'The sooner you can face the numbers and devise a plan to pay it down, the easier you'll breathe,' one financial planner said.

to hopefully restabilize the U.S. economy. In short, the Fed changes the federal funds rate, which alters the prime rate — that's the rate banks charge customers with high credit ratings. Credit card issuers add onto the prime rate to set their interest rates, so when the prime rate goes up, so does what you'll pay when you're in debt.

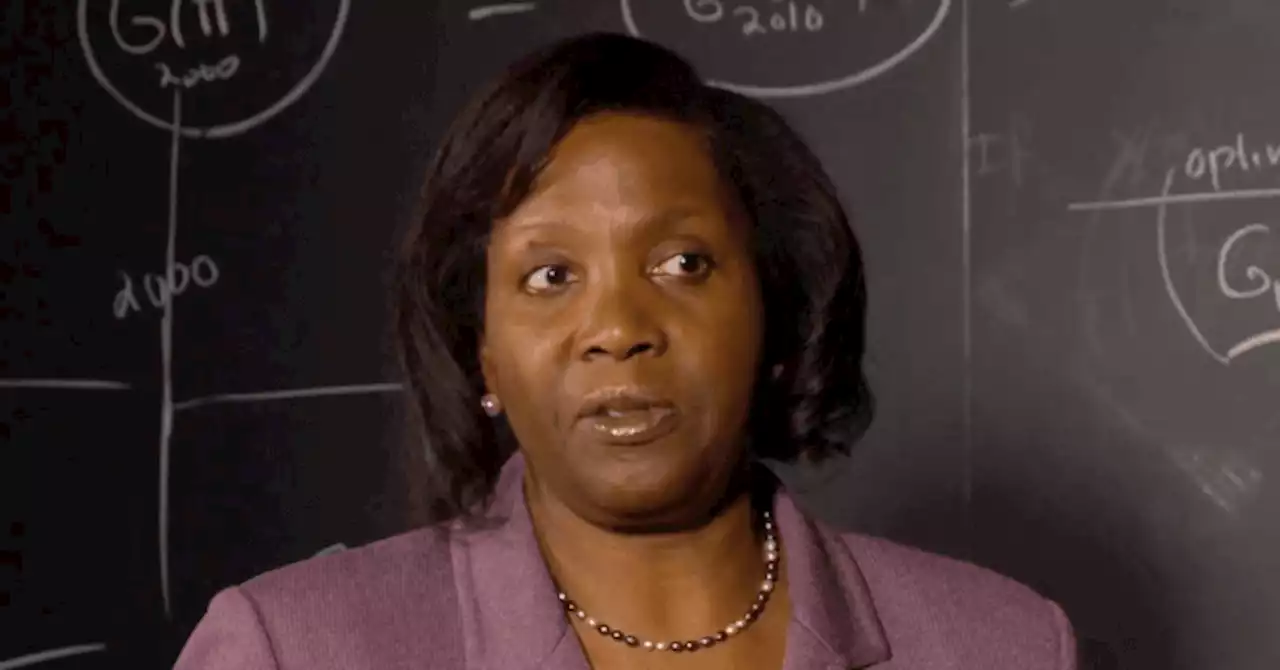

Technically, that means it's not so much a rate hike as it is a gentle uphill slope. But $800 was already a lot, and that's without accounting for the fact that you'll still need to spend additional money you might not be able to pay back. The bills don't stop just because you're in debt. "The hardest part is ripping off the Band-Aid and really just adding up the numbers to see how much you owe," said Akeiva Ellis, a certified financial planner and founder of The Bemused, a financial literacy brand for young adults."But if you're able to make it to that point, it's really all about making a plan. Don't let your debt overwhelm you. The sooner you can face the numbers and devise a plan to pay it down, the easier you'll breathe.

REVISIT YOUR BUDGET: The more money you can apply toward your monthly credit card payment, the sooner you can get out of debt. But that's easier said than done in a time of higher prices."The interest rate hike doesn't live in a vacuum," McClary said."Other things continue to happen that increase financial pressures on every American.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Democrats Discharge Biden Fed Nominee with History of BLM BullyingSenate Democrats discharged Biden Federal Reserve nominee Dr. Lisa Cook, who has a history of canceling those critical of Black Lives Matter.

Democrats Discharge Biden Fed Nominee with History of BLM BullyingSenate Democrats discharged Biden Federal Reserve nominee Dr. Lisa Cook, who has a history of canceling those critical of Black Lives Matter.

Leer más »

Ted Cruz introduces companion to Emmer's bill to exclude Fed retail CBDC digital currency issueSen. Ted Cruz and Rep. Tom Emmer’s bills would limit Federal Reserve options for a central bank digital currency.

Ted Cruz introduces companion to Emmer's bill to exclude Fed retail CBDC digital currency issueSen. Ted Cruz and Rep. Tom Emmer’s bills would limit Federal Reserve options for a central bank digital currency.

Leer más »

Mortgage Rates Approach 5% As Fed Tightens And Inflation Rattles Bond MarketsMortgage rates approached 5% on Friday, the highest daily average in more than four years, as inflation fears spooked financial markets and the Fed ended a two-year program that boosted demand for bonds containing home loans.

Mortgage Rates Approach 5% As Fed Tightens And Inflation Rattles Bond MarketsMortgage rates approached 5% on Friday, the highest daily average in more than four years, as inflation fears spooked financial markets and the Fed ended a two-year program that boosted demand for bonds containing home loans.

Leer más »

Government spending to blame for inflation spike, San Francisco Fed study saysResearchers at the Federal Reserve Bank of San Francisco say that massive government spending during the pandemic has caused U.S. inflation to surge more than in other developed economies.

Government spending to blame for inflation spike, San Francisco Fed study saysResearchers at the Federal Reserve Bank of San Francisco say that massive government spending during the pandemic has caused U.S. inflation to surge more than in other developed economies.

Leer más »

Biden's Fed picks are likely headed to Senate vote after partisan delayThe Senate moved economist Lisa Cook’s nomination for governor in the Federal Reserve System out of the banking committee to a confirmation vote with fellow prospective Fed leadership members Jerome Powell, Lael Brainard, and Philip Jefferson.

Biden's Fed picks are likely headed to Senate vote after partisan delayThe Senate moved economist Lisa Cook’s nomination for governor in the Federal Reserve System out of the banking committee to a confirmation vote with fellow prospective Fed leadership members Jerome Powell, Lael Brainard, and Philip Jefferson.

Leer más »

The Fed Can’t Save UsThere's little evidence that the Fed knows how to reduce prices without bringing the economy down with them, writes EricLevitz

Leer más »