European shares have been on the rise for seven months, outshining their U.S. counterparts, and are now just 6% below their record high. Yet the region’s companies are running out of puff, writes guerreraf72

The makeup of European equity markets also played a large role. Nearly 40% of the region’s stock market consists of so-called cyclical stocks, such as banks and industrial firms, whose fortunes tend to rise and fall with the economy. That compares with just 22% in the United States, according to JPMorgan. The current environment of high inflation, elevated interest rates and slow growth favours these companies, by enabling them to charge more for their products and services.

This supportive environment lured investors to Europe after years of indifference. What they found was a treasure trove of relative bargains. Even after the recent run, Europe’s shares trade on a multiple of 12.7 times next year’s expected earnings, according to IBES estimates, which is a 30% discount to U.S. valuations.

Sharp monetary tightening will slow growth to a trickle, dampening demand and curbing spending by households and companies. The ECBthe euro zone economy to expand by just 1% in 2023, compared with 3.6% last year. For both 2024 and 2025, the central bank projects a modest 1.6% rise in GDP. Higher rates and banking stresses will also make it more difficult and expensive for companies to access capital.

Some investors are already taking their business elsewhere. Europe-focused equity funds have suffered six consecutive weeks of outflows, according to Bank of America. Europe-focused actively-managed funds have seen total outflows of more than $18 billion in 2023 but that has been partially offset by $15.6 billion of inflows into passive funds that invest in the region.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Breakingviews - Tech groupthink could hinder AI competitionEveryone wants a piece of OpenAI, the startup behind artificial intelligence-powered chatbot ChatGPT. After raising $10 billion from technology giant Microsoft , the company has raked in another $300 million from venture capital’s leading lights, including Andreessen Horowitz and Sequoia Capital, TechCrunch reported. Its competitors may struggle to find backers with deep enough pockets to help them unseat the reigning leader.

Breakingviews - Tech groupthink could hinder AI competitionEveryone wants a piece of OpenAI, the startup behind artificial intelligence-powered chatbot ChatGPT. After raising $10 billion from technology giant Microsoft , the company has raked in another $300 million from venture capital’s leading lights, including Andreessen Horowitz and Sequoia Capital, TechCrunch reported. Its competitors may struggle to find backers with deep enough pockets to help them unseat the reigning leader.

Leer más »

Breakingviews - Jamie Dimon bails out First Republic – and FDICJamie Dimon is back at the bailout rodeo. After buying Bear Stearns 15 years ago left a bad taste in his mouth, JPMorgan’s CEO said he’d never ride to the rescue again. In the wee hours of Monday morning, however, he agreed to take mid-sized First Republic Bank out of receivership from the Federal Deposit Insurance Corp. It relieves pressure on taxpayers for now and should benefit his mega-bank’s shareholders, but suggests U.S. authorities don’t have a handle on how to rescue collapsing lenders without further entrenching a risky too-big-to-fail mentality.

Breakingviews - Jamie Dimon bails out First Republic – and FDICJamie Dimon is back at the bailout rodeo. After buying Bear Stearns 15 years ago left a bad taste in his mouth, JPMorgan’s CEO said he’d never ride to the rescue again. In the wee hours of Monday morning, however, he agreed to take mid-sized First Republic Bank out of receivership from the Federal Deposit Insurance Corp. It relieves pressure on taxpayers for now and should benefit his mega-bank’s shareholders, but suggests U.S. authorities don’t have a handle on how to rescue collapsing lenders without further entrenching a risky too-big-to-fail mentality.

Leer más »

Breakingviews - China’s Midea regains outbound deal appetiteMidea , a $58 billion Chinese white goods champion, made waves in Europe in 2016 when it bought German robot maker Kuka for nearly $5 billion. Seven years later, the company is eyeing Sweden’s home appliance brand Electrolux , a complementary asset currently worth around $7 billion including debt. A successful tilt could mark the beginning of a revival in outbound M&A by Chinese firms after offshore deals touched a historic low of $29 billion in 2022, per EY estimates.

Breakingviews - China’s Midea regains outbound deal appetiteMidea , a $58 billion Chinese white goods champion, made waves in Europe in 2016 when it bought German robot maker Kuka for nearly $5 billion. Seven years later, the company is eyeing Sweden’s home appliance brand Electrolux , a complementary asset currently worth around $7 billion including debt. A successful tilt could mark the beginning of a revival in outbound M&A by Chinese firms after offshore deals touched a historic low of $29 billion in 2022, per EY estimates.

Leer más »

Breakingviews - Hot money is cold comfort for China sharesMoney flowing into the People's Republic is getting uncomfortably hot. Chinese equities enjoyed renewed foreign interest since the start of 2023. Yet recent reversals in New York, Hong Kong and Shanghai suggest that is driven by fickle short-term funds – exactly what Beijing doesn’t want.

Breakingviews - Hot money is cold comfort for China sharesMoney flowing into the People's Republic is getting uncomfortably hot. Chinese equities enjoyed renewed foreign interest since the start of 2023. Yet recent reversals in New York, Hong Kong and Shanghai suggest that is driven by fickle short-term funds – exactly what Beijing doesn’t want.

Leer más »

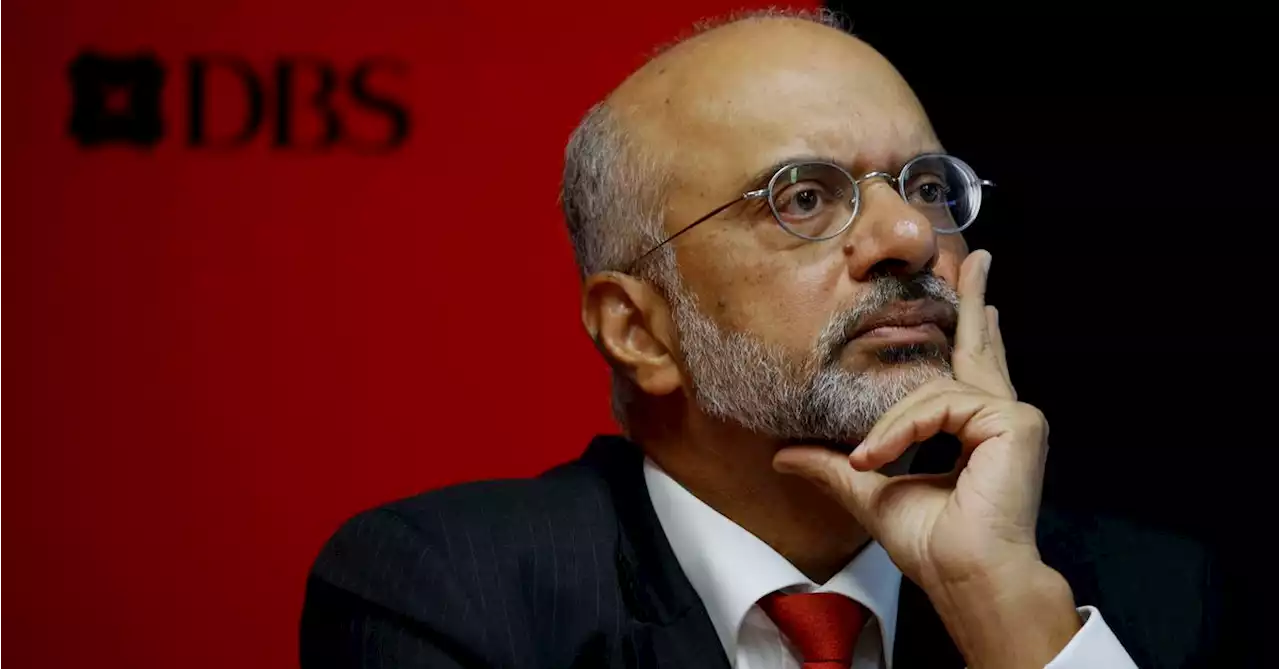

Breakingviews - DBS' safe profit haven nears its peakTop Singapore-based bank DBS on Tuesday released first-quarter numbers that will make rivals envious. The top line jumped 8% from the three months to the end of December. Expenses fell, meaning the bank used just 38% of its revenue to cover costs compared to 59% at JPMorgan . As a result, the firm run by Piyush Gupta earned almost $2 billion, with an annualised return on equity of 18.6%: both are record highs.

Breakingviews - DBS' safe profit haven nears its peakTop Singapore-based bank DBS on Tuesday released first-quarter numbers that will make rivals envious. The top line jumped 8% from the three months to the end of December. Expenses fell, meaning the bank used just 38% of its revenue to cover costs compared to 59% at JPMorgan . As a result, the firm run by Piyush Gupta earned almost $2 billion, with an annualised return on equity of 18.6%: both are record highs.

Leer más »

Breakingviews - Ending the retailers’ crisis has a high price tagHigh-street retailers are facing a heavy bill to weather the cost-of-living crisis. Executives and investors attending the World Retail Congress in Barcelona last week laid out a relatively grim outlook for the sector, where cost-conscious customers are buying sparingly and favouring engaging shopping experiences. Turning the tide requires a big spend that only the strong can afford.

Breakingviews - Ending the retailers’ crisis has a high price tagHigh-street retailers are facing a heavy bill to weather the cost-of-living crisis. Executives and investors attending the World Retail Congress in Barcelona last week laid out a relatively grim outlook for the sector, where cost-conscious customers are buying sparingly and favouring engaging shopping experiences. Turning the tide requires a big spend that only the strong can afford.

Leer más »