This is whittling down family incomes at the precise moment when people are grappling with higher prices.

However, families only received half of their 2021 credit on a monthly basis and the other half will be received once they file their taxes in the coming months. The size of the credit will be cut in 2022, with full payments only going to families that earned enough income to owe taxes, a policy choice that will limit the benefits for the poorest households. And the credits for 2022 will come only once people file their taxes at the start of the following year.

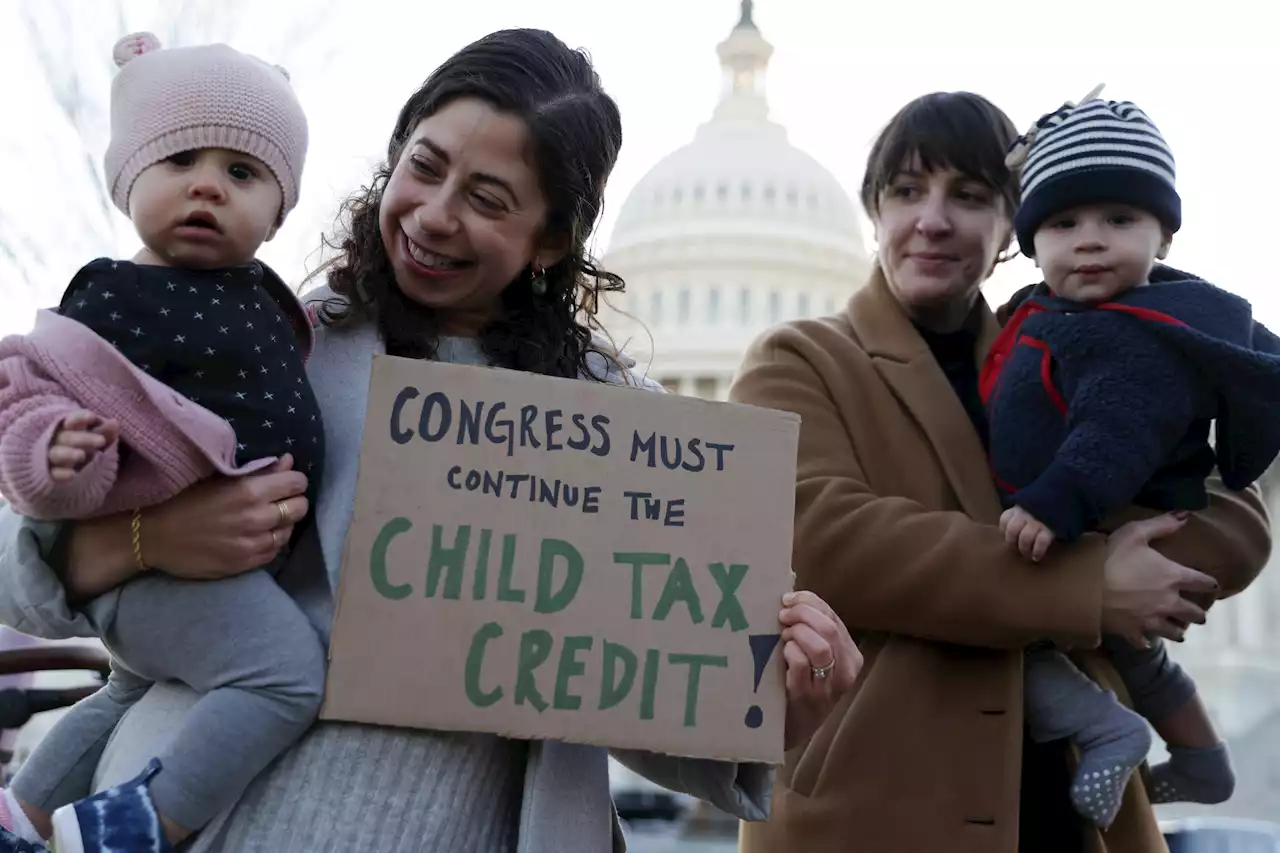

By the Biden administration’s math, the expanded child tax credit and its monthly payments were a policy success that paid out $93 billion over six months. More than 36 million families received the payments in December. The payments were $300 monthly for each child who was five and younger, and $250 monthly for children between the ages of six and 17.

“My Democratic colleagues in Washington are determined to dramatically reshape our society in a way that leaves our country even more vulnerable to the threats we face,” Manchin said. He added that he was worried about inflation and the size of the national debt.the spending patterns of recipients during September and October. Nearly a third used the credit to pay for school expenses, while about 25% of families with young children spent it on child care.

There’s an academic debate over whether the credit could suppress employment in the long term, with most studies suggesting that the impact would be statistically negligible.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Goodbye ‘Godsend': Expiration of Child Tax Credits Hits HomeFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Goodbye ‘Godsend': Expiration of Child Tax Credits Hits HomeFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Leer más »

Goodbye 'godsend': Expiration of child tax credits hits home | AP NewsCHARLESTON, W.Va. (AP) — For the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit — a program that was intended to be part of President Joe Biden's legacy but has emerged instead as a flash point over who is worthy of government support.

Goodbye 'godsend': Expiration of child tax credits hits home | AP NewsCHARLESTON, W.Va. (AP) — For the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit — a program that was intended to be part of President Joe Biden's legacy but has emerged instead as a flash point over who is worthy of government support.

Leer más »

Goodbye 'godsend': Families going without monthly deposit as child tax credit program expiresFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Goodbye 'godsend': Families going without monthly deposit as child tax credit program expiresFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Leer más »

Goodbye 'godsend': Families going without monthly deposit as child tax credit program expiresFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Goodbye 'godsend': Families going without monthly deposit as child tax credit program expiresFor the first time in half a year, families on Friday are going without a monthly deposit from the child tax credit.

Leer más »

Child tax credit, stimulus checks could make tax-filing season confusingTax filing will be confusion this year, because many people did not receive all the Stimulus Checks or Child Tax Credit checks they were entitled to in 2021.

Child tax credit, stimulus checks could make tax-filing season confusingTax filing will be confusion this year, because many people did not receive all the Stimulus Checks or Child Tax Credit checks they were entitled to in 2021.

Leer más »

‘We’re drowning’: Parents fear what’s coming with end of child tax creditAs COVID-19 cases continue to surge due to the highly contagious omicron variant, parents face uncertaintly with end of child tax credit advance payments.

‘We’re drowning’: Parents fear what’s coming with end of child tax creditAs COVID-19 cases continue to surge due to the highly contagious omicron variant, parents face uncertaintly with end of child tax credit advance payments.

Leer más »