Sophisticated traders appear to be wagering that recent pain in ether might worsen. godbole17 reports.

As ether slipped to a 10-day low on Monday, market participants took bets that would offer protection against a deeper slide in the second-largest cryptocurrency.

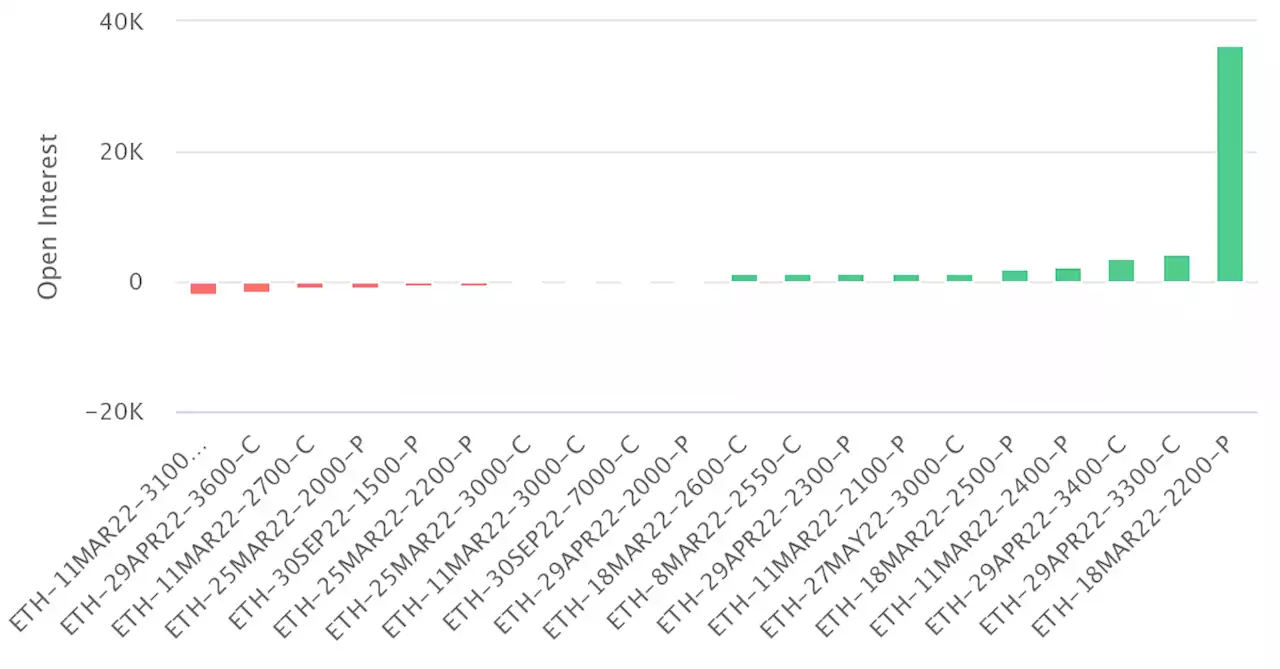

"We witnessed strong demand for 18 March, 2200, puts yesterday as players looked to buy short-dated protection on the key 2,200 pivot level in ETH," Patrick Chu, director of institutional sales and trading at over-the-counter tech platform Paradigm, told CoinDesk in a Telegram chat. On Deribit, one ether options contract represents one ETH. A put option gives the purchaser the right but not the obligation to sell the underlying asset at a predetermined price on or before a specific date. A put buyer is implicitly bearish on the market, while a call option purchaser is bullish.

According to Laevitas, most of the trades in the $2,200 put registered on Monday were straight forward longs and did not appear to be part of a complex options strategy."Most of them were outright trades, possibly short-term hedges," Laevitas said in a Twitter chat.