$ETH plunged to $950 at a certain moment while trading at around $1,200 on the majority of centralized exchanges, here's how it happened

From March 16, 2021, until May 9, 2022, the position backed with almost 130,000 ETH was opened. The investor used it to borrow 80 million DAI. Additionally, the ICO participant funded the lend on Maker DAO with 96,700 ETH.On May 30, the investor decided to increase the leverage by purchasing 24,000 ETH on borrowed funds with the average price of $1,961. With 153,000 ETH in backing, and $126 million DAI borrowed, a participant in the ICO would have faced liquidation at $1,198.

After selling 65,000 ETH, the early Ethereum investor sold another 27,000 to deleverage his position to $500 per ETH liquidation price.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Ethereum's Dip to $1,150 May Cause Catastrophe on Lending Market, Here's HowEthereum is in dangerous position as lenders may face massive cascade of liquidations worth approximately $500 million

Ethereum's Dip to $1,150 May Cause Catastrophe on Lending Market, Here's HowEthereum is in dangerous position as lenders may face massive cascade of liquidations worth approximately $500 million

Leer más »

Bitcoin price drops to lowest since May as Ethereum market trades at 18.4% lossBitcoin lines up a grim weekly close as BTC price action circles $27,000 and Ethereum gives up its realized price.

Bitcoin price drops to lowest since May as Ethereum market trades at 18.4% lossBitcoin lines up a grim weekly close as BTC price action circles $27,000 and Ethereum gives up its realized price.

Leer más »

Ethereum price falls almost 12% in last 24 hoursIn the last week ETH has fallen by 14.04%

Ethereum price falls almost 12% in last 24 hoursIn the last week ETH has fallen by 14.04%

Leer más »

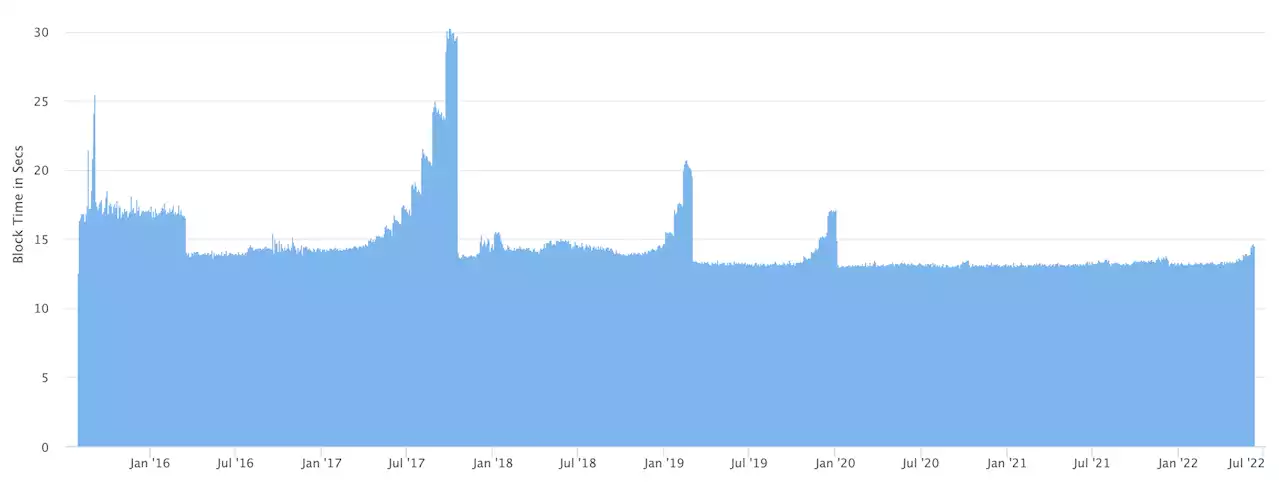

Ethereum’s Difficulty Bomb DelayedEthereum devs have delayed the difficulty bomb. They claim it won't delay the merge, but everyone thinks it will.

Ethereum’s Difficulty Bomb DelayedEthereum devs have delayed the difficulty bomb. They claim it won't delay the merge, but everyone thinks it will.

Leer más »

Ethereum's Dip to $1,150 May Cause Catastrophe on Lending Market, Here's HowICYMI: Ethereum loan and borrowing market is in jeopardy as $ETH's price approaches critical levels that could result in a real disaster ETH

Ethereum's Dip to $1,150 May Cause Catastrophe on Lending Market, Here's HowICYMI: Ethereum loan and borrowing market is in jeopardy as $ETH's price approaches critical levels that could result in a real disaster ETH

Leer más »

Ethereum price enters ‘oversold’ zone for the first time since November 2018The last time Ethereum's RSI turned oversold, it rebounded by 400%. What will happen this time?

Ethereum price enters ‘oversold’ zone for the first time since November 2018The last time Ethereum's RSI turned oversold, it rebounded by 400%. What will happen this time?

Leer más »