Our call of the day from Kevin Muir of the Macro Tourist blog takes us through what markets did after final Fed hikes, with some surprising stock winners.

Stock futures are pointing to a mixed start as investors ponder the 10th straight, and perhaps final, Federal Reserve interest-hike. A European Central Bank meeting, data, earnings from Apple and others, and more bank stress make up a frenetic Thursday.

Elsewhere, JonesTrading’s chief market strategist Mike O’Rourke said he’s “stunned” that Powell has now “hiked twice in the face of sizable bank failures. While we would agree these challenges are far less severe than 2008, we also believe discretion is still the better part of valor,” he told clients.

But on the fourth day, markets stop falling and two weeks later stocks are up, meaning investors just take a few days to digest the rate hike and start to move on.The big takeaway here, says Muir, is that investors should not rush out to buy right away, but hold their fire for a couple of weeks, if things go to script. He also looked at bonds and found things bullish across the boards with falling yields, but only on week 3 and 4 after the last hike.

The markets U.S. stock futures ES00 YM00 NQ00 are bouncing around after Wednesday’s post-Fed decision decline, and Treasury yields TMUBMUSD02Y continue to tumble, with the 10-year note TMUBMUSD10Y at 3.36%. Crude-oil futures CL.1 are higher, just below $70 per barrel. The dollar DXY is flat and gold GC00 and silver SI00 are higher.

The buzz PacWest PACW shares are down 38%. The lender issued a statement saying deposits are rising and confirmed it’s in talks with potential investors or partners. A late plunge in shares came Wednesday on a Bloomberg News report of a possible sale. Western Alliance Bancorp WAL and Zions Bancorp ZION are down 17% and 9%, respectively.

Bud Light problem? Anheuser Busch BUD ABI reported a jump in profits. Moderna MRNA , Peloton PTON , Cardinal Health, Stanley Black & Decker SWK also report results. Then it’s a huge after-hours lineup, with Apple AAPL , DoorDash DASH , Lyft LYFT , Shopify SHOP , Coinbase COIN , DraftKings DKNG , AIG AIG , Bumble BMBL , GoDaddy GDDY and Fortinet FTNT to name a few.Lemonade stock LMND is up 12% after upbeat results from the online insurance group.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Fed playbook: Which stocks to buy or sell depending on what the Fed doesCNBC Pro screened for names screened that are the most sensitive to interest rates by looking at the 100-day correlation between each S&P 500 stock and SHY ETF.

Fed playbook: Which stocks to buy or sell depending on what the Fed doesCNBC Pro screened for names screened that are the most sensitive to interest rates by looking at the 100-day correlation between each S&P 500 stock and SHY ETF.

Leer más »

Fed's Powell: don't assume Fed can shield U.S. economy from debt limit defaultThe U.S. Federal Reserve is unlikely to be able to protect the U.S. economy from the damage caused by a failure to raise the federal debt ceiling, Fed Chair Jerome Powell said on Wednesday, adding that the government should never be in a position where it is unable to pay all of its bills.

Fed's Powell: don't assume Fed can shield U.S. economy from debt limit defaultThe U.S. Federal Reserve is unlikely to be able to protect the U.S. economy from the damage caused by a failure to raise the federal debt ceiling, Fed Chair Jerome Powell said on Wednesday, adding that the government should never be in a position where it is unable to pay all of its bills.

Leer más »

Forex Today: US Dollar rally fades ahead of key US data, Fed policy decisionsForex Today: US Dollar rally fades ahead of key US data, Fed policy decisions – by eren_fxstreet Currencies Majors Macroeconomics Fed Commodities

Forex Today: US Dollar rally fades ahead of key US data, Fed policy decisionsForex Today: US Dollar rally fades ahead of key US data, Fed policy decisions – by eren_fxstreet Currencies Majors Macroeconomics Fed Commodities

Leer más »

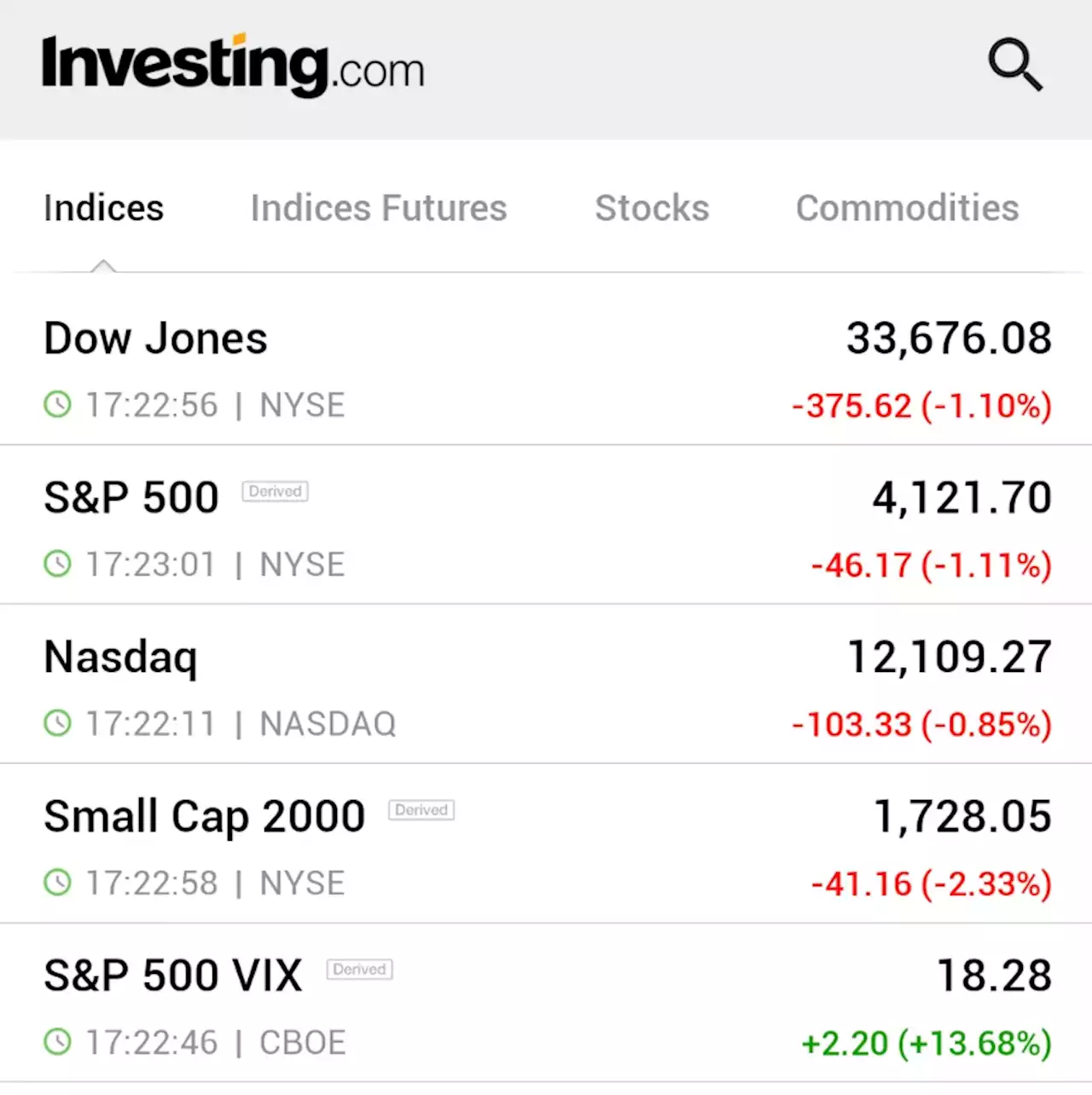

U.S. stocks fall as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *U.S. STOCKS TUMBLE, VIX SPIKES AS WALL STREET BRACES FOR FED DECISION $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

U.S. stocks fall as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *U.S. STOCKS TUMBLE, VIX SPIKES AS WALL STREET BRACES FOR FED DECISION $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Leer más »

U.S. stocks sink as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *DOW DROPS MORE THAN 500 POINTS AS BANK SHARES SLIDE, FED DECISION LOOMS $DIA $SPY $QQQ $IWM

U.S. stocks sink as investors turn attention to Fed decision, debt ceiling By Investing.com⚠️BREAKING: *DOW DROPS MORE THAN 500 POINTS AS BANK SHARES SLIDE, FED DECISION LOOMS $DIA $SPY $QQQ $IWM

Leer más »