The recent expansion in the Fed's balance sheet may not be stimulative, some observers said, as bitcoin rose past $25,000 on QE speculation. Reports godbole17

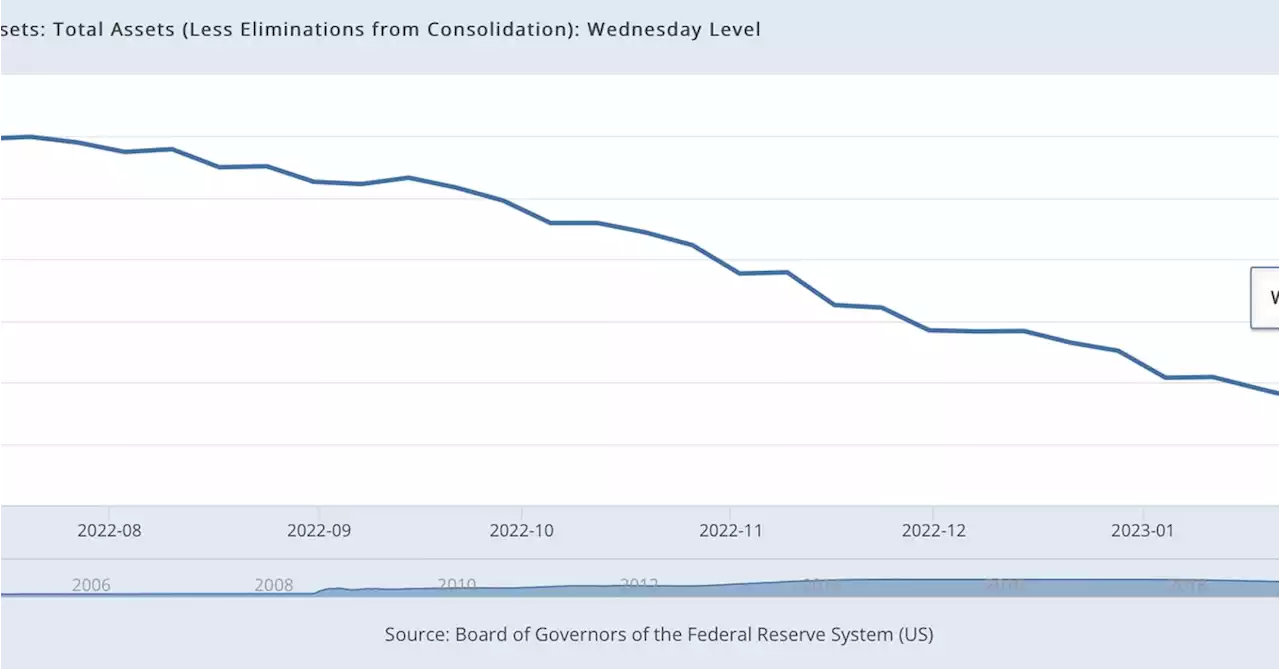

The U.S. Federal Reserve's balance sheet expanded by $297 billion to $8.63 trillion in the week of March 15, reaching the highest value since November.has restarted

However, the recent balance sheet expansion stemmed mainly from banks borrowing short-term loans from the central banks to cope with the crisis of confidence triggered by the collapse of three U.S. banks, including the start-ups focused-Silicon Valley Bank. Banks also borrowed $11.9 billion from the newly created Bank Term Funding Program , a liquidity lifeline for banks guaranteeing loans with holdings of U.S. Treasuries. This also is not a free money as borrowing banks must pay interest rates defined by the one-year overnight index swap rate plus ten basis points.

In the meantime, the Fed's holdings of Treasuries and mortgage-backed securities declined by $7 billion and $2 billion, respectively, as part of the central bank's quantitive tightening program kicked off in June last year.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Blockchain Association seeks documents on crypto 'de-banking' from FDIC, FedCEO Kristin Smith said the FOIA requests are 'intended to uncover the truth behind the potential de-banking of crypto firms in the U.S.'

Blockchain Association seeks documents on crypto 'de-banking' from FDIC, FedCEO Kristin Smith said the FOIA requests are 'intended to uncover the truth behind the potential de-banking of crypto firms in the U.S.'

Leer más »

Blockchain Association seeks info from Fed, FDIC and OCC on ‘de-banking’ crypto firmsIn the week following the closure of Signature Bank, the Blockchain Association is seeking information for 'troubling allegations' involving crypto firms and banks.

Blockchain Association seeks info from Fed, FDIC and OCC on ‘de-banking’ crypto firmsIn the week following the closure of Signature Bank, the Blockchain Association is seeking information for 'troubling allegations' involving crypto firms and banks.

Leer más »

Explaining the Signature Bank Collapse and Crypto Impact | CoinMarketCapThe past weekend saw the second most valuable stablecoin, $USDC, depeg as a result of banks failure, including Silvergate and Silicon Valley Bank. CMC discusses how and why Signature Bank collapsed, and the impact on the crypto industry.👇

Explaining the Signature Bank Collapse and Crypto Impact | CoinMarketCapThe past weekend saw the second most valuable stablecoin, $USDC, depeg as a result of banks failure, including Silvergate and Silicon Valley Bank. CMC discusses how and why Signature Bank collapsed, and the impact on the crypto industry.👇

Leer más »

Bitcoin retreats to $24,000, and NYDFS says Signature closure not tied to crypto: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Gilbert Verdian of Quant reacts to the closure of Signature and Silvergate and what it means for crypto businesses.

Bitcoin retreats to $24,000, and NYDFS says Signature closure not tied to crypto: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what's ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today's show, Gilbert Verdian of Quant reacts to the closure of Signature and Silvergate and what it means for crypto businesses.

Leer más »

Crypto Long & Short: Finding Alpha in AI-Related CryptoThere are large differences between crypto and TradFi, but the process of researching investing opportunities may not be all that different. In this week's issue of Crypto Long & Short, GWilliamsJr_CMT shares 3 AI projects.

Crypto Long & Short: Finding Alpha in AI-Related CryptoThere are large differences between crypto and TradFi, but the process of researching investing opportunities may not be all that different. In this week's issue of Crypto Long & Short, GWilliamsJr_CMT shares 3 AI projects.

Leer más »