U.S. consumers have flooded banking giants, including JPMorgan Chase & Co , Bank of America Corp and Citigroup Inc with deposits after the collapse of Silicon Valley Bank, sources familiar with the matter said.

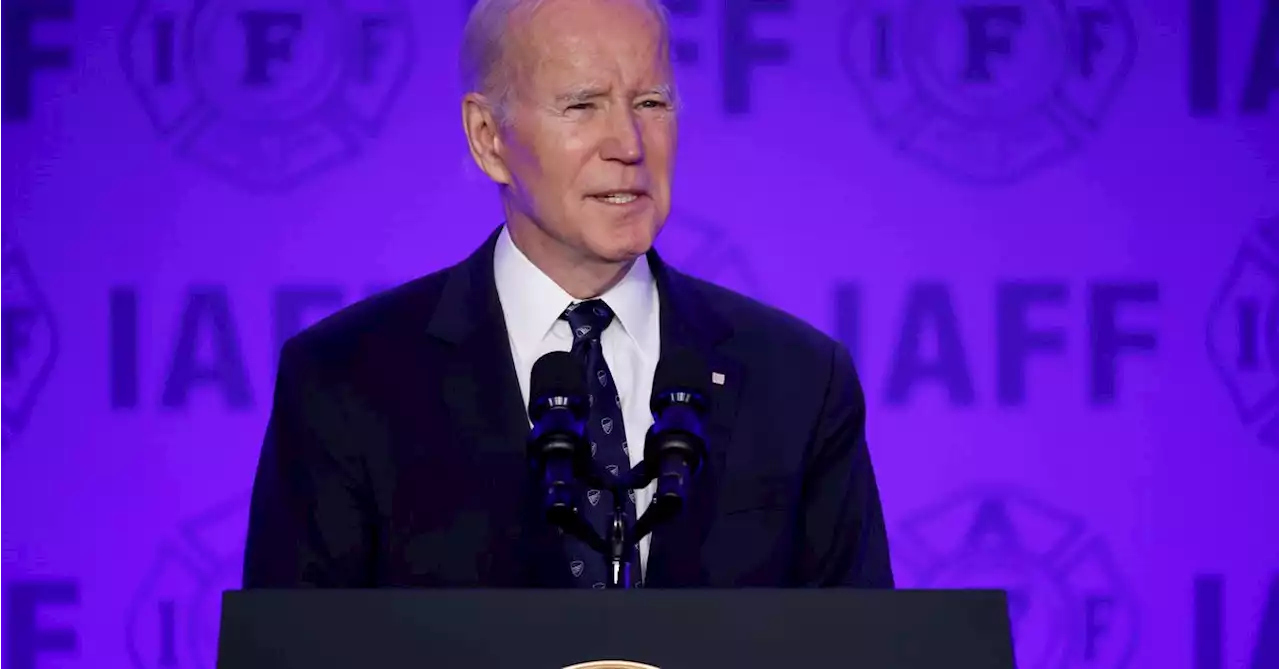

The transfers, which one source said reached billions of dollars, came as investors fretted over the financial health of smaller regional lenders even after receiving assurances from U.S. President Joe Biden and other policymakers.

Large banks saw in influx of money from consumers and businesses in the last week as SVB teetered, one of the sources told Reuters. But the lenders have been careful not to solicit customers from other banks, many of whose stocks have plunged, out of concern that they could accelerate the outflows, two sources said.Latest Updates

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

JPMorgan, PNC among suitors for SVB Financial in deal excluding SVB Bank - AxiosJPMorgan Chase & Co and PNC Financial Service Group Inc are among those in talks about acquiring SVB Financial Group in a deal that would exclude its commercial banking unit Silicon Valley Bank that is currently under U.S. control, Axios reported on Monday citing sources.

Leer más »

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

President Biden Calls for Stronger Bank Regulations in Wake of SVB, Signature Bank CollapsesWhile depositors were protected, managements and investors with collapsed lenders SVB and Signature Bank will receive no bailout, said President Biden on Monday morning. nikhileshde reports

Leer más »

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

SVB collapse: The Treasury must make whole SVB investorsThe Treasury Department is right to ensure that investors at Silicon Valley Bank have access to their deposits.

Leer más »

JPMorgan, other big U.S. banks flooded with new clients post SVB collapse-FTA wave of customers have applied to shift their accounts to large U.S. banks such as JPMorgan Chase & Co and Citigroup Inc from smaller lenders after the collapse of Silicon Valley Bank, the Financial Times reported on Tuesday.

JPMorgan, other big U.S. banks flooded with new clients post SVB collapse-FTA wave of customers have applied to shift their accounts to large U.S. banks such as JPMorgan Chase & Co and Citigroup Inc from smaller lenders after the collapse of Silicon Valley Bank, the Financial Times reported on Tuesday.

Leer más »

Dow futures unsteady as stock-market investors watch efforts to avert SVB-inspired bank crisisU.S. equity markets traded unevenly Sunday afternoon, in the aftermath of the failure of Silicon Valley Bank on Friday, which has cast a pall over the...

Dow futures unsteady as stock-market investors watch efforts to avert SVB-inspired bank crisisU.S. equity markets traded unevenly Sunday afternoon, in the aftermath of the failure of Silicon Valley Bank on Friday, which has cast a pall over the...

Leer más »

Treasury, Fed and FDIC joint statement on SVB and Signature Bank: full text'All depositors of this institution will be made whole ... no losses will be borne by the taxpayer': Read Sunday's full statement from the Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Treasury, Fed and FDIC joint statement on SVB and Signature Bank: full text'All depositors of this institution will be made whole ... no losses will be borne by the taxpayer': Read Sunday's full statement from the Treasury, Federal Reserve and Federal Deposit Insurance Corp.

Leer más »