-Testament-style' central bank reaction to sticky inflation that could cause a deep US recession, says JPMorgan

Leer más »

Stubborn inflation will remain at a very high level, German central bank president saysJoachim Nagel, president of Germany's Bundesbank, said that inflation is likely to remain high in the coming months.

Stubborn inflation will remain at a very high level, German central bank president saysJoachim Nagel, president of Germany's Bundesbank, said that inflation is likely to remain high in the coming months.

Leer más »

Silvergate Stock Plunges as Bank Says It May Face DOJ, Congressional and Bank Regulator InquiriesNEW: Silvergate Bank announced it would have to delay publishing its annual report, and hinted at increased regulatory scrutiny in a new filing. nikhileshde SteveAlpher report

Silvergate Stock Plunges as Bank Says It May Face DOJ, Congressional and Bank Regulator InquiriesNEW: Silvergate Bank announced it would have to delay publishing its annual report, and hinted at increased regulatory scrutiny in a new filing. nikhileshde SteveAlpher report

Leer más »