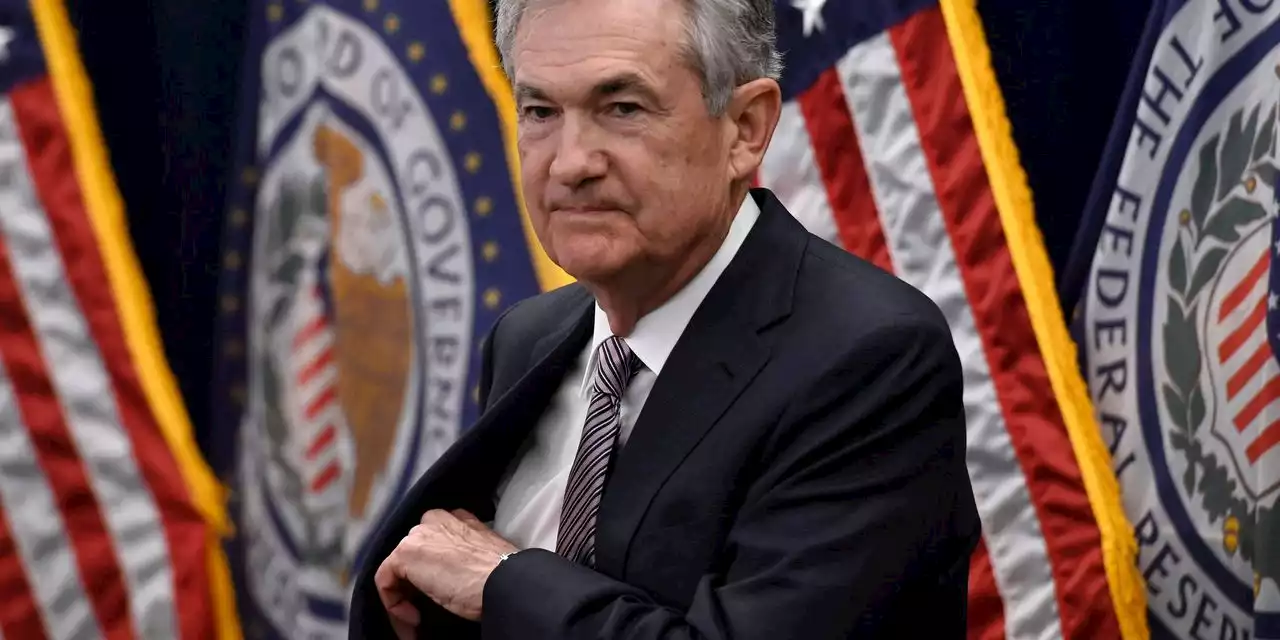

JPMorgan economist Michael Feroli believes that rising inflation will push the Fed to increase the rate by 75 basis points (bps). Economy Economics Inflation

that the Fed would raise the benchmark rate by 50 bps. However, JPMorgan economist Michael Feroli thinks a 75 bps increase is coming and 100 bps is also possible.clients in a note on Monday that a “startling rise in longer-term inflation expectations” may push the Fed to increase the rate by 75 basis points on Wednesday. “One might wonder whether the true surprise would actually be hiking 100bp, something we think is a non-trivial risk,” Feroli added.

Goldman Sachs Economists Predict a 75 bps Hike — JPMorgan Strategist Marko Kolanovic Thinks a Dovish Surprise Could Happena 75 bps hike will likely be announced at the FOMC meeting. “Our Fed forecast is being revised to include 75 bps hikes in June and July,” Goldman economists explained on Monday.We anticipate two more rate increases in 2023 to 3.75-4%, followed by one cut in 2024 to 3.5-3.75%.

“Friday’s strong CPI print that led to a surge in yields, along with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market lower,” Kolanovic’s note to clients on Monday. “However, we believe rates market repricing went too far and the Fed will surprise dovishly relative to what is now priced into the curve,” the JPMorgan strategist added.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on WednesdayEconomists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. Or could it even be 100?

Leer más »

EUR/USD bounces off monthly low to regain 1.0500 amid market’s indecision, Fed in focusEUR/USD picks up bids to consolidate daily losses around 1.0495, staying around the monthly low during a three-day downtrend amid early European morni

EUR/USD bounces off monthly low to regain 1.0500 amid market’s indecision, Fed in focusEUR/USD picks up bids to consolidate daily losses around 1.0495, staying around the monthly low during a three-day downtrend amid early European morni

Leer más »

Gold Price Forecast: XAU/USD eases from $1,880 hurdle on strong USD ahead of FedGold Price (XAU/USD) pulls back to $1,874, after rising to the highest levels since May 09, during Monday’s Asian session. The precious metal’s latest

Gold Price Forecast: XAU/USD eases from $1,880 hurdle on strong USD ahead of FedGold Price (XAU/USD) pulls back to $1,874, after rising to the highest levels since May 09, during Monday’s Asian session. The precious metal’s latest

Leer más »

Gold Price Forecast: XAU/USD moves firmly to near $1,880 despite soaring hawkish Fed betsGold price (XAU/USD) is oscillating in a narrow range of $1,868.92-1,879.25 in the early Asian session despite mounting bets on an extreme hawkish sta

Gold Price Forecast: XAU/USD moves firmly to near $1,880 despite soaring hawkish Fed betsGold price (XAU/USD) is oscillating in a narrow range of $1,868.92-1,879.25 in the early Asian session despite mounting bets on an extreme hawkish sta

Leer más »

What The Fed District Reserve Banks Should Do About ClimateWhat the Fed District Reserve Banks Should Do About Climate

What The Fed District Reserve Banks Should Do About ClimateWhat the Fed District Reserve Banks Should Do About Climate

Leer más »

AUD/USD fades bounce off monthly low near 0.7000 as covid woes join pre-Fed anxietyAUD/USD renews selling pressure towards retesting the monthly low of 0.7000 after Beijing amplifies virus woes during early Monday morning in Europe.

AUD/USD fades bounce off monthly low near 0.7000 as covid woes join pre-Fed anxietyAUD/USD renews selling pressure towards retesting the monthly low of 0.7000 after Beijing amplifies virus woes during early Monday morning in Europe.

Leer más »