Taxpayers living in at least 22 states could face higher taxes as a result of stubbornly high inflation, a phenomenon that is known as 'bracket creep.'

Fox News Contributor Jonas Max Ferris and Quill Intelligence CEO Danielle DiMartino discuss the population exodus from Democrat states to GOP states over taxes, cost of living and crime on 'Cavuto Live'.as a result of stubbornly high inflation.

That's because of a phenomenon known as "bracket creep," which happens when taxpayers are pushed into higher-income brackets even though their purchasing power is essentially unchanged due to steeper prices for most goods. for inflation, a recent analysis published by the Tax Foundation shows that 15 states fail to account for inflation when drawing the brackets for taxes on wages and income. An additional 18 states do not index personal exemption tax to inflation.

Altogether, 22 states have at least "one major unindexed provision," which could mean higher taxes for millions of taxpayers who are already confronting the steepest inflation in decades.

The so-called "hidden tax" is most likely to affect residents living in states where taxes are not indexed to inflation, meaning there's no automaticbuilt into the tax provision in order to keep pace with inflation. States with an income tax that is not indexed to inflation are: Alabama, Connecticut, Delaware, Georgia, Hawaii, Kansas, Louisiana, Maryland, Mississippi, New Jersey, New Mexico, New York and Oklahoma.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

The Big Payback: San Antonio's high-profile police misconduct cases could start costing taxpayersOver the past 10 years, San Antonio paid out a total of $1,566,300 to settle claims of police brutality and misconduct, according to documents obtained by the Current. SanAntonio SATX SanAntonioTX PoliceBrutality PoliceReform Texas

The Big Payback: San Antonio's high-profile police misconduct cases could start costing taxpayersOver the past 10 years, San Antonio paid out a total of $1,566,300 to settle claims of police brutality and misconduct, according to documents obtained by the Current. SanAntonio SATX SanAntonioTX PoliceBrutality PoliceReform Texas

Leer más »

Improperly-paid unemployment payments cost Illinois taxpayers $28 billionThe Inspector General said of the $888 billion paid during the COVID-19 pandemic nationwide, more than 21% was improper.

Improperly-paid unemployment payments cost Illinois taxpayers $28 billionThe Inspector General said of the $888 billion paid during the COVID-19 pandemic nationwide, more than 21% was improper.

Leer más »

Have you heard about the state agency that serves itself rather than California taxpayers?Meet the California Civil Rights Department (CRD), formerly known as the Department of Fair Employment and Housing.

Have you heard about the state agency that serves itself rather than California taxpayers?Meet the California Civil Rights Department (CRD), formerly known as the Department of Fair Employment and Housing.

Leer más »

Taxpayers should not subsidize government unionsHow much should taxpayers spend subsidizing political advocacy groups? If you answered “nothing,” you have more sense than the government.

Taxpayers should not subsidize government unionsHow much should taxpayers spend subsidizing political advocacy groups? If you answered “nothing,” you have more sense than the government.

Leer más »

After Telling Millions of Taxpayers to Hold Off Filing, IRS Says Go AheadMost Americans won't owe taxes on state rebates and refunds from 2022 related to the pandemic, the IRS said

After Telling Millions of Taxpayers to Hold Off Filing, IRS Says Go AheadMost Americans won't owe taxes on state rebates and refunds from 2022 related to the pandemic, the IRS said

Leer más »

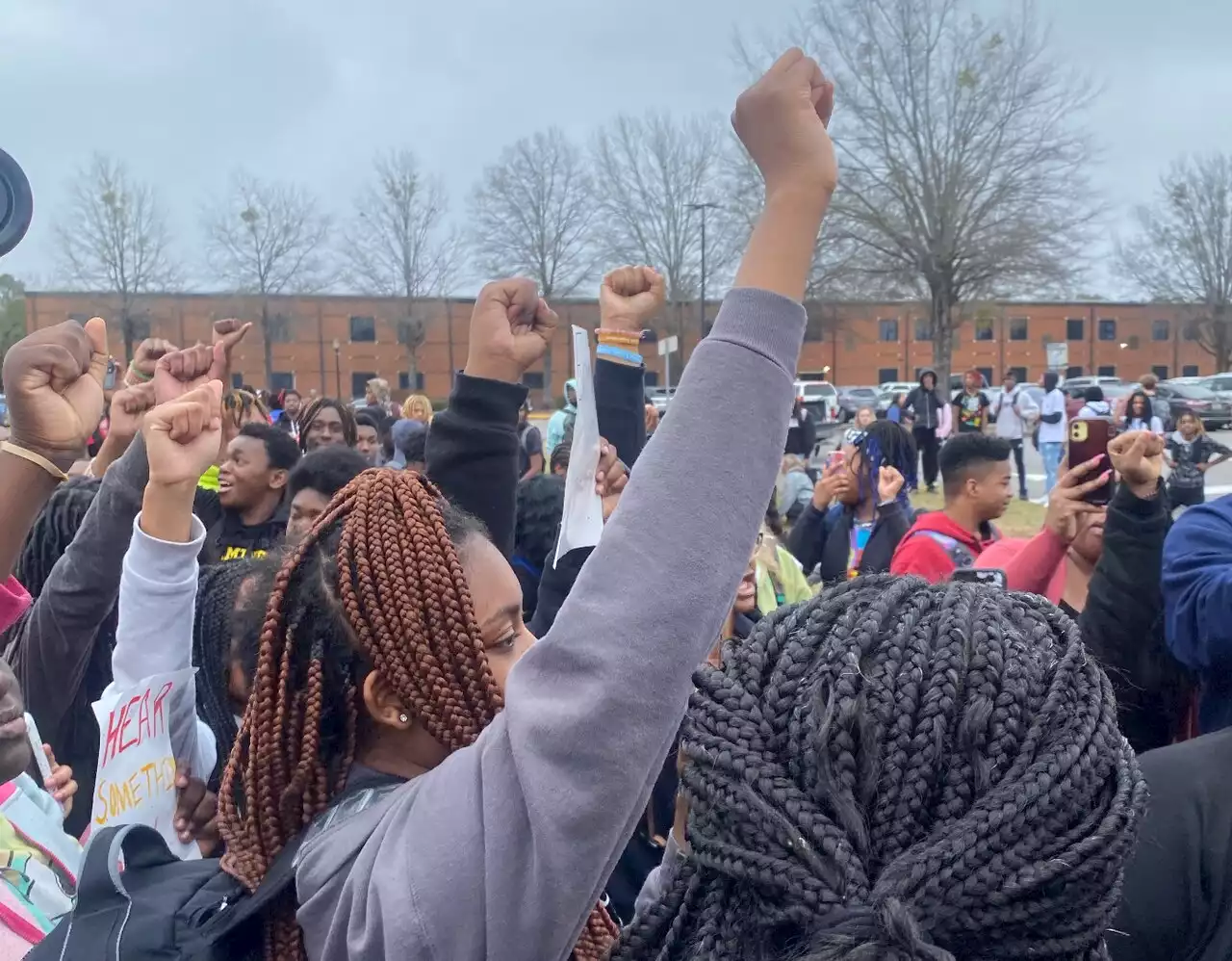

Why 300 Tuscaloosa area high school students walked out of class: ‘We are disrespected’About 300 students protested a school administration that organizers said had promoted “psychological trauma” among Black students.

Why 300 Tuscaloosa area high school students walked out of class: ‘We are disrespected’About 300 students protested a school administration that organizers said had promoted “psychological trauma” among Black students.

Leer más »