The world of global business standards is a deliberate and slow-moving one. That makes the recent release of the first International Sustainability Standards Board (ISSB) standards after just 18 months lightning quick, in relative terms.

, which sets out specific climate-related disclosures and is designed to be used with IFRS S1.

Disclosure scheme CDP will integrate its questionnaires to companies with ISSB from 2024, says Sue Armstrong-Brown, CDP’s global director for environmental standards and thought leadership. “There is a proliferation of reporting requirements and standards. It’s confusing for the market, and it makes it difficult to navigate.”

The potential of a global baseline has already been partially fulfilled, with both the European Union and the Securities and Exchange Commission working closely with ISSB. To cement the link between the two initiatives, the ISSB will take over responsibility for monitoring progress of companies’ climate-related disclosures from the Financial Stability Board from next year. The FSB said that the publication of the ISSB standards marked the culmination of the TCFD’s work, and the move has been welcomed by many as a further consolidation that clarifies the “alphabet soup” that plagued sustainability reporting until recently.

In addition, fewer than half of companies are reporting on their supply chain emissions, or Scope 3, even though these amount to 11.4 times their direct emissions.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Anonymous Google insider leaks exclusive watch faces for the Pixel Watch 2Watch faces that will be exclusive to the Pixel Watch 2 have been leaked by an anonymous Google Insider.

Anonymous Google insider leaks exclusive watch faces for the Pixel Watch 2Watch faces that will be exclusive to the Pixel Watch 2 have been leaked by an anonymous Google Insider.

Leer más »

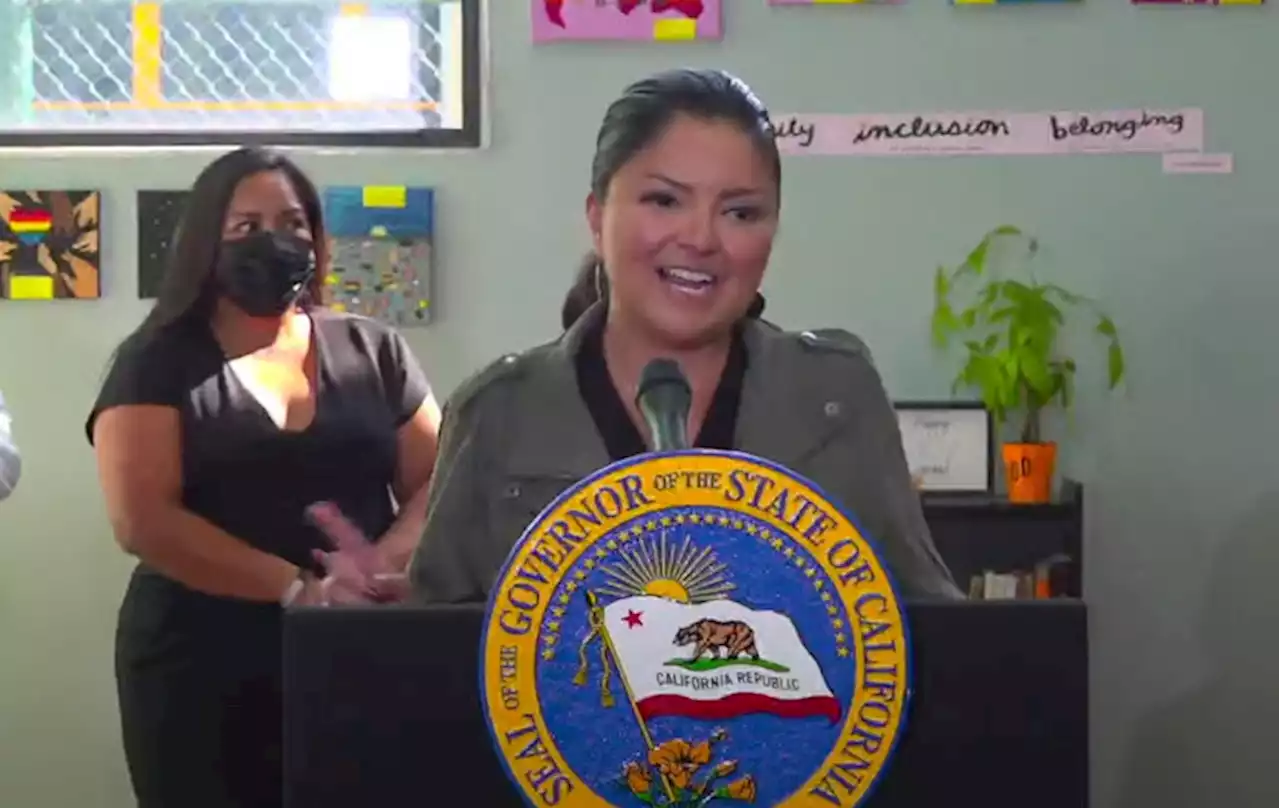

CalPERS walks tightrope on ESG principlesCalifornia taxpayers are ultimately responsible for guaranteeing that the retirement benefit promises made to public employees are kept.

CalPERS walks tightrope on ESG principlesCalifornia taxpayers are ultimately responsible for guaranteeing that the retirement benefit promises made to public employees are kept.

Leer más »

Everyday Investors Are Thriving in a World Awash in YieldAlthough it is more expensive to borrow money now than it was 18 months ago, consumers have more options to put their cash to work

Everyday Investors Are Thriving in a World Awash in YieldAlthough it is more expensive to borrow money now than it was 18 months ago, consumers have more options to put their cash to work

Leer más »

Analysis: Commercial real estate investors risk painful losses in post-COVID worldCommercial real-estate investors and lenders are slowly confronting an ugly question: If people never again shop in malls or work in offices the way they did before the COVID pandemic, how safe are the fortunes they piled into bricks and mortar?

Analysis: Commercial real estate investors risk painful losses in post-COVID worldCommercial real-estate investors and lenders are slowly confronting an ugly question: If people never again shop in malls or work in offices the way they did before the COVID pandemic, how safe are the fortunes they piled into bricks and mortar?

Leer más »

Josh Wolfe on Where Investors Will Make Money in AIInvestor Josh Wolfe joins Odd Lots to talk about where the money is heading in the booming field of AI

Josh Wolfe on Where Investors Will Make Money in AIInvestor Josh Wolfe joins Odd Lots to talk about where the money is heading in the booming field of AI

Leer más »

Pro-XRP lawyer claims SEC prioritizes corporate capitalism over investorsPro-XRP lawyer John E. Deaton believes SEC's actions against crypto prioritize corporate capitalism, hinder innovation and may favor established entities. He points out concerns about unequal treatment and SEC's reluctance to consider retail investors' perspectives.

Pro-XRP lawyer claims SEC prioritizes corporate capitalism over investorsPro-XRP lawyer John E. Deaton believes SEC's actions against crypto prioritize corporate capitalism, hinder innovation and may favor established entities. He points out concerns about unequal treatment and SEC's reluctance to consider retail investors' perspectives.

Leer más »