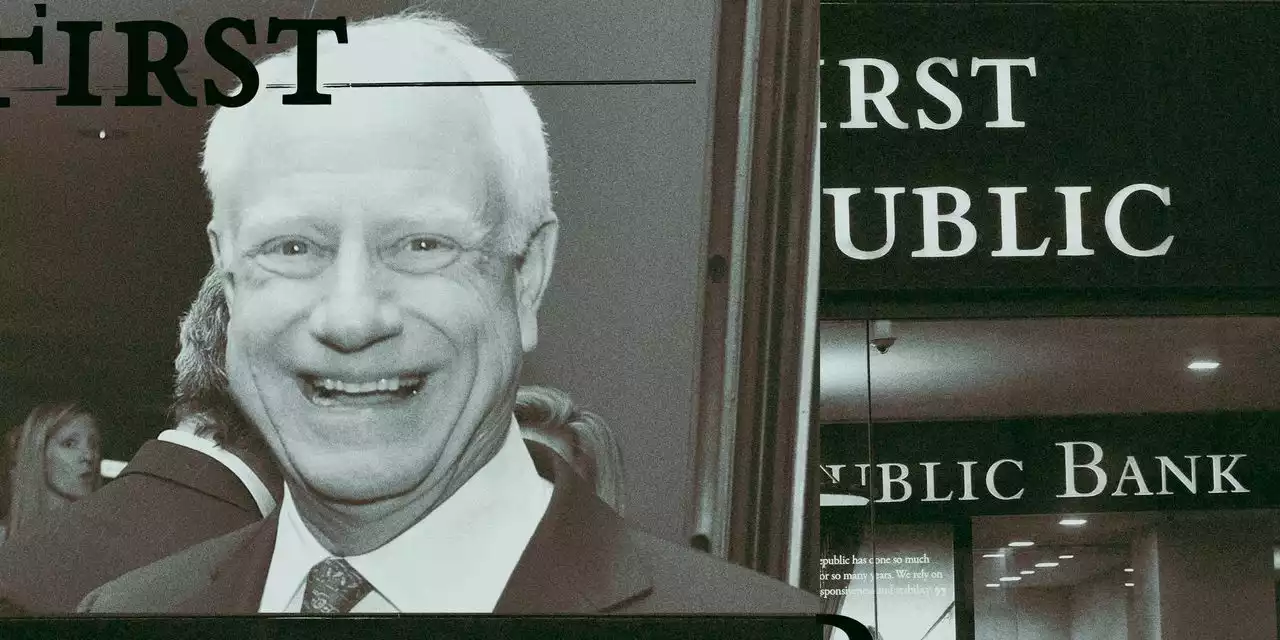

First Republic Bank’s founder James Herbert, along with his son and brother-in-law, have secured multi-million dollar paydays in recent years, an investigation from The Wall Street Journal revealed Friday.

First Republic Bank’s founder James Herbert, along with his son and brother-in-law, have secured multi-million dollar paydays in recent years, an investigation fromrevealed Friday.

The investigation comes after the bank’s recent catastrophic stock crash, with shares dropping 70 percent last week. Herbert made $17.8 million in 2021, far more than CEOs at similarly-sized banks, according to theMeanwhile, his son made $3.5 million to oversee a lending unit, and his brother-in-law's consulting company made $2.3 million for advisory work, the

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Deutsche Bank, First Republic weigh on bank stocksDeutsche Bank credit default swaps jitters weigh on big U.S. banks; First Republic stock moves lower as investors await official word of second capital...

Deutsche Bank, First Republic weigh on bank stocksDeutsche Bank credit default swaps jitters weigh on big U.S. banks; First Republic stock moves lower as investors await official word of second capital...

Leer más »

First Republic stock drops again as bank stocks trade mixedFirst Republic loses ground ranks as the most actively-traded NYSE bank stock while the sector trades mixed after heavy losses in the previous session

First Republic stock drops again as bank stocks trade mixedFirst Republic loses ground ranks as the most actively-traded NYSE bank stock while the sector trades mixed after heavy losses in the previous session

Leer más »

WSJ News Exclusive | First Republic Bank Founder Earned a Big Pay—as Did His Family MembersFirst Republic Bank paid family members of its founder, James Herbert, millions of dollars for work at the lender in recent years

WSJ News Exclusive | First Republic Bank Founder Earned a Big Pay—as Did His Family MembersFirst Republic Bank paid family members of its founder, James Herbert, millions of dollars for work at the lender in recent years

Leer más »

Stocks making the biggest moves premarket: Coinbase, AMC, Chewy, First Republic and moreThese are the stocks posting the largest moves in premarket trading.

Stocks making the biggest moves premarket: Coinbase, AMC, Chewy, First Republic and moreThese are the stocks posting the largest moves in premarket trading.

Leer más »

Here are Thursday's biggest analyst calls: Tesla, First Republic, Coinbase, Boeing, Pinterest & moreHere are Thursday's biggest calls on Wall Street.

Here are Thursday's biggest analyst calls: Tesla, First Republic, Coinbase, Boeing, Pinterest & moreHere are Thursday's biggest calls on Wall Street.

Leer más »

First Republic's marginal gains keep stock close to record-low levelsShares of First Republic Bank rose 5% on Thursday as they drew the attention of bargain-hunting retail investors, but still hovered near record-low levels on lingering fears about the future of the U.S. regional lender.

First Republic's marginal gains keep stock close to record-low levelsShares of First Republic Bank rose 5% on Thursday as they drew the attention of bargain-hunting retail investors, but still hovered near record-low levels on lingering fears about the future of the U.S. regional lender.

Leer más »