The change, which is reflected in section 55 of the Tax Code, imposes a 15% minimum tax on the adjusted financial statement income of large corporations.

that it will grant penalty relief for corporations that did not pay estimated tax in connection with the new corporate alternative minimum tax, or CAMT.As part of the Inflation Reduction Act of 2022, Congress created the CAMT. The change, which is reflected in

CAMT does not apply to S corporations, real estate investment trusts , and regulated investment companies . That's a practical exception—those are typically pass-through entities and not subject to corporate income taxes.As you can imagine, corporations can't simply rely on a line on a tax return to determine whether they are an applicable corporation subject to the CAMT.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

U.S. Lawmakers Urge IRS, Treasury to Hurry Crypto Tax RulesCongressmen Brad Sherman and Stephen Lynch called the industry 'a major source of tax evasion' in a letter asking for the prompt release of proposed regulations on reporting requirements.

U.S. Lawmakers Urge IRS, Treasury to Hurry Crypto Tax RulesCongressmen Brad Sherman and Stephen Lynch called the industry 'a major source of tax evasion' in a letter asking for the prompt release of proposed regulations on reporting requirements.

Leer más »

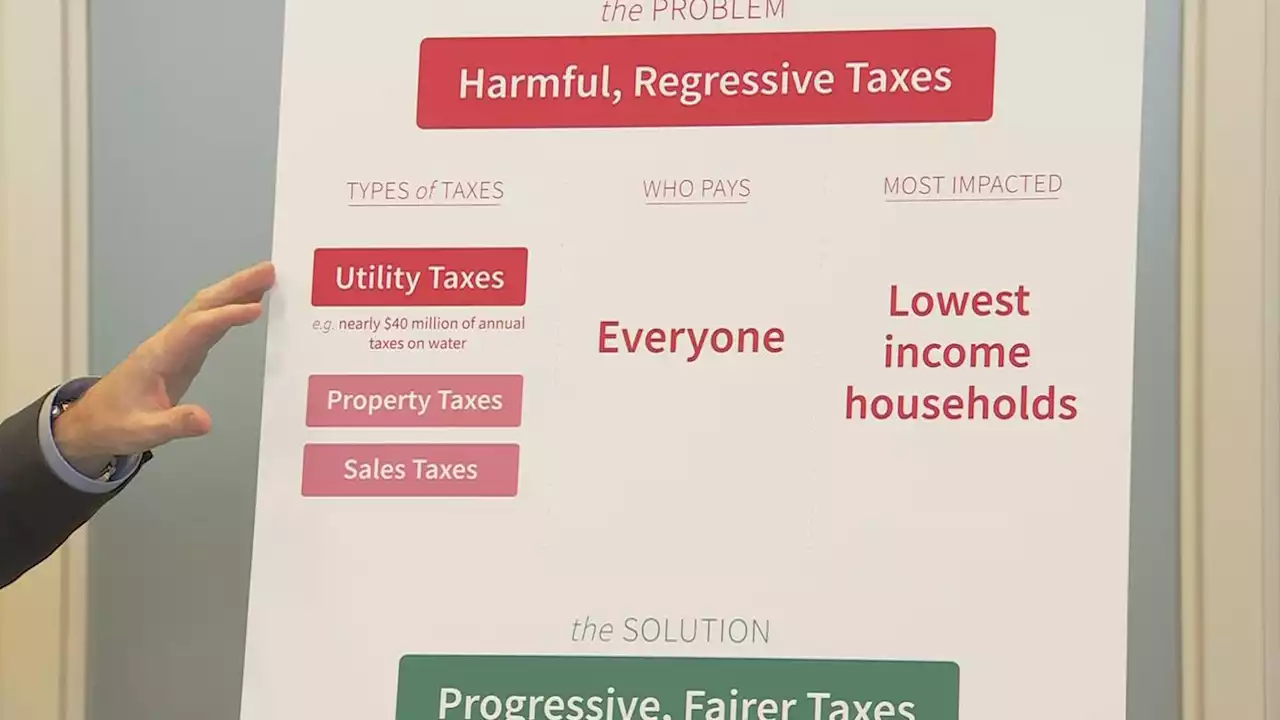

New proposal would replace Seattle’s water tax with expanded tax on capital gainsA new proposal from Seattle Councilmember Alex Pedersen would expand Washington’s capital gains tax to replace what he calls a “regressive water tax.”

New proposal would replace Seattle’s water tax with expanded tax on capital gainsA new proposal from Seattle Councilmember Alex Pedersen would expand Washington’s capital gains tax to replace what he calls a “regressive water tax.”

Leer más »

Hydrogen projects hang on IRS decision on how clean is clean energyThe flurry of clean hydrogen projects under development along the Gulf Coast await a...

Leer más »

Texas Senate panel advances bill increasing penalty for human smugglingThe proposal, written by Sen. Pete Flores, R-Lakeway, establishes a “mandatory minimum” prison sentence of 10 years.

Texas Senate panel advances bill increasing penalty for human smugglingThe proposal, written by Sen. Pete Flores, R-Lakeway, establishes a “mandatory minimum” prison sentence of 10 years.

Leer más »

Idaho murder victims' parents divided over death penalty for killerSome of the families of the victims have said they support the death penalty, while others hold a stance against it or have not made their views clear.

Idaho murder victims' parents divided over death penalty for killerSome of the families of the victims have said they support the death penalty, while others hold a stance against it or have not made their views clear.

Leer más »