Like water and electricity, bank deposits are and should be guarded by the government.

The U.S. has a fractional reserve banking system: for every dollar banks lend out, 85 cents comes from deposits and 15 cents from their own equity. The problem with deposits, as we saw with the demise of Silicon Valley Bank, is that depositors are fickle – they can ask for their money back at any time.

Bank runs occur when depositors lose confidence in the bank and demand their money, depleting the bank’s reserves and forcing it into bankruptcy. At the beginning of the 20th century, bank runs were common, leading to the establishment of the Federal Reserve in 1913. The Fed was created to act as a lender of last resort to help prevent bank runs from occurring.

Eventually, bailouts introduce so much risk into the system that failures and bailouts become too costly for the society to bear, government creates draconian rules trying to prevent them in future, which in turn kills innovation and the formation of new businesses, and the result is a stagnating economy.

Investors can influence the behavior of a bank. Fearing loss, not just being jubilant about prospective gain, makes equity and bond investors extremely mindful about their investment decisions and in the end reduces risk in the system overall.As a society, we want depositors to be mindless, not mindful, when they put money into a bank. People shouldn’t have to become financial analysts to buy a CD.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Failed Banks Shouldn't Be Cash Machines for Disgraced Execut...In debates about who to blame for failures at Silicon Valley Bank and Signature Bank, and fears of contagion as we see UBS buy out Credit Suisse, a major angle is being overlooked: the wide swath of common ground on this issue.

Failed Banks Shouldn't Be Cash Machines for Disgraced Execut...In debates about who to blame for failures at Silicon Valley Bank and Signature Bank, and fears of contagion as we see UBS buy out Credit Suisse, a major angle is being overlooked: the wide swath of common ground on this issue.

Leer más »

European banks launch ‘sustainable’ blockchain platform for digital bondsThe platform will enable institutional clients to issue, trade, and settle bonds digitally, providing a more efficient and secure process than traditional methods.

European banks launch ‘sustainable’ blockchain platform for digital bondsThe platform will enable institutional clients to issue, trade, and settle bonds digitally, providing a more efficient and secure process than traditional methods.

Leer más »

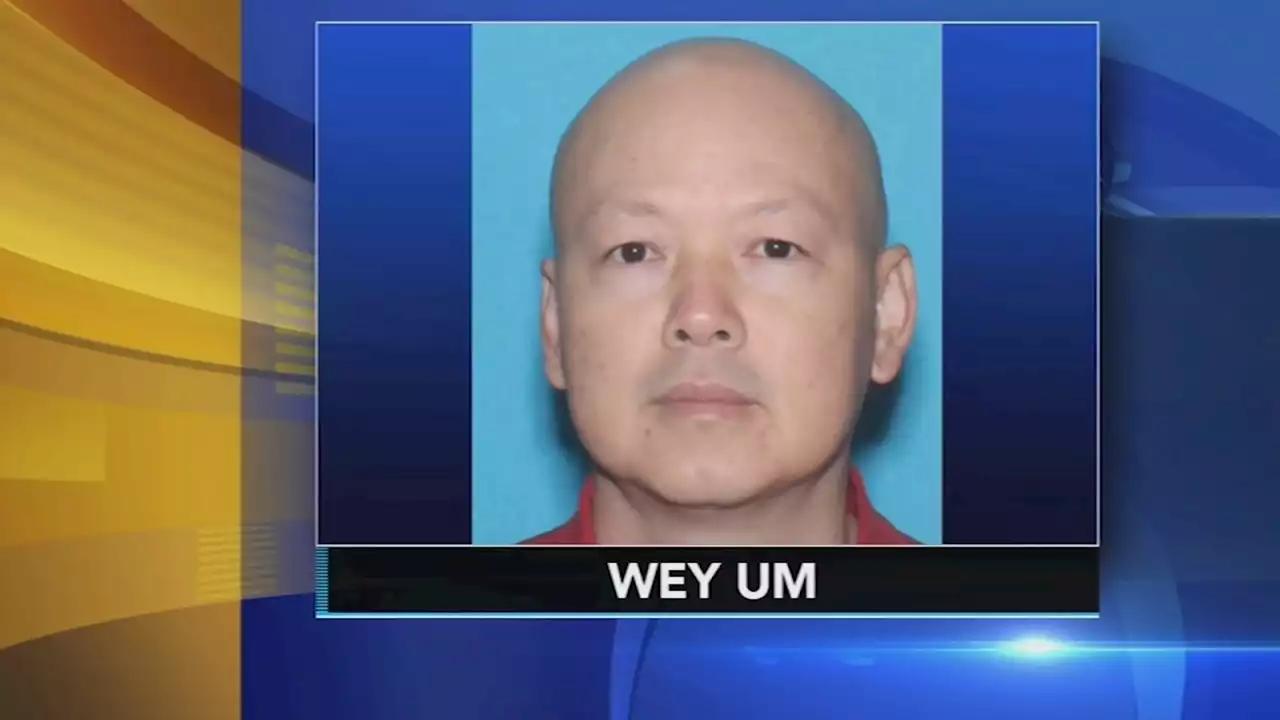

Sources: Authorities search Delaware River banks in connection with Philadelphia abductionPolice have been searching for 48-year-old Wey Um who vanished during the early morning hours of March 31.

Sources: Authorities search Delaware River banks in connection with Philadelphia abductionPolice have been searching for 48-year-old Wey Um who vanished during the early morning hours of March 31.

Leer más »

Asia Pacific Market: Struggles to make headway as central banks, job numbers prod bullsAsia Pacific Market: Struggles to make headway as central banks, job numbers prod bulls – by anilpanchal7 Asia RiskAversion Equities Fed Employment

Asia Pacific Market: Struggles to make headway as central banks, job numbers prod bullsAsia Pacific Market: Struggles to make headway as central banks, job numbers prod bulls – by anilpanchal7 Asia RiskAversion Equities Fed Employment

Leer más »

Exclusive: Europe's banks ramp up bespoke loan trades to reduce riskEuropean banks are increasingly turning to bespoke deals with investors such as hedge funds to offload some of the risk on multi-billion euro loan portfolios and improve their financial strength, several sources involved told Reuters.

Exclusive: Europe's banks ramp up bespoke loan trades to reduce riskEuropean banks are increasingly turning to bespoke deals with investors such as hedge funds to offload some of the risk on multi-billion euro loan portfolios and improve their financial strength, several sources involved told Reuters.

Leer más »

RBI Preview: Forecasts from five major banks, hiking 25 bps, will be the final?India’s Monetary Policy Committee (MPC) is scheduled to announce its Interest Rate Decision on Thursday, April 6 at 04:30 GMT and as we get closer to

RBI Preview: Forecasts from five major banks, hiking 25 bps, will be the final?India’s Monetary Policy Committee (MPC) is scheduled to announce its Interest Rate Decision on Thursday, April 6 at 04:30 GMT and as we get closer to

Leer más »