BlackRock’s Bitcoin ETF filing only adds to the validity of Bitcoin as an asset class, and is a testament to its “staying power,” said Grayscale CEO Michael Sonnenshein.

If approved, both institutional and retail investors in the U.S. would have a simple, legally compliant way of getting exposure to the price of Bitcoin without actually owning any.

“The ETF wrapper is tried and true and it has become the access point for so many different assets, whether they’re commodities or stocks,” said Sonnenshein.Up until this point, Sonnenshein’s Grayscale has been offering U.S. investors a roundabout way of gaining exposure to Bitcoin — by enabling investors to trade shares in trusts holding large pools of Bitcoin via its Grayscale Bitcoin Trust .

Today, our attorneys filed a letter with the DC Circuit highlighting the disparity between the SEC’s approval of a leveraged

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Grayscale's Lawyers Protest SEC's Leveraged Bitcoin ETF ApprovalLawyers for Grayscale have sent a letter to a D.C. court protesting the SECgov's approval of a leveraged bitcoin-based ETF application after the SEC rejected its own spot bitcoin-based ETF application. LizKNapolitano reports

Grayscale's Lawyers Protest SEC's Leveraged Bitcoin ETF ApprovalLawyers for Grayscale have sent a letter to a D.C. court protesting the SECgov's approval of a leveraged bitcoin-based ETF application after the SEC rejected its own spot bitcoin-based ETF application. LizKNapolitano reports

Leer más »

Grayscale lawyers criticize SEC over leveraged bitcoin ETFGrayscale lawyer Donald Verrilli argued that the leveraged crypto ETF is “an even riskier investment product.'

Grayscale lawyers criticize SEC over leveraged bitcoin ETFGrayscale lawyer Donald Verrilli argued that the leveraged crypto ETF is “an even riskier investment product.'

Leer más »

Bitcoin halving bullish for Saylor’s MicroStrategy: Berenberg CapitalAnalysts from Berenberg Capital Markets say that the upcoming Bitcoin halving could be a major positive for value of shares in saylor’s enterprise analytics firm MicroStrategy.

Bitcoin halving bullish for Saylor’s MicroStrategy: Berenberg CapitalAnalysts from Berenberg Capital Markets say that the upcoming Bitcoin halving could be a major positive for value of shares in saylor’s enterprise analytics firm MicroStrategy.

Leer más »

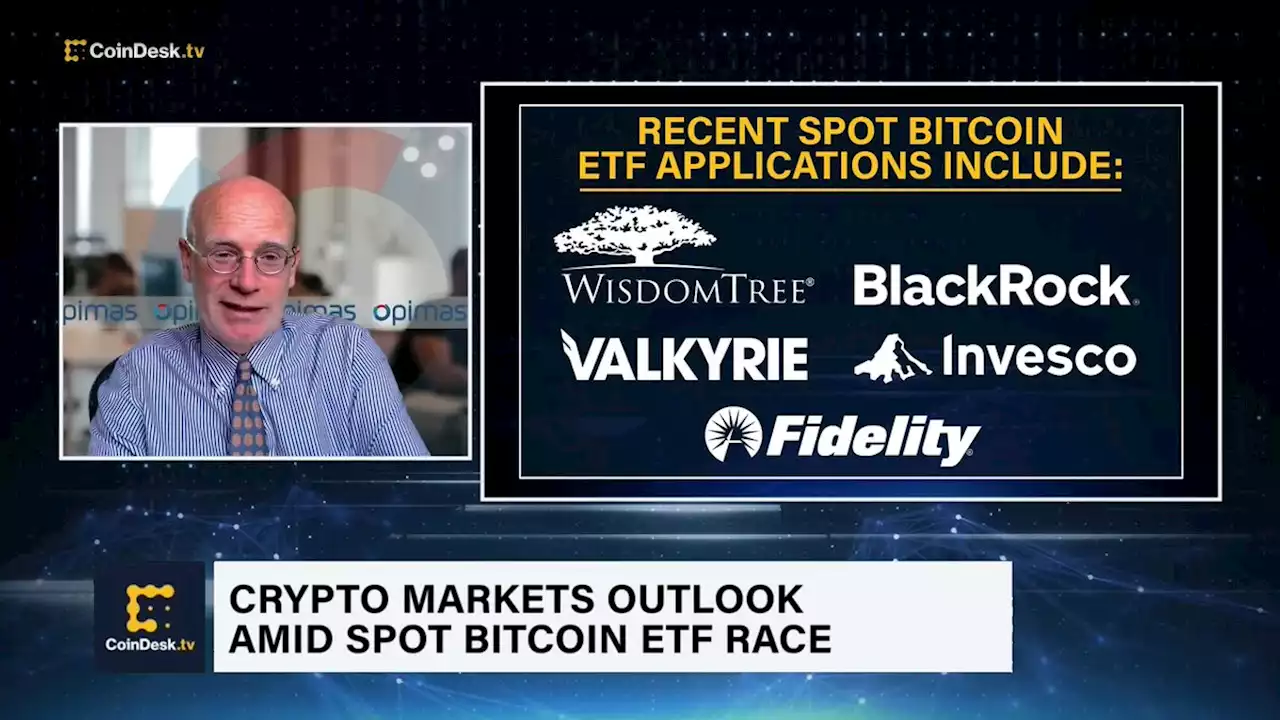

Opimas LLC CEO: BlackRock’s Spot Bitcoin ETF Filing Likely 'Dead on Arrival'Opimas LLC CEO and founder Octavio Marenzi shares his reaction to BlackRock filing for a spot bitcoin exchange-traded fund (ETF) with Coinbase as their partner in the surveillance-sharing agreements. 'They've identified a custodian for the assets that the SEC itself has said is operating illegally...I don't quite see how BlackRock makes this happen,' Marenzi said.

Opimas LLC CEO: BlackRock’s Spot Bitcoin ETF Filing Likely 'Dead on Arrival'Opimas LLC CEO and founder Octavio Marenzi shares his reaction to BlackRock filing for a spot bitcoin exchange-traded fund (ETF) with Coinbase as their partner in the surveillance-sharing agreements. 'They've identified a custodian for the assets that the SEC itself has said is operating illegally...I don't quite see how BlackRock makes this happen,' Marenzi said.

Leer más »

Grayscale lawyers refer to SEC allowing Volatility Shares' investment vehicle in push for ETFThe attorney behind Grayscale's lawsuit with the SEC called on the court to consider Volatility Shares' leveraged Bitcoin ETF in its push to launch a spot crypto investment vehicle.

Grayscale lawyers refer to SEC allowing Volatility Shares' investment vehicle in push for ETFThe attorney behind Grayscale's lawsuit with the SEC called on the court to consider Volatility Shares' leveraged Bitcoin ETF in its push to launch a spot crypto investment vehicle.

Leer más »

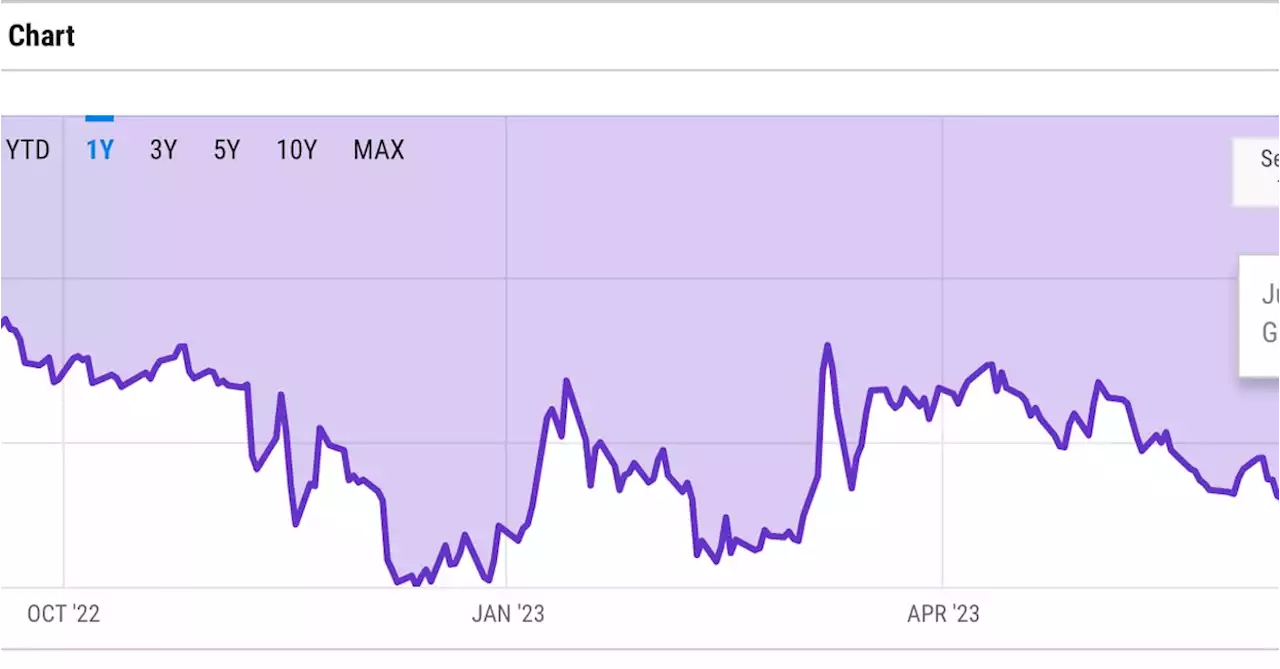

Grayscale Bitcoin Trust Discount Narrows to Lowest Since May 2022The discount to net asset value for the $19 billion-plus Grayscale Bitcoin Trust $GBTC continues to narrow in the wake of asset manager BlackRock’s $BLK application to open a spot bitcoin ETF in the United States. LedesmaLyllah writes

Grayscale Bitcoin Trust Discount Narrows to Lowest Since May 2022The discount to net asset value for the $19 billion-plus Grayscale Bitcoin Trust $GBTC continues to narrow in the wake of asset manager BlackRock’s $BLK application to open a spot bitcoin ETF in the United States. LedesmaLyllah writes

Leer más »