Mortgage rates will drop to 5.2% this year despite the uptick this month, said a top economist

Part of the reason is that US economic growth should slow as a result of tighter Federal Reserve monetary policy, which would send investors to the safety of government bonds, Joel Kan, the deputy chief economist at the association, said. That demand tends to boost bond prices and lower the yields. a government-backed debt security that's issued by the US Treasury

— decline to 3% in 2023 from levels above 3.75%, as the Mortgage Bankers Association projected, mortgage rates are likely to retreat as well. For a few weeks, it looked like mortgage rates were well on their way to sub-6% levels. A drop in Treasury yields on the back of easing inflation data in January pushed 30-year-mortgage rates to as low as 6.09%, about a full percentage point off November highs. The rate move resulted in anConversely, Treasury yields have spiked by 0.45 percentage points this month after a stronger-than-expected January employment report and when data showed stubbornly high consumer price inflation.

Despite the whipsawing rates, the Mortgage Bankers Association is sticking to its forecasts, Kan said. mortgage-backed securitiesAs the Fed pulled back on mortgage-bond purchases last year, that caused the yields on the 30-year mortgages linked to those bonds to rise relative to the 10-year Treasury yield, Kan said. So as investors move back into mortgage-backed securities, that should help narrow the spread between those yields and Treasurys, which would result in lower mortgage rates, he said.

"We are expecting things to pick up in the second half of this year but not anywhere as strong as what we saw in 2020 and 2021," Kan said."Those were really massive years for the housing market."to the monthly housing costs for a homeowner taking out a new loan, which creates a rate-lock effect in the real-estate market. With fewer Americans willing to move, the available supply is constrained, and home prices are likely to remain high, he said.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

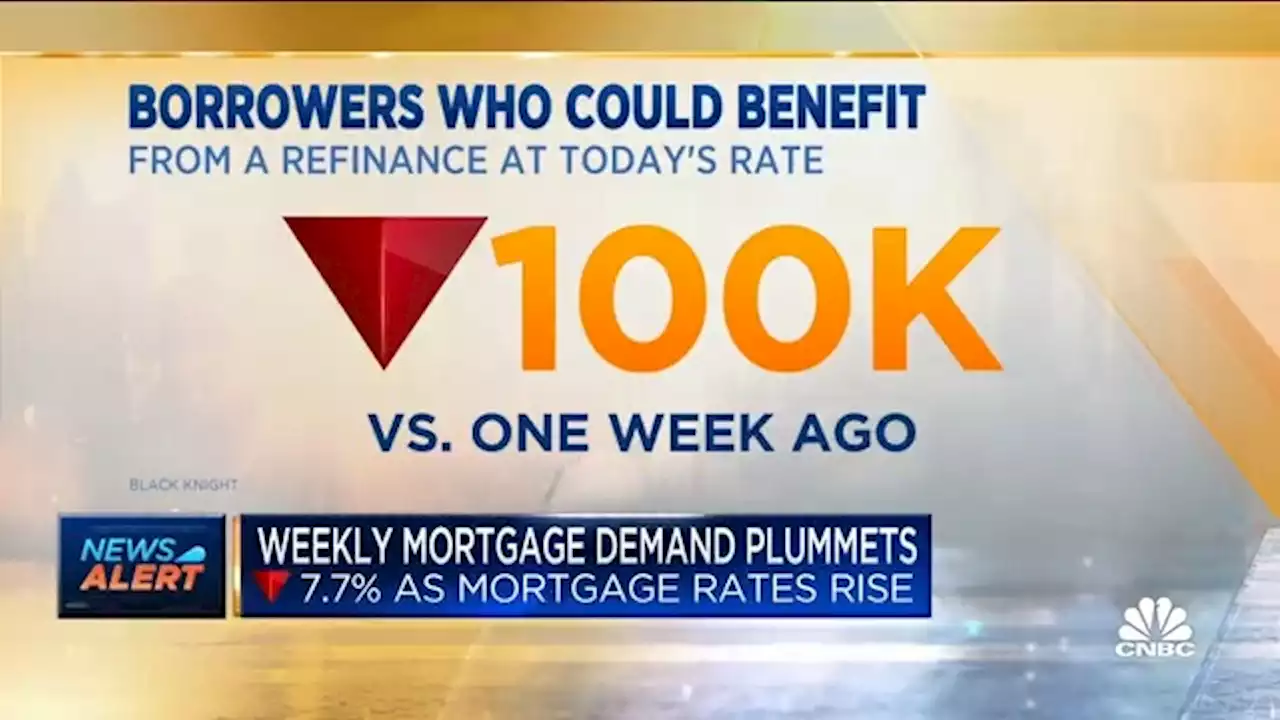

Mortgage demand drops as interest rates bounce higherTotal mortgage application volume fell 7.7% last week, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. DianaOlick reports.

Mortgage demand drops as interest rates bounce higherTotal mortgage application volume fell 7.7% last week, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. DianaOlick reports.

Leer más »

Mortgage rates rise for 2nd consecutive week, pushing more potential home buyers onto the sidelinesThe 30-year mortgage rate is averaging at 6.32%, Freddie Mac said in its latest weekly survey on Thursday.

Mortgage rates rise for 2nd consecutive week, pushing more potential home buyers onto the sidelinesThe 30-year mortgage rate is averaging at 6.32%, Freddie Mac said in its latest weekly survey on Thursday.

Leer más »

U.S. mortgage rates rise across the board, breaking a five-week downward streakU.S. mortgage applications fell 7.7% in the latest week, the Mortgage Bankers Association said. The average rate for a 30-year mortgage is 6.39%.

U.S. mortgage rates rise across the board, breaking a five-week downward streakU.S. mortgage applications fell 7.7% in the latest week, the Mortgage Bankers Association said. The average rate for a 30-year mortgage is 6.39%.

Leer más »

Ohio State Cancels Home-and-Home Series with Washington for 2024, 2025Ohio State will no longer play a home-and-home series with Washington in 2024 and 2025. The Buckeyes will instead play home games in both years against opponents to be determined.

Ohio State Cancels Home-and-Home Series with Washington for 2024, 2025Ohio State will no longer play a home-and-home series with Washington in 2024 and 2025. The Buckeyes will instead play home games in both years against opponents to be determined.

Leer más »

Ohio State football cancels home-and-home series with WashingtonOhio State will no longer face Washington in 2024 and 2025 after it canceled the previously scheduled home-and-home series between the schools.

Ohio State football cancels home-and-home series with WashingtonOhio State will no longer face Washington in 2024 and 2025 after it canceled the previously scheduled home-and-home series between the schools.

Leer más »

Home owners: How No. 4 UCLA gained the nation's longest active home winning streakThe No. 4 Bruins have won 21 consecutive games at Pauley Pavilion and look to go undefeated at home for the first time since the 2006-07 season.

Home owners: How No. 4 UCLA gained the nation's longest active home winning streakThe No. 4 Bruins have won 21 consecutive games at Pauley Pavilion and look to go undefeated at home for the first time since the 2006-07 season.

Leer más »