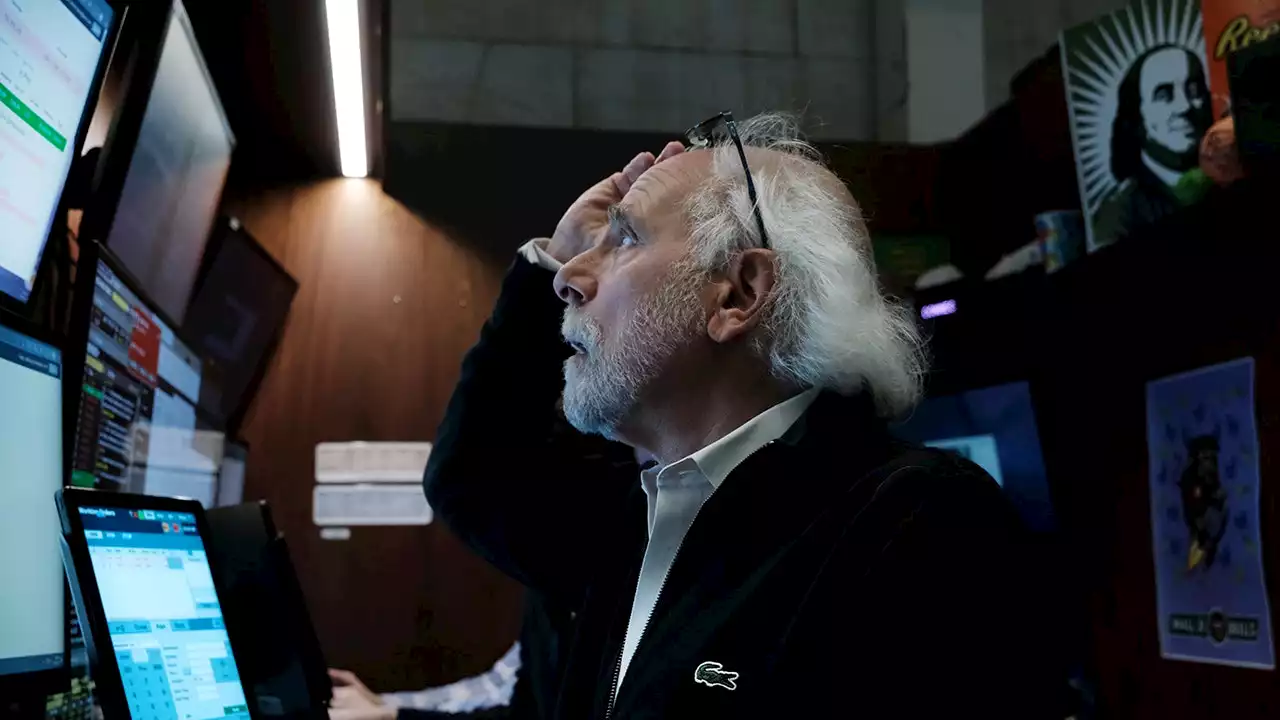

LONG ROAD AHEAD: Stock market to see more pain before reaching low, BofA warns

Bluerock Capital Markets CEO Jeff Schwaber reacts to stocks surging after the September CPI rose to a nearly 40-year high, on 'The Claman Countdown.'

The U.S. stock market will likely experience more pain and see losses accelerate in the coming months as scorching-hot inflation and an aggressive Federal Reserve continue to weigh on the broader economy. That's according to Bank of America strategist Michael Hartnett, who warned in an analyst note this week that lows in the stock market likely won't be reached until 2023, once the Fed backs away from its aggressive tightening campaign.

The note came after stocks rallied on the heels of the hotter-than-expected September inflation report, which showed that consumer prices had jumped 0.4% from the previous month. When excluding gasoline and food, prices soared 0.6%, or 6.6% from the previous year – the fastest pace since 1982. Hartnett described the gains on Thursday as a "decent counter-rally" that he said represented something like a "bear hug," but he suggested that more market pain will be necessary as the Fed tries to crush inflation with a series of rapid interest rate hikes.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Fed governor says the U.S. doesn't need a digital dollarFederal Reserve Governor Christopher Waller expanded on his opposition to a U.S. central bank digital currency.

Fed governor says the U.S. doesn't need a digital dollarFederal Reserve Governor Christopher Waller expanded on his opposition to a U.S. central bank digital currency.

Leer más »

Chase Bank allegedly shutters bank account of religious freedom nonprofit, demands donor listJPMorgan Chase allegedly closed the bank account of the National Committee for Religious Freedom and demanded a list of political donors from the bipartisan, multi-faith nonprofit.

Chase Bank allegedly shutters bank account of religious freedom nonprofit, demands donor listJPMorgan Chase allegedly closed the bank account of the National Committee for Religious Freedom and demanded a list of political donors from the bipartisan, multi-faith nonprofit.

Leer más »

US: Atlanta Fed GDPNow for Q3 declines to 2.8%According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.8% in the third quarter

US: Atlanta Fed GDPNow for Q3 declines to 2.8%According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to grow at an annualized rate of 2.8% in the third quarter

Leer más »

Big bank earnings ‘are not good numbers’ for the economy, chief strategist warnsOdeon Capital Group chief financial strategist Dick Bove predicts big bank earnings won't continue to be 'very strong' if the economy slows down and loan demand slides.

Big bank earnings ‘are not good numbers’ for the economy, chief strategist warnsOdeon Capital Group chief financial strategist Dick Bove predicts big bank earnings won't continue to be 'very strong' if the economy slows down and loan demand slides.

Leer más »

U.S. stock futures slip after 'crazy' rally as key bank reports, retail sales data loomU.S. stock futures slipped Friday after what's been called one of the craziest market days in history, showing the difficulty stocks will face in sustaining...

U.S. stock futures slip after 'crazy' rally as key bank reports, retail sales data loomU.S. stock futures slipped Friday after what's been called one of the craziest market days in history, showing the difficulty stocks will face in sustaining...

Leer más »

Inflation is busting bank accounts across America. Cash-strapped voters vent frustrationsPeople in Washington, Tennessee, New Jersey and Oklahoma sound off on the ongoing effects of inflation as experts predict September numbers will hit 40-year-highs.

Inflation is busting bank accounts across America. Cash-strapped voters vent frustrationsPeople in Washington, Tennessee, New Jersey and Oklahoma sound off on the ongoing effects of inflation as experts predict September numbers will hit 40-year-highs.

Leer más »