From Breakingviews - The end of cheap credit could hurry Japanese M&A

in a $5.9 billion deal, funded almost entirely with debt. Diversifying abroad looks attractive to many Japanese companies given weak home markets. For the $28 billion drugmaker, which already earns the bulk of its revenue from overseas, exceptionally low borrowing costs at home may have boosted its offshore appetite even more.

The country's third-largest drugmaker by sales is paying a modest-looking 22% premium to Iveric's share price before the announcement. The target's key asset, a treatment for a common cause of vision loss in the elderly, is on track to secure U.S. regulatory approval later this year. Analysts at Jefferies reckon those sales could top $85 million in its first year and peak at $2.4 billion annually by 2034.

Financing the purchase with 800 billion yen in short-term loans and commercial paper is clever and perhaps a bit aggressive. Astellas, which has been on a buying spree since 2019, sits on a net cash pile. Borrowing at the ultra-low rates available for quick-expiry debt could end up costing more if the Bank of Japan

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Astellas Pharma buys Iveric Bio for $5.9 billionJapan's Astellas Pharma said on Monday it agreed to buy U.S.-based drugmaker IVERIC Bio Inc for about $5.9 billion in its biggest acquisition, giving it access to a range of ophthalmology treatments.

Astellas Pharma buys Iveric Bio for $5.9 billionJapan's Astellas Pharma said on Monday it agreed to buy U.S.-based drugmaker IVERIC Bio Inc for about $5.9 billion in its biggest acquisition, giving it access to a range of ophthalmology treatments.

Leer más »

Breakingviews - Tech groupthink could hinder AI competitionEveryone wants a piece of OpenAI, the startup behind artificial intelligence-powered chatbot ChatGPT. After raising $10 billion from technology giant Microsoft , the company has raked in another $300 million from venture capital’s leading lights, including Andreessen Horowitz and Sequoia Capital, TechCrunch reported. Its competitors may struggle to find backers with deep enough pockets to help them unseat the reigning leader.

Breakingviews - Tech groupthink could hinder AI competitionEveryone wants a piece of OpenAI, the startup behind artificial intelligence-powered chatbot ChatGPT. After raising $10 billion from technology giant Microsoft , the company has raked in another $300 million from venture capital’s leading lights, including Andreessen Horowitz and Sequoia Capital, TechCrunch reported. Its competitors may struggle to find backers with deep enough pockets to help them unseat the reigning leader.

Leer más »

Breakingviews - Jamie Dimon bails out First Republic – and FDICJamie Dimon is back at the bailout rodeo. After buying Bear Stearns 15 years ago left a bad taste in his mouth, JPMorgan’s CEO said he’d never ride to the rescue again. In the wee hours of Monday morning, however, he agreed to take mid-sized First Republic Bank out of receivership from the Federal Deposit Insurance Corp. It relieves pressure on taxpayers for now and should benefit his mega-bank’s shareholders, but suggests U.S. authorities don’t have a handle on how to rescue collapsing lenders without further entrenching a risky too-big-to-fail mentality.

Breakingviews - Jamie Dimon bails out First Republic – and FDICJamie Dimon is back at the bailout rodeo. After buying Bear Stearns 15 years ago left a bad taste in his mouth, JPMorgan’s CEO said he’d never ride to the rescue again. In the wee hours of Monday morning, however, he agreed to take mid-sized First Republic Bank out of receivership from the Federal Deposit Insurance Corp. It relieves pressure on taxpayers for now and should benefit his mega-bank’s shareholders, but suggests U.S. authorities don’t have a handle on how to rescue collapsing lenders without further entrenching a risky too-big-to-fail mentality.

Leer más »

Breakingviews - China’s Midea regains outbound deal appetiteMidea , a $58 billion Chinese white goods champion, made waves in Europe in 2016 when it bought German robot maker Kuka for nearly $5 billion. Seven years later, the company is eyeing Sweden’s home appliance brand Electrolux , a complementary asset currently worth around $7 billion including debt. A successful tilt could mark the beginning of a revival in outbound M&A by Chinese firms after offshore deals touched a historic low of $29 billion in 2022, per EY estimates.

Breakingviews - China’s Midea regains outbound deal appetiteMidea , a $58 billion Chinese white goods champion, made waves in Europe in 2016 when it bought German robot maker Kuka for nearly $5 billion. Seven years later, the company is eyeing Sweden’s home appliance brand Electrolux , a complementary asset currently worth around $7 billion including debt. A successful tilt could mark the beginning of a revival in outbound M&A by Chinese firms after offshore deals touched a historic low of $29 billion in 2022, per EY estimates.

Leer más »

Breakingviews - Hot money is cold comfort for China sharesMoney flowing into the People's Republic is getting uncomfortably hot. Chinese equities enjoyed renewed foreign interest since the start of 2023. Yet recent reversals in New York, Hong Kong and Shanghai suggest that is driven by fickle short-term funds – exactly what Beijing doesn’t want.

Breakingviews - Hot money is cold comfort for China sharesMoney flowing into the People's Republic is getting uncomfortably hot. Chinese equities enjoyed renewed foreign interest since the start of 2023. Yet recent reversals in New York, Hong Kong and Shanghai suggest that is driven by fickle short-term funds – exactly what Beijing doesn’t want.

Leer más »

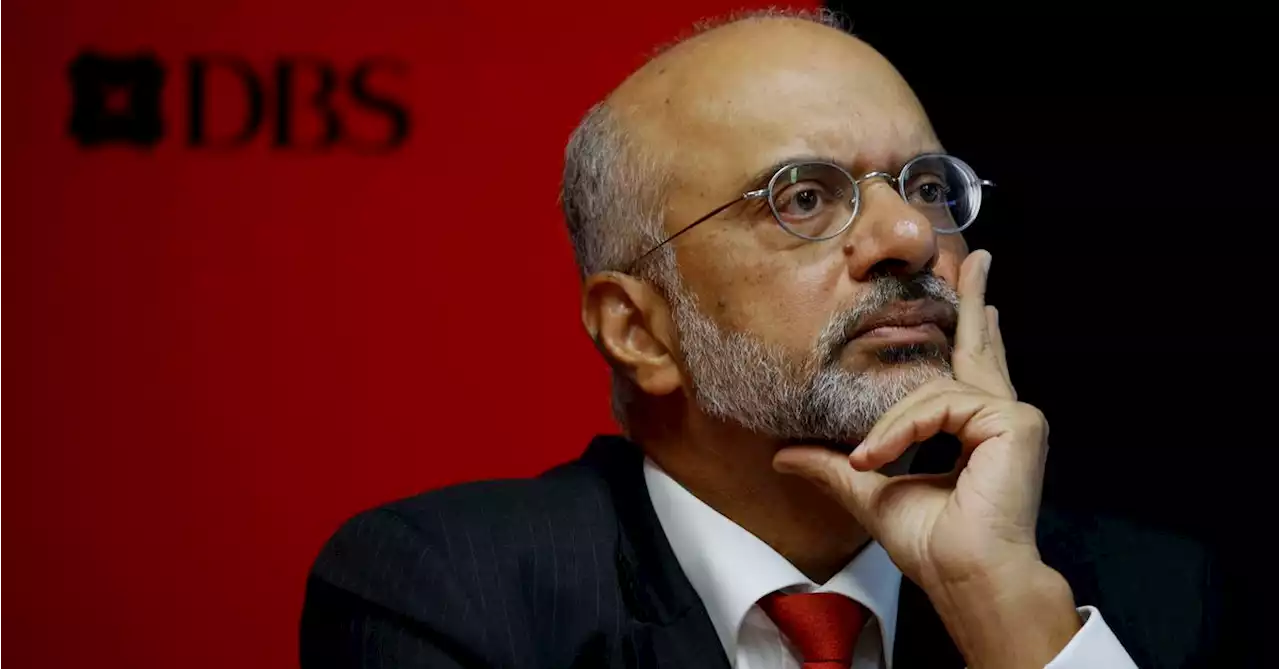

Breakingviews - DBS' safe profit haven nears its peakTop Singapore-based bank DBS on Tuesday released first-quarter numbers that will make rivals envious. The top line jumped 8% from the three months to the end of December. Expenses fell, meaning the bank used just 38% of its revenue to cover costs compared to 59% at JPMorgan . As a result, the firm run by Piyush Gupta earned almost $2 billion, with an annualised return on equity of 18.6%: both are record highs.

Breakingviews - DBS' safe profit haven nears its peakTop Singapore-based bank DBS on Tuesday released first-quarter numbers that will make rivals envious. The top line jumped 8% from the three months to the end of December. Expenses fell, meaning the bank used just 38% of its revenue to cover costs compared to 59% at JPMorgan . As a result, the firm run by Piyush Gupta earned almost $2 billion, with an annualised return on equity of 18.6%: both are record highs.

Leer más »