Inflation is running hotter, making mortgage rates more volatile, with the expectation that they could move in the 6% to 7% range over the next few weeks.

The 30-year fixed-rate mortgage averaged 6.32% in the week ending February 16, up from 6.12% the week before, according to data from Freddie Mac released Thursday. A year ago, the 30-year fixed-rate was 3.92%. After climbing for most of 2022, mortgage rates had been trending downward since November, as various economic indicators indicated inflation may have peaked.

“While the Fed signaled that it will continue to raise rates this year, the moves are expected to come in 25 basis point increments, a less aggressive tightening than what we saw in 2022,” said Ratiu. “The central bank is acknowledging that it sees its monetary actions having a tangible effect on inflation. The CPI data out this week seems to confirm the bank’s views.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

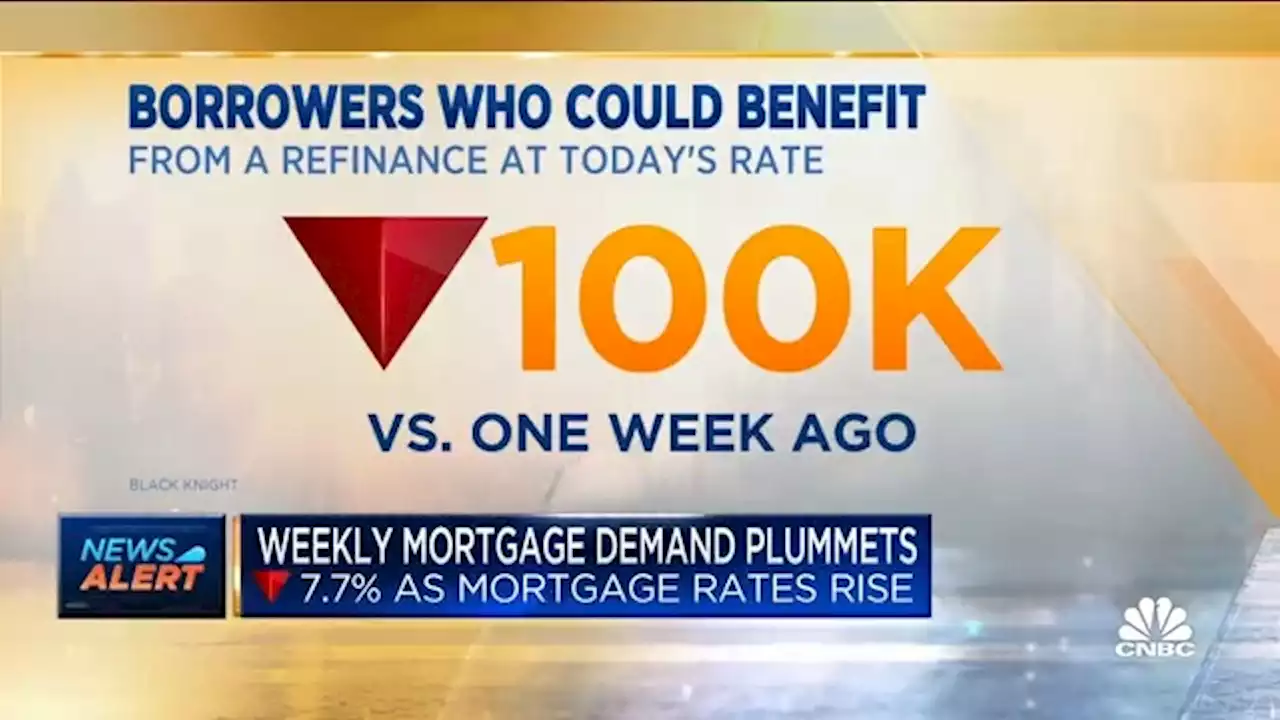

Mortgage demand drops as interest rates bounce higherTotal mortgage application volume fell 7.7% last week, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. DianaOlick reports.

Mortgage demand drops as interest rates bounce higherTotal mortgage application volume fell 7.7% last week, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. DianaOlick reports.

Leer más »

Inflation dents mortgage applicationsDemand for mortgages dropped from the prior week as worries about higher rates and inflation dented the market.

Inflation dents mortgage applicationsDemand for mortgages dropped from the prior week as worries about higher rates and inflation dented the market.

Leer más »

FBI announces investigation into Harris County jail system after 32 inmates dieThe FBI has opened an investigation into allegations of federal rights violations following the deaths of two inmates in Texas.

FBI announces investigation into Harris County jail system after 32 inmates dieThe FBI has opened an investigation into allegations of federal rights violations following the deaths of two inmates in Texas.

Leer más »

The Honda Civic Was a Generation's '32 FordA 5,600-mile 2000 Honda Civic Si coupe sold for $50,000 on Bring a Trailer two years ago. There's the sense that something ubiquitous is coming to an end.

The Honda Civic Was a Generation's '32 FordA 5,600-mile 2000 Honda Civic Si coupe sold for $50,000 on Bring a Trailer two years ago. There's the sense that something ubiquitous is coming to an end.

Leer más »

32 Pieces Of Clothing That'll Help Make 2023 The Comfiest Year EverLoungewear, athletic sets, chunky sweaters and a pair of jeans that are actually lined with fleece.

32 Pieces Of Clothing That'll Help Make 2023 The Comfiest Year EverLoungewear, athletic sets, chunky sweaters and a pair of jeans that are actually lined with fleece.

Leer más »