A small grouping of mega-cap stocks are behind almost all of the S&P 500’s 2023 rally, as investors pile back into the stocks battered last year and shun smaller-cap stocks amid macroeconomic and banking uncertainty.

A small grouping of mega-cap stocks are behind almost all of the S&P 500’s 2023 rally, as investors pile back into the stocks battered last year and shun smaller-cap stocks amid macroeconomic and banking uncertainty, though one analyst cautioned about what the concentrated rally means for the market’s broader health.Silicon Valley titans Alphabet, Apple, Meta and Nvidia, Seattle’s Amazon and Microsoft and electric vehicle giant Tesla gained more than $2.

Incredibly, those seven stocks account for 88% of the S&P’s 2023 gains, with the index up $2.4 trillion this year and 7% overall. Apple’s $549 billion in added market cap is by far the greatest of the seven stalwarts, though each stock is up more than 20% year-to-date with more than $175 billion in market cap gains apiece.

In a recent note to clients, LPL Financial strategist Jeffrey Buchbinder said “narrow leadership” in the S&P “reflects a less healthy rally than one with broader participation,” pointing out there’s a lack of technical basis for the recovery as forward-looking metrics for tech remain “stretched” thin.

And Morgan Stanley analyst Michael Wilson noted last week historical data disagrees with the notion that big tech companies are a defensive play, as their gains in recent weeks as cracks in the U.S. banking system emerged may suggest, cautioning against investing in the sector until there’s a clear bottoming among the broader market.for tech, with the Nasdaq composite sliding 33%, captained by Meta and Tesla’s more than 60% losses.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Washington vows to tackle AI, as tech titans and critics descendAfter years of inaction on Big Tech — and the explosive success of ChatGPT — lawmakers aim to avoid similar mistakes with artificial intelligence

Washington vows to tackle AI, as tech titans and critics descendAfter years of inaction on Big Tech — and the explosive success of ChatGPT — lawmakers aim to avoid similar mistakes with artificial intelligence

Leer más »

Day traders are buying stocks in 2023, but meme interest fading: RobinhoodRobinhood's head of investment strategy says retail traders are continuing to pile into stocks - and now favor long-term strategies over the rush of meme plays

Leer más »

Tech CEO Says Burger With Mammoth DNA Tastes DeliciousPaleo, a Belgian competitor experimenting with mammoth protein, says a plant-based burger injected with mammoth myoglobin is delicious.

Tech CEO Says Burger With Mammoth DNA Tastes DeliciousPaleo, a Belgian competitor experimenting with mammoth protein, says a plant-based burger injected with mammoth myoglobin is delicious.

Leer más »

PepsiCo exec on how to encourage tech transformation within a companyWith over two decades of technology implementation experience, Kanioura shared insight into how companies — big or small — can strategically implement new tools internally. Presented by sapbtp.

Leer más »

Seattle, hit by tech cuts and pandemic, tries to rebootThe city, which has sustained rapid tech growth, is looking for its next act.

Seattle, hit by tech cuts and pandemic, tries to rebootThe city, which has sustained rapid tech growth, is looking for its next act.

Leer más »

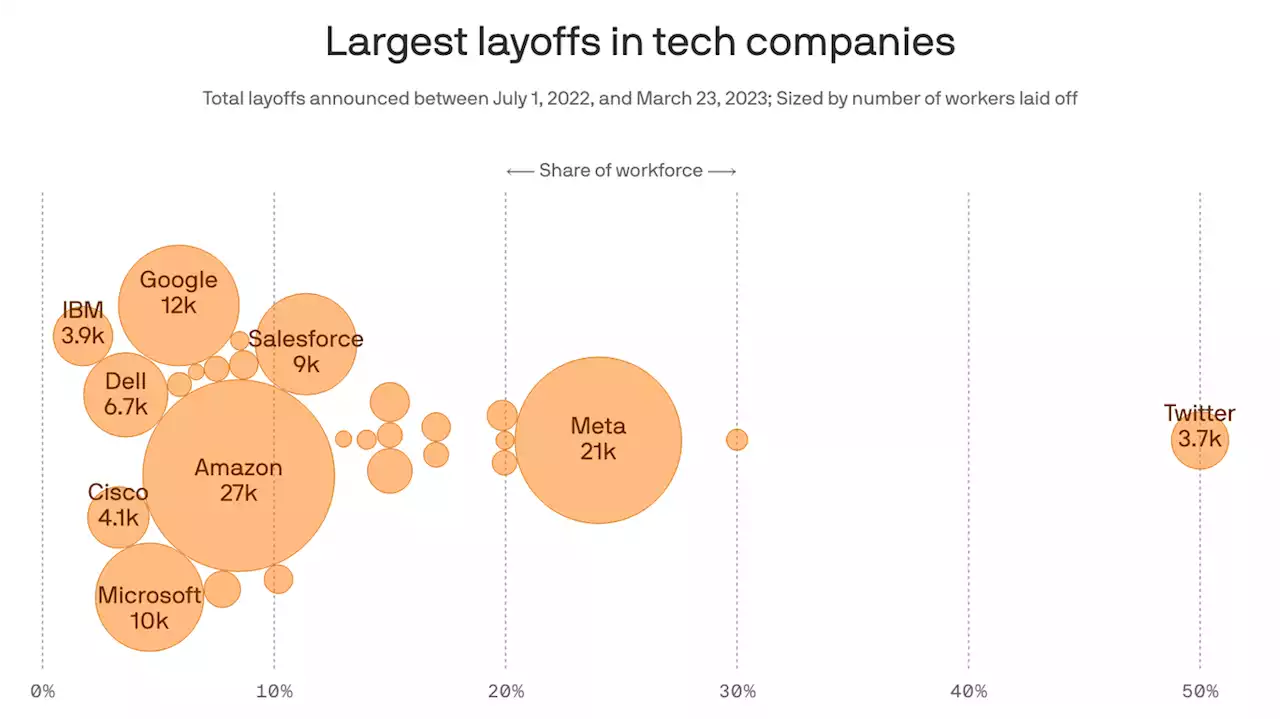

After nine months of layoffs, Big Tech sees signs of a turnaroundLayoffs are often understood as an indicator of incipient recession, and stock prices typically fall in step with both of those trends.

After nine months of layoffs, Big Tech sees signs of a turnaroundLayoffs are often understood as an indicator of incipient recession, and stock prices typically fall in step with both of those trends.

Leer más »