European banks are increasingly turning to bespoke deals with investors such as hedge funds to offload some of the risk on multi-billion euro loan portfolios and improve their financial strength, several sources involved told Reuters.

Banks supervised by the European Central Bank , the biggest ones in the euro zone, completed a record 174 billion euros of such deals last year, the regulator told Reuters.

Unlike a traditional securitisation, in which a bank's assets are moved to a separate entity that then sells securities to investors, SRTs are often "synthetic" and mimic a sale. "Investor interest has widened," said Jason Marlow, managing director in Barclays' corporate loan portfolio management team.

To minimize the risk the bank would face were the investor unable to make good on its part of the trade, cash collateral is posted to cover the potential losses whose risk has been transferred, which market sources say is key for the bank to obtain the capital relief from the regulator. The ECB, which has not published data for SRT trades in 2022, typically does not name the banks involved, the number of proposed transactions at any one time nor the likely volume.Germany's Oldenburgische Landesbank AG said last week it had entered into its first SRT and boosted its common equity Tier 1 ratio, a key measure of balance sheet strength, by 40 basis points. OLB, backed by Apollo Global Management, previously reported a CET1 ratio of 13.6% for 2022.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

European banks launch ‘sustainable’ blockchain platform for digital bondsThe platform will enable institutional clients to issue, trade, and settle bonds digitally, providing a more efficient and secure process than traditional methods.

European banks launch ‘sustainable’ blockchain platform for digital bondsThe platform will enable institutional clients to issue, trade, and settle bonds digitally, providing a more efficient and secure process than traditional methods.

Leer más »

Tesla posts record quarterly deliveries after price cuts, up 4% from Q4 By Reuters*TESLA POSTS RECORD Q1 QUARTERLY DELIVERIES OF 422,875, UP 4% FROM Q4 $TSLA

Tesla posts record quarterly deliveries after price cuts, up 4% from Q4 By Reuters*TESLA POSTS RECORD Q1 QUARTERLY DELIVERIES OF 422,875, UP 4% FROM Q4 $TSLA

Leer más »

Oil surges as OPEC+ surprise output cuts shake markets By Reuters⚠️BREAKING: *OIL SPIKES OVER 5% TO START Q2 AS SURPRISE OPEC OUTPUT CUTS SHAKE MARKETS $CL_F OOTT

Oil surges as OPEC+ surprise output cuts shake markets By Reuters⚠️BREAKING: *OIL SPIKES OVER 5% TO START Q2 AS SURPRISE OPEC OUTPUT CUTS SHAKE MARKETS $CL_F OOTT

Leer más »

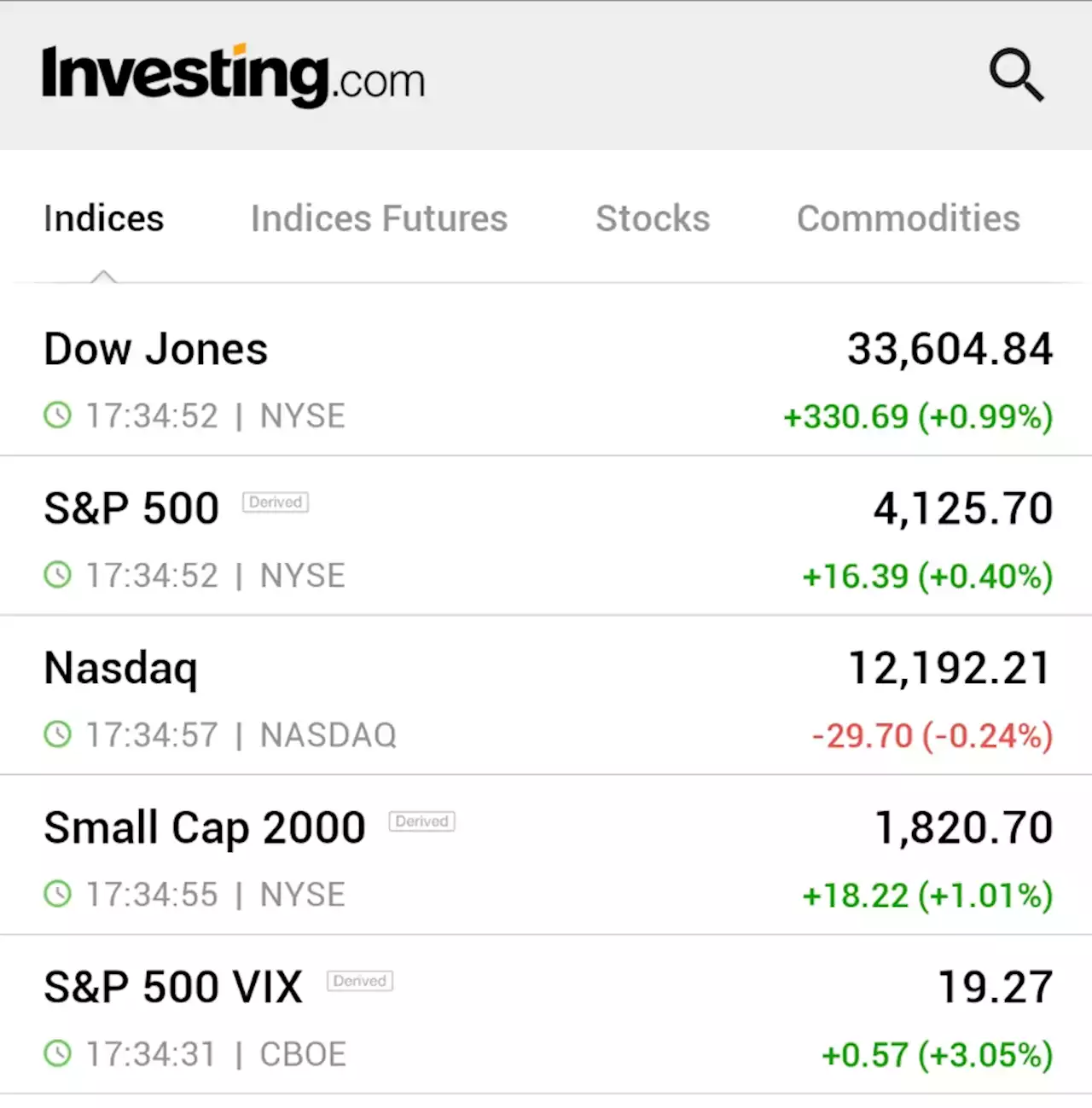

Oil prices up sharply after output cuts; stocks mixed By Reuters⚠️BREAKING: *DOW JUMPS OVER 300 POINTS AS OIL STOCKS SURGE ON OPEC+ MOVE $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Oil prices up sharply after output cuts; stocks mixed By Reuters⚠️BREAKING: *DOW JUMPS OVER 300 POINTS AS OIL STOCKS SURGE ON OPEC+ MOVE $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Leer más »

BVTV: Israel’s tech troubles | Reuters VideoPrime Minister Benjamin Netanyahu put his judicial overhaul on hold for now. But the idea may return, which would discourage foreign investors from betting on Israel’s technology firms. That’s bad news for a sector that is already facing a downturn, Karen Kwok argues.

Leer más »

Finland becomes member of NATO By Reuters*FINLAND OFFICIALLY BECOMES A MEMBER OF NATO, RUSSIA WARNS OF COUNTER-MEASURES

Finland becomes member of NATO By Reuters*FINLAND OFFICIALLY BECOMES A MEMBER OF NATO, RUSSIA WARNS OF COUNTER-MEASURES

Leer más »