Everyone is watching commercial property, given how reliant it is on some of the same regional banks that have been under pressure since the collapse of Silicon Valley Bank.

That pushes up CMBS yields .

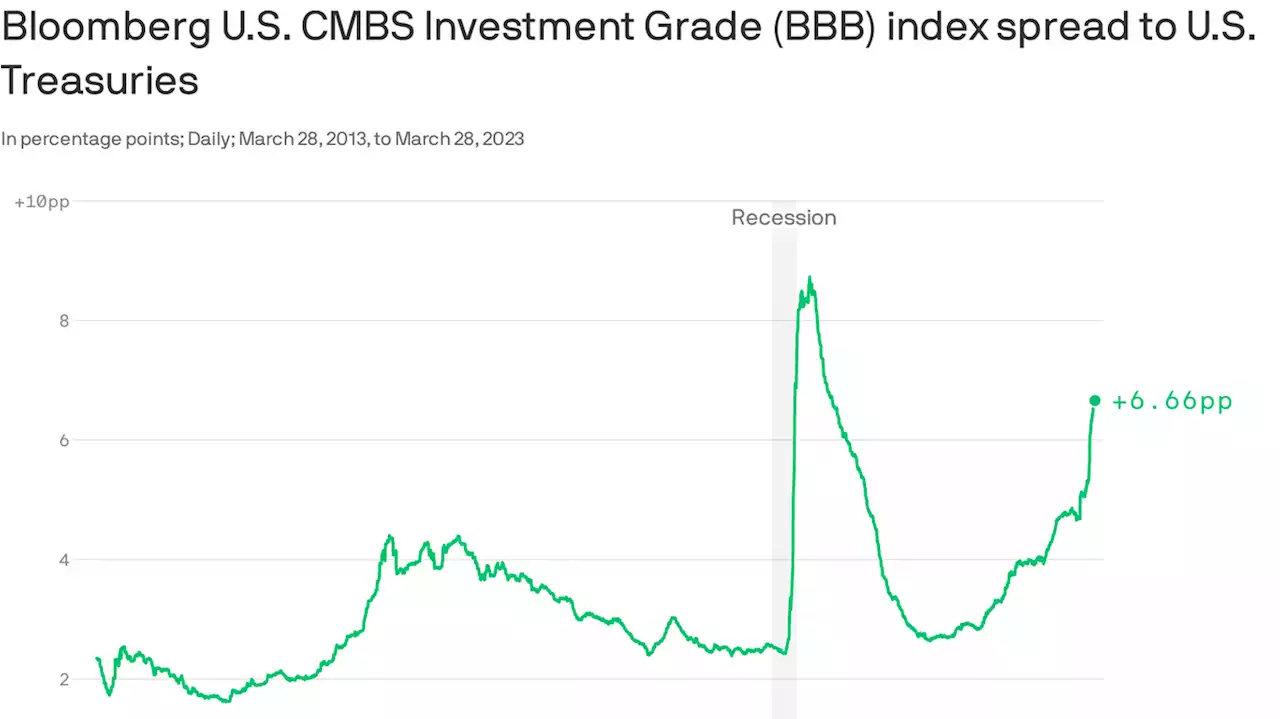

As those yields rose, the difference between those and yields on super-safe U.S. government bonds has surged.When spreads go up — traders usually say "widen" or "blow out" — it means trading activity is declining, credit is harder to come by and expensive, and the flow of capital through the economy, or in this case the commercial property sector, is starting to slow.

When spreads really go nuts, as they did early in the COVID crisis and during the financial crisis in 2008, it's the equivalent of a financial heart attack. Sometimes called a "credit crunch," it's when capital stops flowing, and the economy suffers.These spreads are telling us that worries about the commercial property market are getting more serious.

"The direction of travel is concerning," wrote analysts with Capital Economics in a note on Wednesday. "We believe there are risks of a credit crunch developing and spreads widening further."

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

![]() Silicon Valley Bank hearing live updates: FDIC, Treasury and Fed officials testify before Senate panelThis is CNBC's live blog tracking Tuesday's hearing on the collapse of Silicon Valley Bank and other lenders before the Senate Banking Committee.

Silicon Valley Bank hearing live updates: FDIC, Treasury and Fed officials testify before Senate panelThis is CNBC's live blog tracking Tuesday's hearing on the collapse of Silicon Valley Bank and other lenders before the Senate Banking Committee.

Leer más »

![]() Silicon Valley Bank itself was main cause of bank’s failure, Fed official saysThe nation’s top financial regulator is asserting that Silicon Valley Bank’s own management was largely to blame for the bank’s failure earlier this month.

Silicon Valley Bank itself was main cause of bank’s failure, Fed official saysThe nation’s top financial regulator is asserting that Silicon Valley Bank’s own management was largely to blame for the bank’s failure earlier this month.

Leer más »

Key bank regulators appear before Congress in first Silicon Valley Bank hearingThree key bank regulators are testifying before Congress today in the first hearing about Silicon Valley Bank's collapse that sparked panic about the health of the financial system. Here's what to know.

Key bank regulators appear before Congress in first Silicon Valley Bank hearingThree key bank regulators are testifying before Congress today in the first hearing about Silicon Valley Bank's collapse that sparked panic about the health of the financial system. Here's what to know.

Leer más »

![]() Fed official tells lawmakers that Silicon Valley Bank failed from mismanagementThe top banking regulator at the Federal Reserve told Congress Tuesday that Silicon Valley Bank failed due to mismanagement, while lawmakers on the Senate Banking Committee blamed federal regulators for being caught flat-footed by the nation’s second-largest bank collapse.

Fed official tells lawmakers that Silicon Valley Bank failed from mismanagementThe top banking regulator at the Federal Reserve told Congress Tuesday that Silicon Valley Bank failed due to mismanagement, while lawmakers on the Senate Banking Committee blamed federal regulators for being caught flat-footed by the nation’s second-largest bank collapse.

Leer más »

US regulator cites 'terrible' risk management for Silicon Valley Bank failureA top U.S. regulator told a Senate panel on Tuesday that Silicon Valley Bank did a 'terrible' job of managing risk before its collapse, fending off criticism from lawmakers who blamed bank watchdogs for missing warning signs.

US regulator cites 'terrible' risk management for Silicon Valley Bank failureA top U.S. regulator told a Senate panel on Tuesday that Silicon Valley Bank did a 'terrible' job of managing risk before its collapse, fending off criticism from lawmakers who blamed bank watchdogs for missing warning signs.

Leer más »

![]() Don't let Silicon Valley Bank's financial catastrophe spill over to these crucial banksCommunity banks may pay a heavy price for the collapse of Silicon Valley Bank and Signature Bank. But the nation's smallest banks bear no responsibility for recent financial fiasco.

Don't let Silicon Valley Bank's financial catastrophe spill over to these crucial banksCommunity banks may pay a heavy price for the collapse of Silicon Valley Bank and Signature Bank. But the nation's smallest banks bear no responsibility for recent financial fiasco.

Leer más »