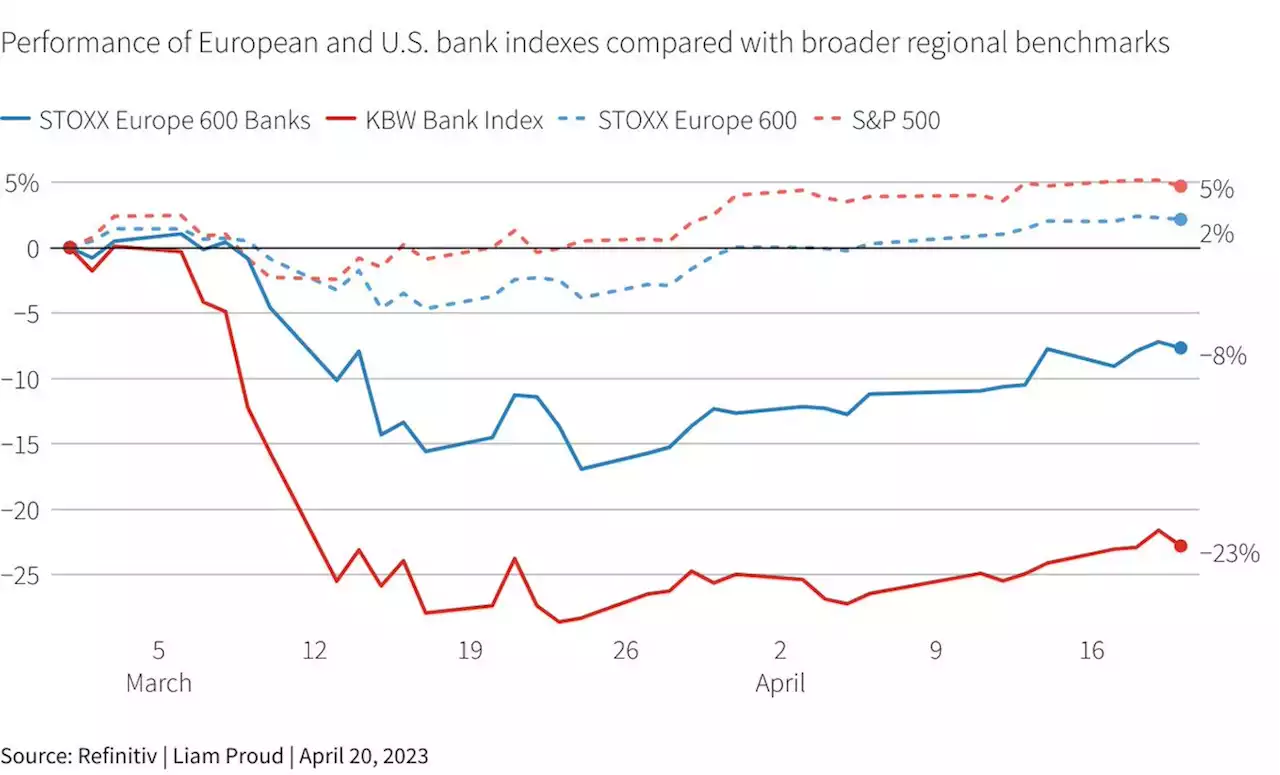

Banks were supposed to be boring after 2008. But recent collapses have exposed that vision as a fantasy, writes former analyst Rupak Ghose in a guest view

Supervisors themselves are another source of uncertainty. Lenders are uniquely important to the rest of the economy, and also politically toxic, which makes unpredictable policy moves a regular occurrence. Europe’s top bank watchdog Andrea Enriadividends and share buybacks during the pandemic, even though lenders’ capital levels had not declined to the levels at which such measures would normally kick in. More recently, U.S.

Finally, as the Californian group’s rapid collapse illustrates, banks live and die on trust. Bosses can point as much as they like to strong capital and liquidity ratios, which investors follow religiously. But, particularly in an age of social-media panics and instant money transfers, confidence and customer cash can disappear overnight. Silicon Valley Bank’s clients tried to withdraw $42 billion in a single day.

The upshot for bank investors is that seemingly low valuations might not be low enough. Just ask the Saudi National Bank

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Credit Suisse has 'learnt nothing' from 2008 crash, London court toldCredit Suisse was accused on Thursday of having 'learnt nothing' from the 2008 financial crisis on the first day of a trial at London's High Court over residential mortgage-backed securities.

Credit Suisse has 'learnt nothing' from 2008 crash, London court toldCredit Suisse was accused on Thursday of having 'learnt nothing' from the 2008 financial crisis on the first day of a trial at London's High Court over residential mortgage-backed securities.

Leer más »

Scarlett Johansson Compliments Ex Ryan Reynolds: 'He's a Good Guy'Scarlett Johansson reflects on her marriage to Ryan Reynolds: 'He's a good guy.'

Scarlett Johansson Compliments Ex Ryan Reynolds: 'He's a Good Guy'Scarlett Johansson reflects on her marriage to Ryan Reynolds: 'He's a good guy.'

Leer más »

Breakingviews - Worldline seeks to crack tough French payments nutWorldline’s boss Gilles Grapinet has spotted an opportunity to access a hard-to-crack payments market. The $12 billion group announced on Wednesday plans to set up a joint venture with French lender Crédit Agricole , which was looking for a new payments ally after ditching a past accord with bankrupt Wirecard. A partnership with Crédit Agricole will allow Worldline to enter Europe’s top market for merchant payments, which several domestic banks still handle directly. The joint venture, set to be operational in 2025, will see Worldline owning 50% plus one share, with investment of 80 million euros split between the two players.

Breakingviews - Worldline seeks to crack tough French payments nutWorldline’s boss Gilles Grapinet has spotted an opportunity to access a hard-to-crack payments market. The $12 billion group announced on Wednesday plans to set up a joint venture with French lender Crédit Agricole , which was looking for a new payments ally after ditching a past accord with bankrupt Wirecard. A partnership with Crédit Agricole will allow Worldline to enter Europe’s top market for merchant payments, which several domestic banks still handle directly. The joint venture, set to be operational in 2025, will see Worldline owning 50% plus one share, with investment of 80 million euros split between the two players.

Leer más »

Breakingviews - Allianz picks acceptable time to quit N26Allianz is striking a blow for forlorn investors of privately held startups. The $96 billion global insurer may sell all its 5% stake in N26 in a deal that values the German digital banking startup at $3 billion, the Financial Times reported on Wednesday. While that would be a 68% discount to N26’s $9 billion valuation as of October 2021, Allianz’s exit route looks agreeably straightforward.

Breakingviews - Allianz picks acceptable time to quit N26Allianz is striking a blow for forlorn investors of privately held startups. The $96 billion global insurer may sell all its 5% stake in N26 in a deal that values the German digital banking startup at $3 billion, the Financial Times reported on Wednesday. While that would be a 68% discount to N26’s $9 billion valuation as of October 2021, Allianz’s exit route looks agreeably straightforward.

Leer más »

Breakingviews - Investors can discount IMF’s emerging-market gloomEarly April in Washington is famous for two time-honoured rituals. The U.S. capital’s Tidal Basin hosts the National Cherry Blossom Festival. A few blocks further north you can hear the International Monetary Fund tell visiting finance ministers, central bankers and financiers about the dire economic outlook for emerging markets.

Breakingviews - Investors can discount IMF’s emerging-market gloomEarly April in Washington is famous for two time-honoured rituals. The U.S. capital’s Tidal Basin hosts the National Cherry Blossom Festival. A few blocks further north you can hear the International Monetary Fund tell visiting finance ministers, central bankers and financiers about the dire economic outlook for emerging markets.

Leer más »

Breakingviews - AT&T’s magic number falls shortAfter a myriad of multi-billion-dollar deals, buying then splitting off media giant Time Warner and satellite-TV operator DirecTV, AT&T is once again a simple story. The telecom company’s highest goal is to keep paying a steady dividend. To do that, it needs free cash flow. That makes this quarter’s 64% year-over-year tumble in the metric, reported Wednesday, a problem.

Breakingviews - AT&T’s magic number falls shortAfter a myriad of multi-billion-dollar deals, buying then splitting off media giant Time Warner and satellite-TV operator DirecTV, AT&T is once again a simple story. The telecom company’s highest goal is to keep paying a steady dividend. To do that, it needs free cash flow. That makes this quarter’s 64% year-over-year tumble in the metric, reported Wednesday, a problem.

Leer más »