Robinhood plans to launch Robinhood Retirement, offering a 1% “match” on contributions its customers make to a Robinhood individual retirement account. CEO Vlad Tenev joins andrewrsorkin to discuss.

Others are skeptical whether the relatively small dollar amounts at stake will amount to a positive behavioral shift, and wonder if it's more a marketing effort to stand out amid ample competition.

A 401 match is generally structured as a share of employee contributions. Let's say a worker saves 6% of their annual salary in a 401; an employer might match 50% or 100% of that dollar total, up to a federal limit. But there are some key differences in how the match works. A typical 401 match is generally a percentage of a worker's compensation, while Robinhood's is a share of an investor's contribution.to an IRA, per federal rules. Investors age 50 and over can contribute an additional $1,000.director of retirement savings at The Pew Charitable Trusts

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Robinhood wants to be your retirement fund, offering a 1% matchRobinhood, a stock-trading app that became a favorite of the 'meme-stock' crowd during the pandemic, has a new proposition: Open an Individual Retirement Account with the service and it will match 1% of the funds customers contribute.

Robinhood wants to be your retirement fund, offering a 1% matchRobinhood, a stock-trading app that became a favorite of the 'meme-stock' crowd during the pandemic, has a new proposition: Open an Individual Retirement Account with the service and it will match 1% of the funds customers contribute.

Leer más »

Robinhood Wants Your Retirement MoneyThe brokerage, which rose to prominence during the meme-stock craze, is now offering tax-advantaged retirement accounts.

Robinhood Wants Your Retirement MoneyThe brokerage, which rose to prominence during the meme-stock craze, is now offering tax-advantaged retirement accounts.

Leer más »

Robinhood launches IRA retirement plans for gig economy workersAutomatic paycheck transfers, contribution matching and other retirement saving tools are often not available to gig economy workers, said Steph Guild, Robinhood’s head of investment strategy. Gig workers make up as much as 40% of the U.S. workforce.

Robinhood launches IRA retirement plans for gig economy workersAutomatic paycheck transfers, contribution matching and other retirement saving tools are often not available to gig economy workers, said Steph Guild, Robinhood’s head of investment strategy. Gig workers make up as much as 40% of the U.S. workforce.

Leer más »

Robinhood takes on retirement in search for more growthNEW YORK (AP) — Robinhood, the company that blazed onto Wall Street after turning millions of novices into investors by making trading fun, is now setting its sights on a more staid corner of the industry: saving for retirement.

Robinhood takes on retirement in search for more growthNEW YORK (AP) — Robinhood, the company that blazed onto Wall Street after turning millions of novices into investors by making trading fun, is now setting its sights on a more staid corner of the industry: saving for retirement.

Leer más »

Robinhood goes after retirement fundsHow does a retail brokerage stop its customers from leaving when the markets turn south? By giving them a retirement product designed to last for decades.

Robinhood goes after retirement fundsHow does a retail brokerage stop its customers from leaving when the markets turn south? By giving them a retirement product designed to last for decades.

Leer más »

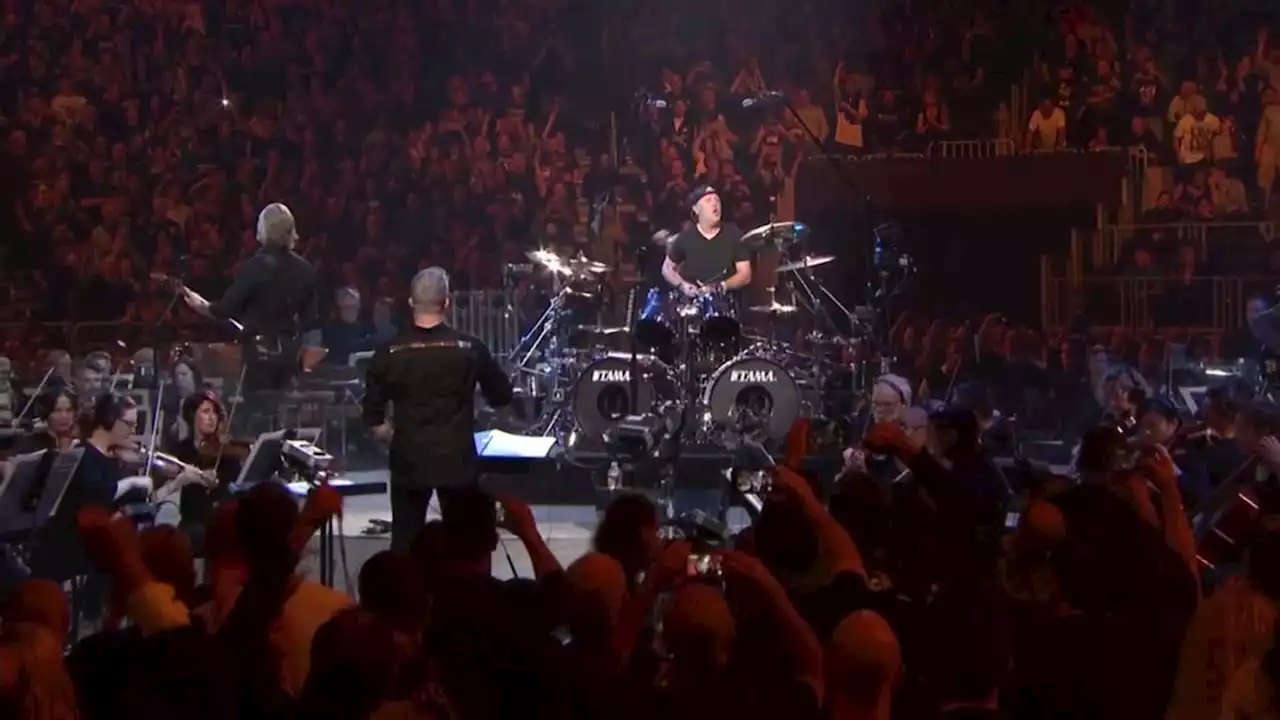

CONSUMER CATCH-UP: Metallica warns fans of impostor crypto scams, Robinhood launches IRAs on appIn this edition of Consumer Catch-Up, metal legends Metallica warn their fans of impostors pretending to stream their new album to lure them into a cryptocurrency scam, and investment app Robinhood announces new retirement accounts for customers.

CONSUMER CATCH-UP: Metallica warns fans of impostor crypto scams, Robinhood launches IRAs on appIn this edition of Consumer Catch-Up, metal legends Metallica warn their fans of impostors pretending to stream their new album to lure them into a cryptocurrency scam, and investment app Robinhood announces new retirement accounts for customers.

Leer más »