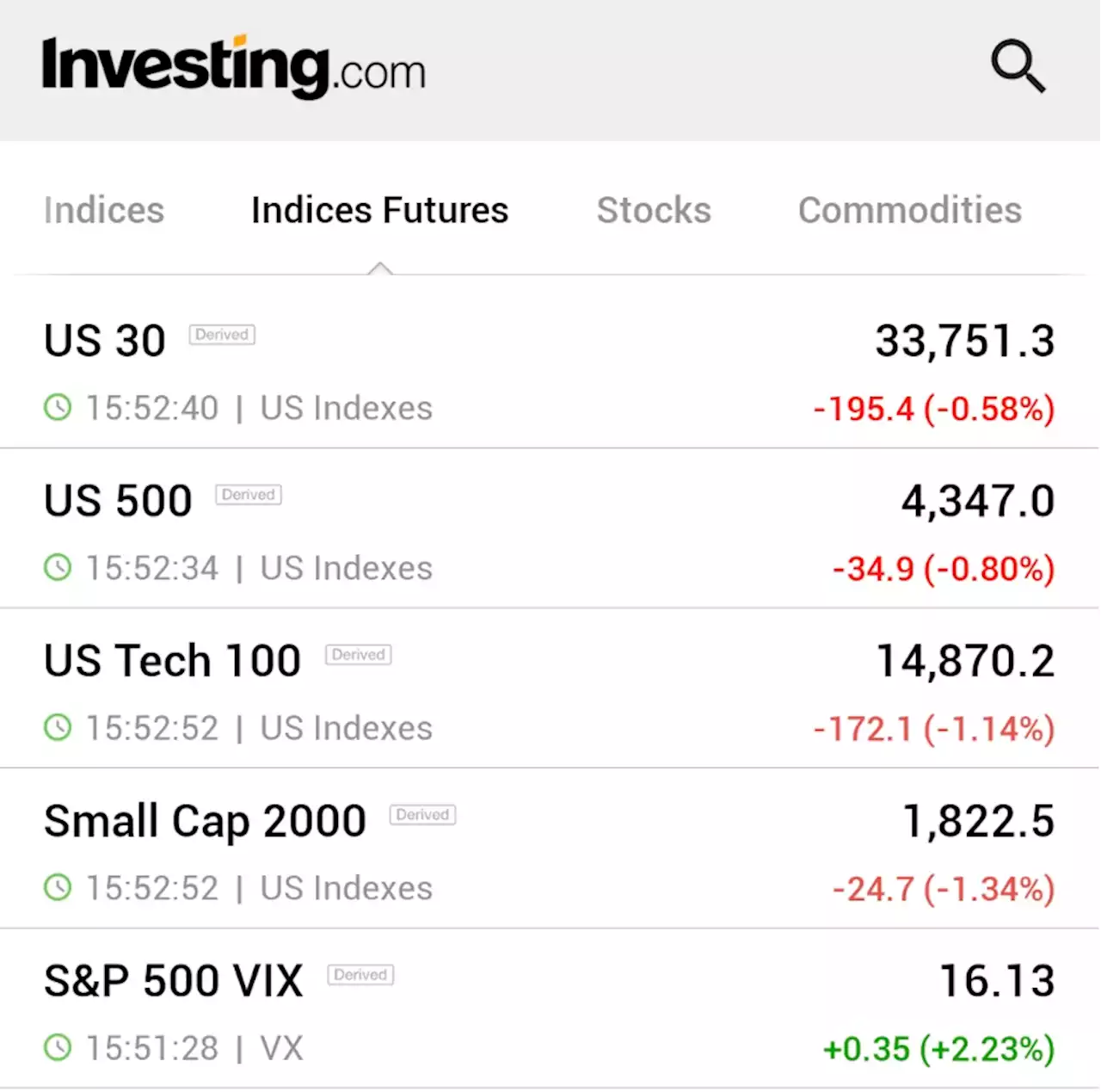

Wall Street's main indexes fell on Friday and were set for weekly declines as hawkish comments from Federal Reserve officials fueled worries of interest rates staying higher for longer.

"You're seeing a little bit of profit taking after a big run," said Michael James, managing director of equity trading at Wedbush Securities.

"We're clearly overbought and without proof being demonstrated by the Bulls, it is going to be a tough slog from here to make higher highs, especially with the weakness that we're seeing overseas this week."CME Group's FedWatch toolYields on the 2-year, which best reflects interest rate expectations, dropped to hover at 4.77% on Friday, in line with the European bond market following weaker-than-expected euro zone data.

On the data front, S&P Global's Purchasing Managers' Index for both U.S. manufacturing and services activity business activity fell to a three-month low in June as services growth eased for the first time this year and the contraction in the manufacturing sector deepened.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Wall Street opens lower as hawkish Fed saps market moodWall Street's main indexes opened lower on Friday as investor sentiment remained damp due to the hawkish interest-rate outlook by Federal Reserve Chair Jerome Powell in his two-day congressional testimony.

Wall Street opens lower as hawkish Fed saps market moodWall Street's main indexes opened lower on Friday as investor sentiment remained damp due to the hawkish interest-rate outlook by Federal Reserve Chair Jerome Powell in his two-day congressional testimony.

Leer más »

Here are Friday's biggest analyst calls: Meta, Apple, Uber, Target, SoFi, Nike, Amazon, GM & moreHere are Friday's biggest calls on Wall Street.

Here are Friday's biggest analyst calls: Meta, Apple, Uber, Target, SoFi, Nike, Amazon, GM & moreHere are Friday's biggest calls on Wall Street.

Leer más »

Wall St falls as hawkish Fed comments sap risk appetite By Reuters⚠️BREAKING: *U.S. STOCK FUTURES TUMBLE ON RATE HIKE WORRIES, GROWTH FEARS $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Wall St falls as hawkish Fed comments sap risk appetite By Reuters⚠️BREAKING: *U.S. STOCK FUTURES TUMBLE ON RATE HIKE WORRIES, GROWTH FEARS $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Leer más »

Speed cameras proposed for problem areas of Seattle to curtail street racingPeople in Seattle are fed up with street racing.

Speed cameras proposed for problem areas of Seattle to curtail street racingPeople in Seattle are fed up with street racing.

Leer más »

Despite recent good news, many on Wall Street still see a recession comingThe economy is facing a number of dangers ahead that could cause at least a mild contraction.

Despite recent good news, many on Wall Street still see a recession comingThe economy is facing a number of dangers ahead that could cause at least a mild contraction.

Leer más »

Wall Street's most pessimistic bank sees improving prospects for U.S. inflationDeutsche Bank expects the Federal Reserve's favorite inflation gauge to fall further than the central bank thinks by year-end.

Wall Street's most pessimistic bank sees improving prospects for U.S. inflationDeutsche Bank expects the Federal Reserve's favorite inflation gauge to fall further than the central bank thinks by year-end.

Leer más »