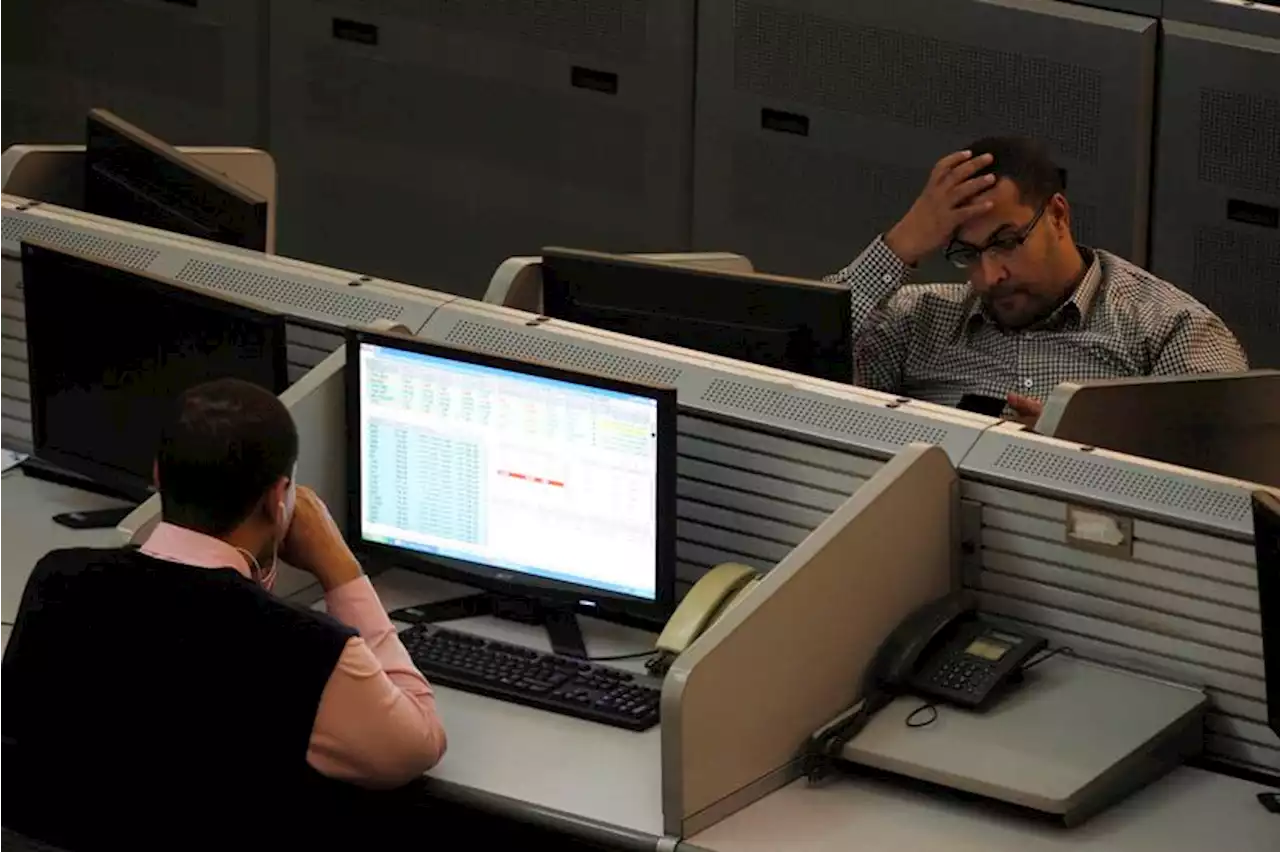

Investors took some heart from the rescue of troubled lender Credit Suisse by its Swiss rival UBS, though concerns lingered about the risk of shockwaves further damaging credit markets and smaller U.S. banks

jumped almost 11% after saying deposit outflows had stabilised and its available cash exceeded total uninsured deposits.Policymakers from Washington to Europe have repeatedly stressed that the current turmoil is different from the global financial crisis 15 years ago, pointing to banks being better capitalised and funds more easily available.

Still, top central banks promised at the weekend to provide dollar liquidity to stabilise the financial system to prevent the banking jitters from snowballing into a bigger crisis. In a global response not seen since the height of the pandemic, the Fed said it had joined central banks in Canada, Britain, Japan, the euro zone and Switzerland in a co-ordinated action to enhance market liquidity.

Traders have now increased their bets the Fed will pause its hiking cycle on Wednesday to try to ensure financial stability, but on the whole"The banking sector's near-death experience over the last two weeks is likely to make Fed officials more measured in their stance on the pace of hikes," said Standard Chartered's head of G10 FX research, Steve Englander.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Crunch time for Credit Suisse talks as UBS seeks Swiss assurances By Reuters*CRUNCH TIME FOR CREDIT SUISSE AS UBS AND SWISS REGULATORS RUSH TO SEAL TAKEOVER DEAL AS SOON AS SUNDAY: REPORTS

Crunch time for Credit Suisse talks as UBS seeks Swiss assurances By Reuters*CRUNCH TIME FOR CREDIT SUISSE AS UBS AND SWISS REGULATORS RUSH TO SEAL TAKEOVER DEAL AS SOON AS SUNDAY: REPORTS

Leer más »

UBS seeks Swiss backstop in any Credit Suisse deal - Bloomberg News By Reuters*UBS SEEKS SWISS BACKSTOP IN ANY CREDIT SUISSE DEAL $UBS $CS 🇨🇭🇨🇭

UBS seeks Swiss backstop in any Credit Suisse deal - Bloomberg News By Reuters*UBS SEEKS SWISS BACKSTOP IN ANY CREDIT SUISSE DEAL $UBS $CS 🇨🇭🇨🇭

Leer más »

Exclusive: Swiss authorities may impose losses on Credit Suisse bondholdersSwiss authorities are examining imposing losses on Credit Suisse bondholders as part of a rescue of the bank, two sources with knowledge of the matter said on Sunday.

Exclusive: Swiss authorities may impose losses on Credit Suisse bondholdersSwiss authorities are examining imposing losses on Credit Suisse bondholders as part of a rescue of the bank, two sources with knowledge of the matter said on Sunday.

Leer más »

UBS to buy troubled Credit Suisse in deal brokered by Swiss governmentBanking giant UBS will buy rival Credit Suisse in a last-minute deal brokered by Swiss officials to try and prevent a banking crisis.

UBS to buy troubled Credit Suisse in deal brokered by Swiss governmentBanking giant UBS will buy rival Credit Suisse in a last-minute deal brokered by Swiss officials to try and prevent a banking crisis.

Leer más »

Swiss government approves UBS purchase of Credit SuisseThe Swiss government announced that it approves of the UBS purchase of lender Credit Suisse and that the Central Bank of Switzerland will provide essential liquidity for both sides. Gretchen Morgenson explains if the buyout will calm the markets following a Credit Suisse stock plunge.

Swiss government approves UBS purchase of Credit SuisseThe Swiss government announced that it approves of the UBS purchase of lender Credit Suisse and that the Central Bank of Switzerland will provide essential liquidity for both sides. Gretchen Morgenson explains if the buyout will calm the markets following a Credit Suisse stock plunge.

Leer más »

UBS to buy Credit Suisse for more than $3 billion in deal backed by Swiss governmentStruggling Swiss banking giant Credit Suisse has agreed to be bought by its arch-rival UBS at a discount to Friday’s close price, after seeing a wave of customer deposits exit the bank.

UBS to buy Credit Suisse for more than $3 billion in deal backed by Swiss governmentStruggling Swiss banking giant Credit Suisse has agreed to be bought by its arch-rival UBS at a discount to Friday’s close price, after seeing a wave of customer deposits exit the bank.

Leer más »