CEXs will continue to remain relevant and wield outsized influence as the key entry point into the asset class, DBS Digital Exchange CEO Lionel Lim writes, especially as it grows in sophistication and institutional adoption. An opinion:

This month marks one year since the Terra-Luna fallout and six months since the implosion of FTX. These spectacular events, which marked the beginning and culmination of several other collapses respectively, severely shook confidence in cryptocurrencies and arguably triggered the industry’s most daunting existential crisis in its 15-year history.

into decentralized exchanges following FTX’s collapse, as well as positive reactions towards Ethereum’s proof-of-stake transition and Shapella upgrade.Yet, despite these developments, centralized digital asset exchanges will continue to remain relevant and wield outsized influence as the key entry point into the asset class, especially as it grows in sophistication and institutional adoption. After all, they remain the dominant platform when it comes to digital asset transactions.

Investors who actively manage their portfolios may also wish to rebalance their asset allocations frequently between traditional assets and digital assets. The fiat on-off ramps in CEXes thus forms a critical infrastructure layer to do so quickly, which is especially important during periods of market volatility.

, investors will find value in working with CEXes that provide dedicated hotlines or account managers.While CEXes are likely here to stay, one area where such platforms must improve on is the segregation of customer and corporate assets. Now, more than ever, scrutiny around this is mounting. Largely in response to the co-mingling of funds by FTX, a practice which led to many retail investors incurring significant losses when the exchange unraveled, policymakers like U.S.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

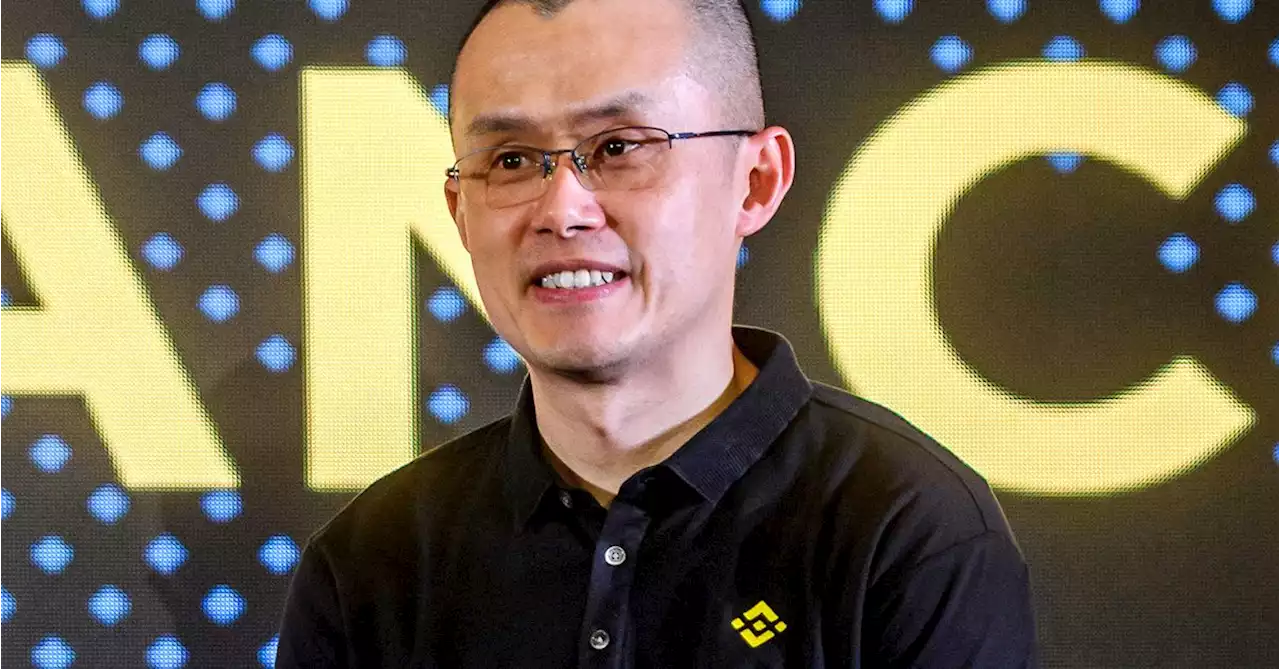

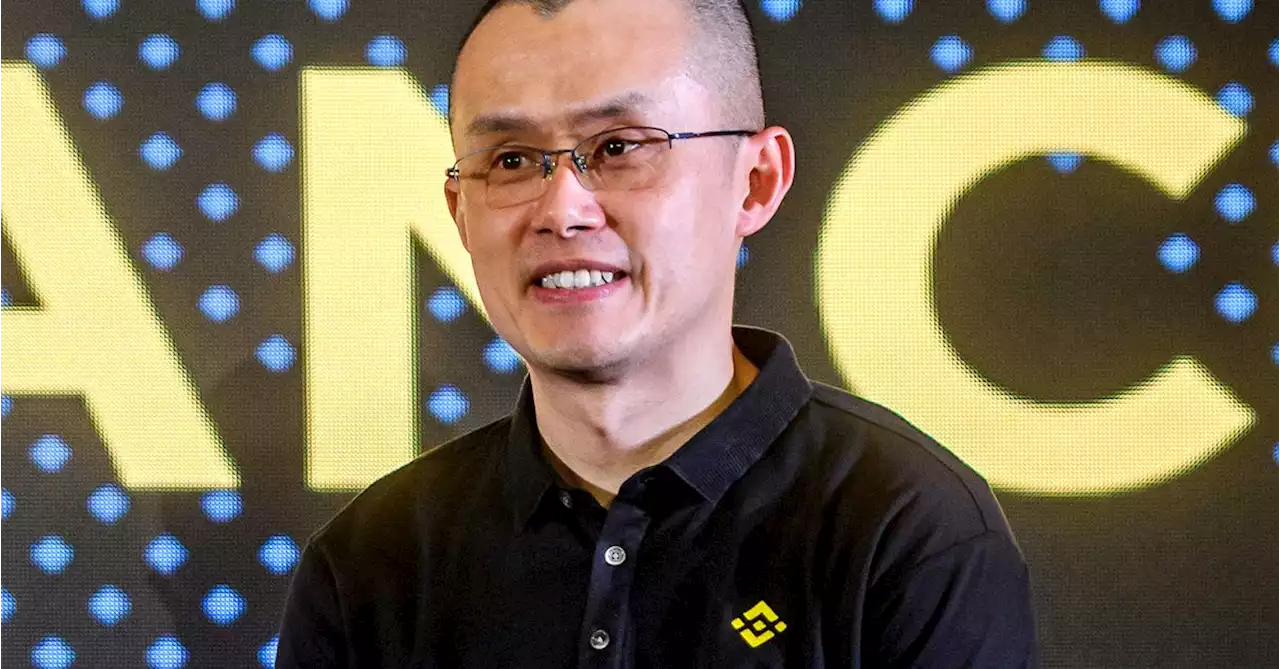

Binance Hands Rising Star Teng Key Role to Replace CEO Zhao at Largest Crypto ExchangeTaking an expanded role overseeing regional markets outside the U.S., former regulator Richard Teng wants to demonstrate Binance is “a new organization.”

Binance Hands Rising Star Teng Key Role to Replace CEO Zhao at Largest Crypto ExchangeTaking an expanded role overseeing regional markets outside the U.S., former regulator Richard Teng wants to demonstrate Binance is “a new organization.”

Leer más »

SEC Sues Crypto Exchange Binance, CEO Changpeng ZhaoBREAKING: Crypto exchange binance and CEO cz_binance sued by the SEC on allegations of violating federal securities laws. nikhileshde reports.

SEC Sues Crypto Exchange Binance, CEO Changpeng ZhaoBREAKING: Crypto exchange binance and CEO cz_binance sued by the SEC on allegations of violating federal securities laws. nikhileshde reports.

Leer más »

SEC Sues Crypto Exchange Binance, CEO Changpeng Zhao Over Multiple Securities Violation AllegationsUPDATE: The price of bitcoin has plunged under $26K as the details roll in from the SEC's suit against Binance and CZ. nikhileshde and IanAllison123 report

SEC Sues Crypto Exchange Binance, CEO Changpeng Zhao Over Multiple Securities Violation AllegationsUPDATE: The price of bitcoin has plunged under $26K as the details roll in from the SEC's suit against Binance and CZ. nikhileshde and IanAllison123 report

Leer más »

Cboe Digital receives nod for margin trades on its crypto futures exchangeCrypto options exchange Cboe Digital can now offer margined futures contracts for Bitcoin and Ether on its platform after the CFTC approved its amended application.

Cboe Digital receives nod for margin trades on its crypto futures exchangeCrypto options exchange Cboe Digital can now offer margined futures contracts for Bitcoin and Ether on its platform after the CFTC approved its amended application.

Leer más »

SEC Accuses Crypto Giant Binance of Misusing Billions in Customer FundsThe SEC has filed 13 charges against the giant crytpo exchange Binance, as well as its mysterious CEO.

SEC Accuses Crypto Giant Binance of Misusing Billions in Customer FundsThe SEC has filed 13 charges against the giant crytpo exchange Binance, as well as its mysterious CEO.

Leer más »

Linda Yaccarino finishes first day as Twitter CEO | Digital TrendsLindaYaccarino has stepped into the role earlier than expected, though that's probably because there's much work to be done.

Linda Yaccarino finishes first day as Twitter CEO | Digital TrendsLindaYaccarino has stepped into the role earlier than expected, though that's probably because there's much work to be done.

Leer más »