Bond are offering nice yields for the first time in years. This options strategy could lead to even better returns.

Many investors are delighted to earn 5% or more in their money-market funds or short-term government bonds. Even the 10-year Treasury bond is yielding around 4.3%.

Here’s the plan: Put 80% or 90% of your cash into bonds and the remainder into whatever interest-bearing account your broker allows to be used to finance options strategies. You then will sell puts on a blue-chip stock worthy of long-term ownership. The upshot: Investors can benefit from attractive fixed-income yields while monetizing the rising fear-premiums in put options. The bulk of an investor’s money is invested in bonds, and money that is needed to finance cash-secured put sales is also in an account that pays attractive interest rates. The put premium is gravy.

We have seen, again and again, that stocks do not like 10-year yields of 4% or higher. At that level, yields disrupt popular valuation models used to value multiyear earnings.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Extra Extra: NYC's beekeeper population is buzzingBecause we could always use more bees, here are your afternoon links: NJ could legalize human composting, NY is producing more doctors than any other state, PornHub's beef with an East Village kebab shop, and more.

Extra Extra: NYC's beekeeper population is buzzingBecause we could always use more bees, here are your afternoon links: NJ could legalize human composting, NY is producing more doctors than any other state, PornHub's beef with an East Village kebab shop, and more.

Leer más »

Extra Extra: Leave the pepper spray at home when you flyBecause it's a tough time for all Broadway shows, including one about Britney Spears, here are your afternoon links: a Papa John's robbery, broadcasting yourself sleeping, a Knicks v. Raptors lawsuit, and more.

Extra Extra: Leave the pepper spray at home when you flyBecause it's a tough time for all Broadway shows, including one about Britney Spears, here are your afternoon links: a Papa John's robbery, broadcasting yourself sleeping, a Knicks v. Raptors lawsuit, and more.

Leer más »

Why investors are back to a ‘grab for yield,’ according to Mizuho strategistThe U.S. economy isn't in the ditch, which is giving a boost to riskier corporate bonds, according to Mizuho Securities.

Why investors are back to a ‘grab for yield,’ according to Mizuho strategistThe U.S. economy isn't in the ditch, which is giving a boost to riskier corporate bonds, according to Mizuho Securities.

Leer más »

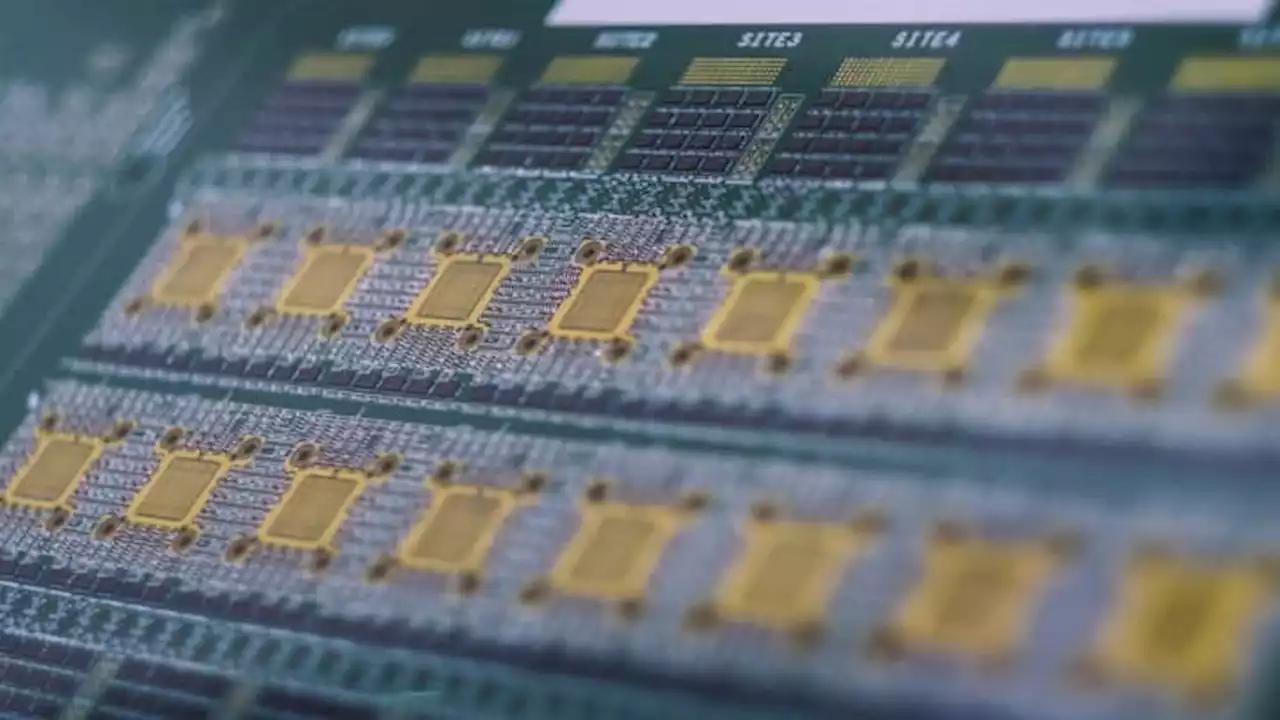

This chip stock could yield a quick profit, depending on Nvidia's earnings, Morgan Stanley saysHow well Nvidia performs Wednesday could have implications for this derivative play, according to Morgan Stanley.

This chip stock could yield a quick profit, depending on Nvidia's earnings, Morgan Stanley saysHow well Nvidia performs Wednesday could have implications for this derivative play, according to Morgan Stanley.

Leer más »

Asia markets largely set to rise as 10-year U.S. Treasury yield hits 16-year highThe benchmark 10-year Treasury note yield hit a high of 4.34%, reaching its highest level since November 2007.

Asia markets largely set to rise as 10-year U.S. Treasury yield hits 16-year highThe benchmark 10-year Treasury note yield hit a high of 4.34%, reaching its highest level since November 2007.

Leer más »

Asia markets largely rise as 10-year U.S. Treasury yield hits 16-year highThe benchmark 10-year Treasury note yield hit a high of 4.34%, reaching its highest level since November 2007.

Asia markets largely rise as 10-year U.S. Treasury yield hits 16-year highThe benchmark 10-year Treasury note yield hit a high of 4.34%, reaching its highest level since November 2007.

Leer más »