Fear trickled through the bank sector following the collapses of Silicon Valley Bank and Signature Bank last week, prompting major federal intervention over the weekend to backstop uninsured deposits at Silicon Valley Bank in a bid to halt panic.

Silicon Valley Bank's collapse in particular marked the most significant banking failure in the United States since Washington Mutual faltered in 2008. More broadly, blowback from the cratering of the two banks could wreak havoc across the economy, a fate government authorities are desperate to avert.Here's everything you may have missed about the banking meltdown.Silicon Valley Bank was founded in the 1980s and helped fund tech startups across the country.

This is because higher rates meant that new bonds and treasuries earned more for investors than older ones. As a result, the older assets that Silicon Valley Bank stockpiled became less desirable and therefore shed value. On Thursday, customers withdrew $42 billion in a single day. For comparison, Washington Mutual"lost $16 billion over 10 days" during the financial crisis of 2008, according to Sen. Mark Warner .

"Let me be clear that during the financial crisis, there were investors and owners of systemic large banks that were bailed out," Yellen told CBS."The reforms that have been put in place mean we are not going to do that again." Simultaneously, the Fed announced plans to offer banks a separate facility to help them meet depositor withdrawals Sunday. Under the mechanism, banks can take heavily collateralized loans to up their cash to meet service requirements for withdrawals and other needs.

Similar to Silicon Valley Bank, many of Signature Bank's assets shed value as interest rates spiked. Authorities at the Treasury, Fed, and FDIC declared that as with those at Silicon Valley Bank, deposits at Signature Bank will be available Monday.Since the fallout from Silicon Valley Bank and Signature Bank, attention has turned to a roughly $620 billion hole in the banking system.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Leer más »

![]() Silicon Valley Bank Collapse: US Moves to Protect Deposits, HSBC to Buy SVB's UK SubsidiaryGovernments in the U.S. and Britain are taking extraordinary steps to stop a potential banking crisis after the historic failure of Silicon Valley Bank.

Silicon Valley Bank Collapse: US Moves to Protect Deposits, HSBC to Buy SVB's UK SubsidiaryGovernments in the U.S. and Britain are taking extraordinary steps to stop a potential banking crisis after the historic failure of Silicon Valley Bank.

Leer más »

![]() Silicon Valley Bank collapse: How SVB stock price performed in 5 yearsSilicon Valley Bank had been rated as one of the top banks in America for five years before its closure by U.S. regulators in March 2023.

Silicon Valley Bank collapse: How SVB stock price performed in 5 yearsSilicon Valley Bank had been rated as one of the top banks in America for five years before its closure by U.S. regulators in March 2023.

Leer más »

![]() SVB collapse: HSBC buys Silicon Valley Bank's UK branch for just over $1HSBC acquired the U.K. branch of the failing Silicon Valley Bank for just 1 pound, or $1.21.

SVB collapse: HSBC buys Silicon Valley Bank's UK branch for just over $1HSBC acquired the U.K. branch of the failing Silicon Valley Bank for just 1 pound, or $1.21.

Leer más »

![]() Bank regulators seize Silicon Valley Bank in largest bank failure since the Great RecessionThe bank failed after depositors — mostly technology workers and venture capital-backed companies — began withdrawing their money creating a run on the bank.

Bank regulators seize Silicon Valley Bank in largest bank failure since the Great RecessionThe bank failed after depositors — mostly technology workers and venture capital-backed companies — began withdrawing their money creating a run on the bank.

Leer más »

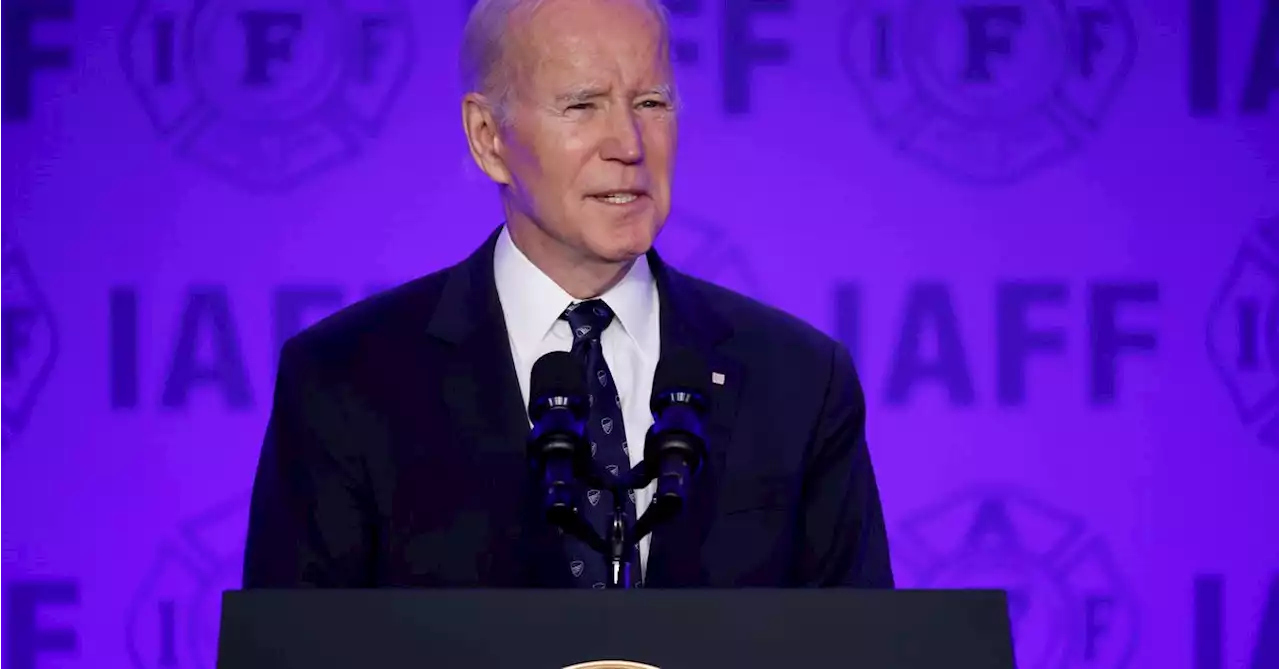

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

Leer más »