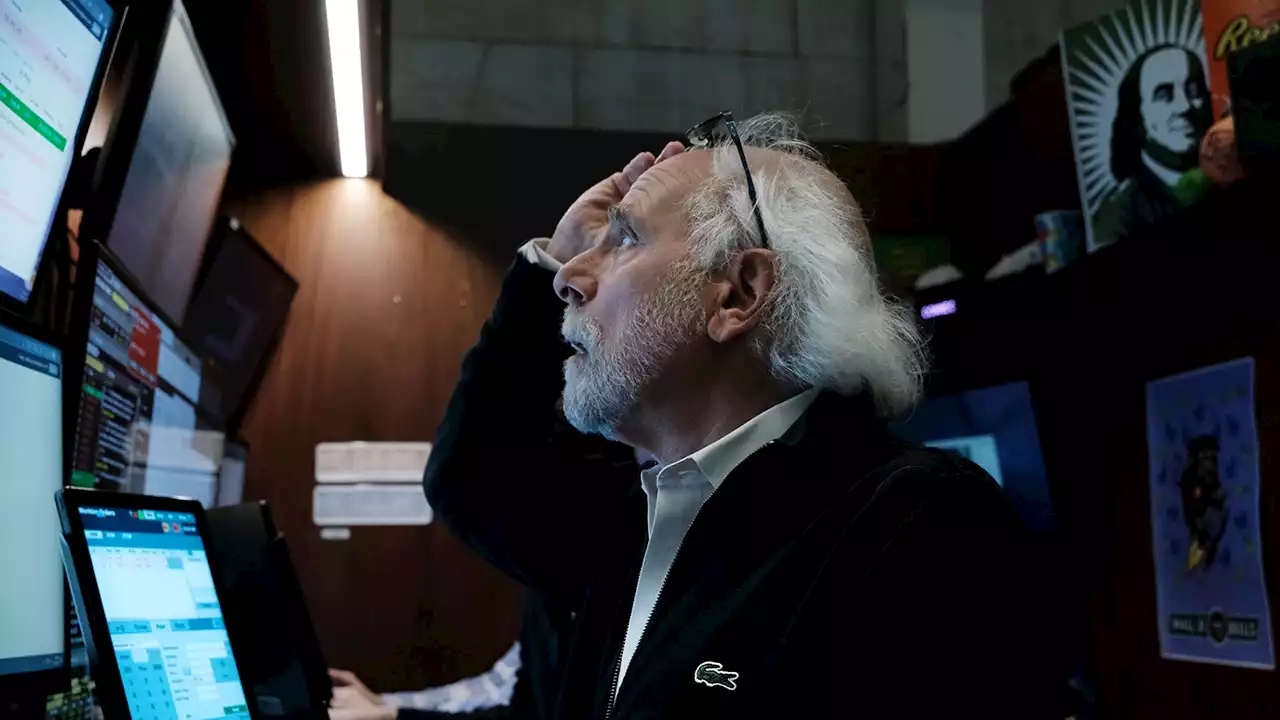

Analyst Bruno Montanari expects a 'compelling' dividend yield of 16%.

It's time to buy Petrobras on the strength of its dividend potential, Morgan Stanley said Wednesday. Analyst Bruno Montanari upgraded the Brazilian energy giant to overweight from equal weight and hiked his price target. "PBR has been a strong performer YTD, but we see further room for capital appreciation," Montanari wrote. "And the potential total return — 51% after a ~16% dividend yield — looks compelling enough to us to justify a more positive stance on the stock in 2023.

50, suggests the stock has 30% upside from Tuesday's closing price of $12.65. That bullish outlook is driven by "far less disruptive" policy changes from the government than the analyst was previously expecting, as well as lower oil prices that only bolstered the case for Petrobras. Montanari expects the firm will generate generous dividends for investors going forward.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Morgan Stanley's Mike Wilson says don’t buy this breakout, a market correction is comingThe widely followed strategist stood by his base case for S&P 500 to finish 2023 at 3,900, about 9% below the current level.

Morgan Stanley's Mike Wilson says don’t buy this breakout, a market correction is comingThe widely followed strategist stood by his base case for S&P 500 to finish 2023 at 3,900, about 9% below the current level.

Leer más »

Morgan Stanley sees an earnings wipe out ahead for Wall Street's unloved stock rallyMorgan Stanley strategist Mike Wilson still expects "a meaningful earnings recession this year (-16% year-over-year decline) that has yet to be priced...

Morgan Stanley sees an earnings wipe out ahead for Wall Street's unloved stock rallyMorgan Stanley strategist Mike Wilson still expects "a meaningful earnings recession this year (-16% year-over-year decline) that has yet to be priced...

Leer más »

Stock market rally could be derailed by an earnings slump, Morgan Stanley warnsMorgan Stanley analysts warned that the recent stock market rally could end this year as earnings per share for the benchmark index S&P 500 slide 16%.

Stock market rally could be derailed by an earnings slump, Morgan Stanley warnsMorgan Stanley analysts warned that the recent stock market rally could end this year as earnings per share for the benchmark index S&P 500 slide 16%.

Leer más »

Morgan Stanley downgrades Dollar General, says retailer not as defensive as expectedDollar General hasn't proven itself to be a quintessential defensive stock so far this year, according to Morgan Stanley.

Morgan Stanley downgrades Dollar General, says retailer not as defensive as expectedDollar General hasn't proven itself to be a quintessential defensive stock so far this year, according to Morgan Stanley.

Leer más »

Watch this natural gas stock for more than 50% upside as key pipeline gains steam, Morgan Stanley saysMorgan Stanley upgraded Equitrans Midstream on Sunday, citing progress on the Mountain Valley Pipeline.

Watch this natural gas stock for more than 50% upside as key pipeline gains steam, Morgan Stanley saysMorgan Stanley upgraded Equitrans Midstream on Sunday, citing progress on the Mountain Valley Pipeline.

Leer más »

Morgan Stanley sees slump in US earnings in 2023, sharp rebound next yearMorgan Stanley warns of a 16% drop in profit for S&P 500 companies this year, followed by a sharp rebound in 2024 when analysts say the Federal Reserve's policy will become more accommodative.

Morgan Stanley sees slump in US earnings in 2023, sharp rebound next yearMorgan Stanley warns of a 16% drop in profit for S&P 500 companies this year, followed by a sharp rebound in 2024 when analysts say the Federal Reserve's policy will become more accommodative.

Leer más »