How changes to Canada Pension Plan benefits affect your wallet today and retirement tomorrow via financialpost

Since 2019, the CPP contribution rate has gradually increased every year, to 5.95 per cent in 2023 from 4.95 per cent in 2018 , for a total increase of one per cent for both employees and employers. If you’re self-employed, you pay both the employee and employer portions, for a 2023 contribution rate of 11.9 per cent.

If you earn less than the first earnings ceiling, there will be no further CPP rate increases for you. For higher income earners, however, a second CPP contribution rate and earnings ceiling will begin in January 2024, and will only affect workers whose income is above this “second earnings ceiling,”As of 2024, if you have earnings above the first earnings ceiling, you’ll contribute an additional four per cent of your income between the first earnings ceiling up to the second earnings ceiling.

To illustrate, assume Stephanie has an annual income of $100,000, which is higher than the second earnings ceiling each year. She will make base and first CPP contributions at a rate of 5.95 per cent and, beginning in 2024, second CPP contributions at a rate of four per cent on the difference between the annual YAMPE and the YMPE.

In 2025, if we assume the YMPE increases again to, say, $69,700, Stephanie will contribute $3,939 on her income below the first earnings ceiling. The second earnings ceiling will be set 14 per cent higher than the first earnings ceiling, resulting in a YAMPE, or second earnings ceiling, of approximately $79,400. Stephanie will contribute second CPP contributions at a rate of four per cent on her income between the YMPE and the YAMPE, or $388. Thus, her total CPP in 2025 would be $4,327.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

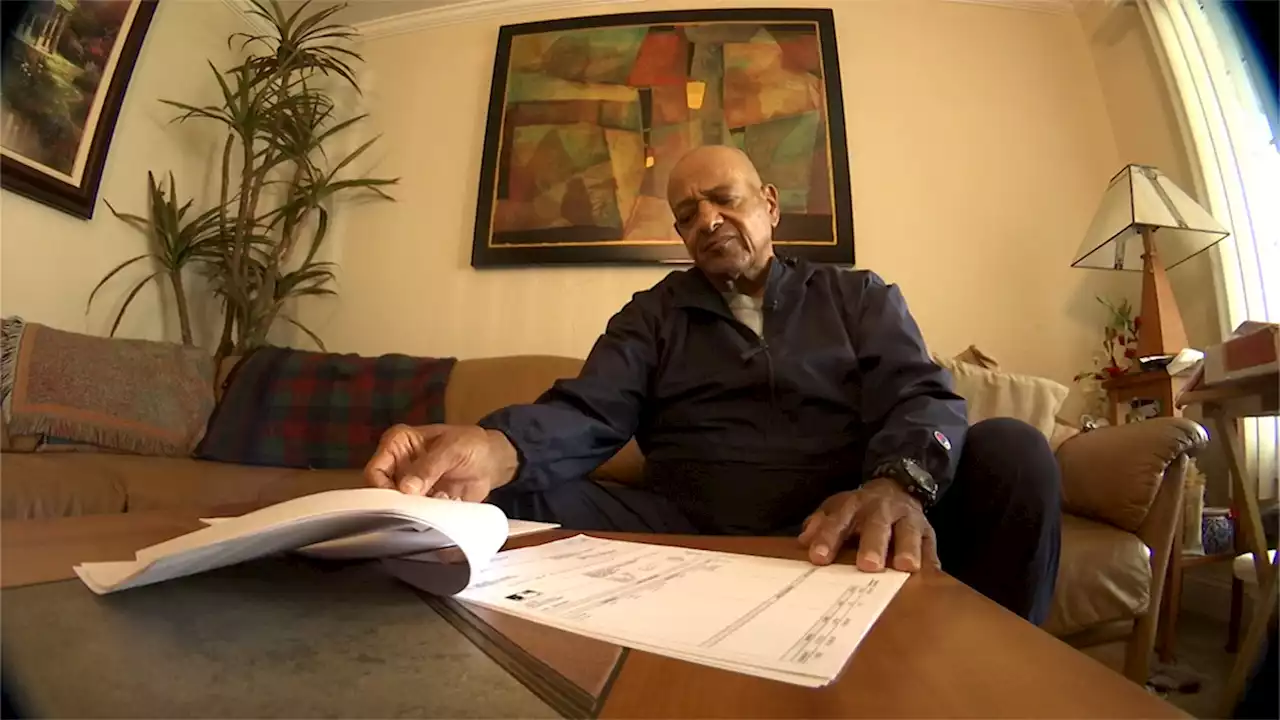

75-Year-Old Former East Bay Major Leaguer Gets Help In His Battle Over PensionThanks to a journalist 3,000 miles away, Les Cain’s quest for a pension from Major League Baseball is getting a new life. Garvin Thomas reports.

75-Year-Old Former East Bay Major Leaguer Gets Help In His Battle Over PensionThanks to a journalist 3,000 miles away, Les Cain’s quest for a pension from Major League Baseball is getting a new life. Garvin Thomas reports.

Leer más »

Ex-Broadmoor police chief pleads not guilty to grand theftGregory Love is accused of illegally collecting a pension and a salary at the same time.

Ex-Broadmoor police chief pleads not guilty to grand theftGregory Love is accused of illegally collecting a pension and a salary at the same time.

Leer más »

Could you have a California boxers’ pension? Here is what you need to knowCalifornia owes benefits to about 200 boxers through the California Professional Boxers’ Pension Fund. How to claim a California boxers' pension.

Could you have a California boxers’ pension? Here is what you need to knowCalifornia owes benefits to about 200 boxers through the California Professional Boxers’ Pension Fund. How to claim a California boxers' pension.

Leer más »

OPINION: Reshaping Canada's caregiving system'If every caregiver took one week off, our care systems would collapse before noon on the very first day,' writes Naomi Azrieli of the azrielifoundation. - healthing_ca OntCaregivers azrielifdn CdnCaregiving healthing caregivers

OPINION: Reshaping Canada's caregiving system'If every caregiver took one week off, our care systems would collapse before noon on the very first day,' writes Naomi Azrieli of the azrielifoundation. - healthing_ca OntCaregivers azrielifdn CdnCaregiving healthing caregivers

Leer más »

Will Hockey’s Greatest Duo Finally Bring the Stanley Cup Back to Canada?Their best rivals are gone, and it’s there for the taking—if they don’t screw it up.

Will Hockey’s Greatest Duo Finally Bring the Stanley Cup Back to Canada?Their best rivals are gone, and it’s there for the taking—if they don’t screw it up.

Leer más »