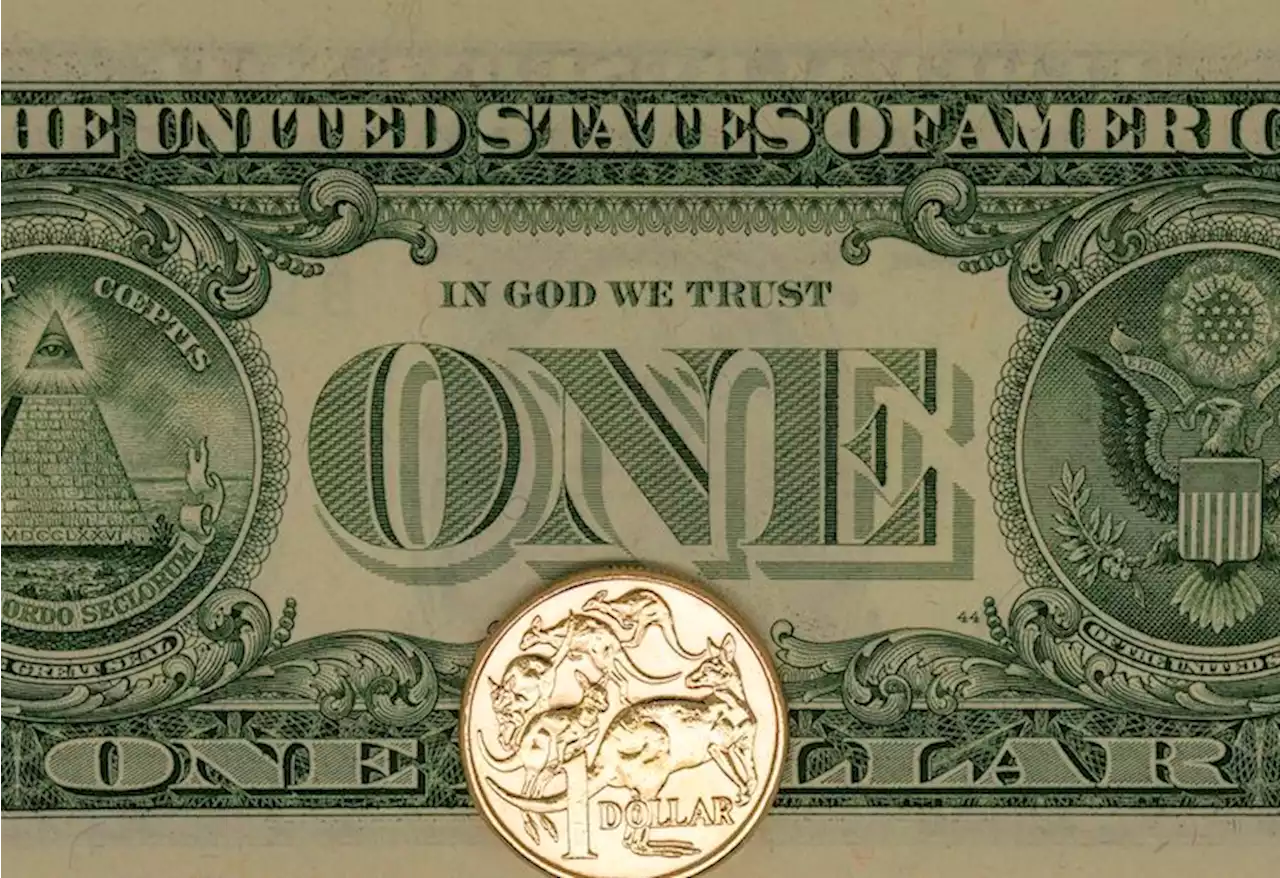

The dollar eased on Tuesday after its rally the previous day, but still hovered near a one-month peak as traders raised their forecasts of how high the U.S. Federal Reserve would need to raise interest rates to tame inflation.

"This will lift longer-term bond yields and short-term rate expectations. It will give the AUD a boost too.", which showed that nonfarm payrolls surged by 517,000 jobs in January, pointing to a stubbornly resilient labour market.

Similarly, the kiwi rose 0.29% to $0.6323, but was not far from Monday's one-month trough of $0.6271. The benchmark 10-year yields were last at 3.6192%, having similarly climbed to a four-week peak of 3.6550% in the previous session.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Dollar pauses bullish run; Aussie jumps after RBA rate decisionThe dollar eased on Tuesday from its rally at the start of the week, but hovered near a one-month peak as traders raised their forecasts of U.S. Federal Reserve interest rate levels needed to tame inflation.

Dollar pauses bullish run; Aussie jumps after RBA rate decisionThe dollar eased on Tuesday from its rally at the start of the week, but hovered near a one-month peak as traders raised their forecasts of U.S. Federal Reserve interest rate levels needed to tame inflation.

Leer más »

AUD/JPY extends recovery beyond 91.00 on better-than-forecast Aussie Retail Sales, RBA in focusAUD/JPY extends recovery beyond 91.00 on better-than-forecast Aussie Retail Sales, RBA in focus – by anilpanchal7 AUDJPY RBA RetailSales RiskAppetite Crosses

AUD/JPY extends recovery beyond 91.00 on better-than-forecast Aussie Retail Sales, RBA in focusAUD/JPY extends recovery beyond 91.00 on better-than-forecast Aussie Retail Sales, RBA in focus – by anilpanchal7 AUDJPY RBA RetailSales RiskAppetite Crosses

Leer más »

Aussie Trade Balance leaves AUD unchanged with eyes on RBAThe Aussie trade balance released by the Australian Bureau of Statistics is out as follows: Australia December balance goods/services A$+12,237 mln, s

Aussie Trade Balance leaves AUD unchanged with eyes on RBAThe Aussie trade balance released by the Australian Bureau of Statistics is out as follows: Australia December balance goods/services A$+12,237 mln, s

Leer más »

Forex Today: Aussie surges on hawkish RBA, eyes on central bank speakForex Today: Aussie surges on hawkish RBA, eyes on central bank speak – by eren_fxstreet Currencies Majors Macroeconomics Commodities CryptoCurrencies

Forex Today: Aussie surges on hawkish RBA, eyes on central bank speakForex Today: Aussie surges on hawkish RBA, eyes on central bank speak – by eren_fxstreet Currencies Majors Macroeconomics Commodities CryptoCurrencies

Leer más »

AUD/USD Price Analysis: Bears under a 78.6% target area ahead of RBAAUD/USD sold off in a huge way at the end of last week and has broken critical breakout structures along the way as the following will illustrates. Th

AUD/USD Price Analysis: Bears under a 78.6% target area ahead of RBAAUD/USD sold off in a huge way at the end of last week and has broken critical breakout structures along the way as the following will illustrates. Th

Leer más »

Australia: RBA expected to hike rates by 25 bps – UOBEconomist at UOB Group Lee Sue Ann expects the RBA to raise the OCR by 25 bps at its event on February 7. Key Quotes “Although we believe the end to t

Australia: RBA expected to hike rates by 25 bps – UOBEconomist at UOB Group Lee Sue Ann expects the RBA to raise the OCR by 25 bps at its event on February 7. Key Quotes “Although we believe the end to t

Leer más »