A critical inflation report next week will test a U.S. stock market already consumed by worries over Federal Reserve hawkishness and potential fallout from the largest bank failure since the financial crisis.

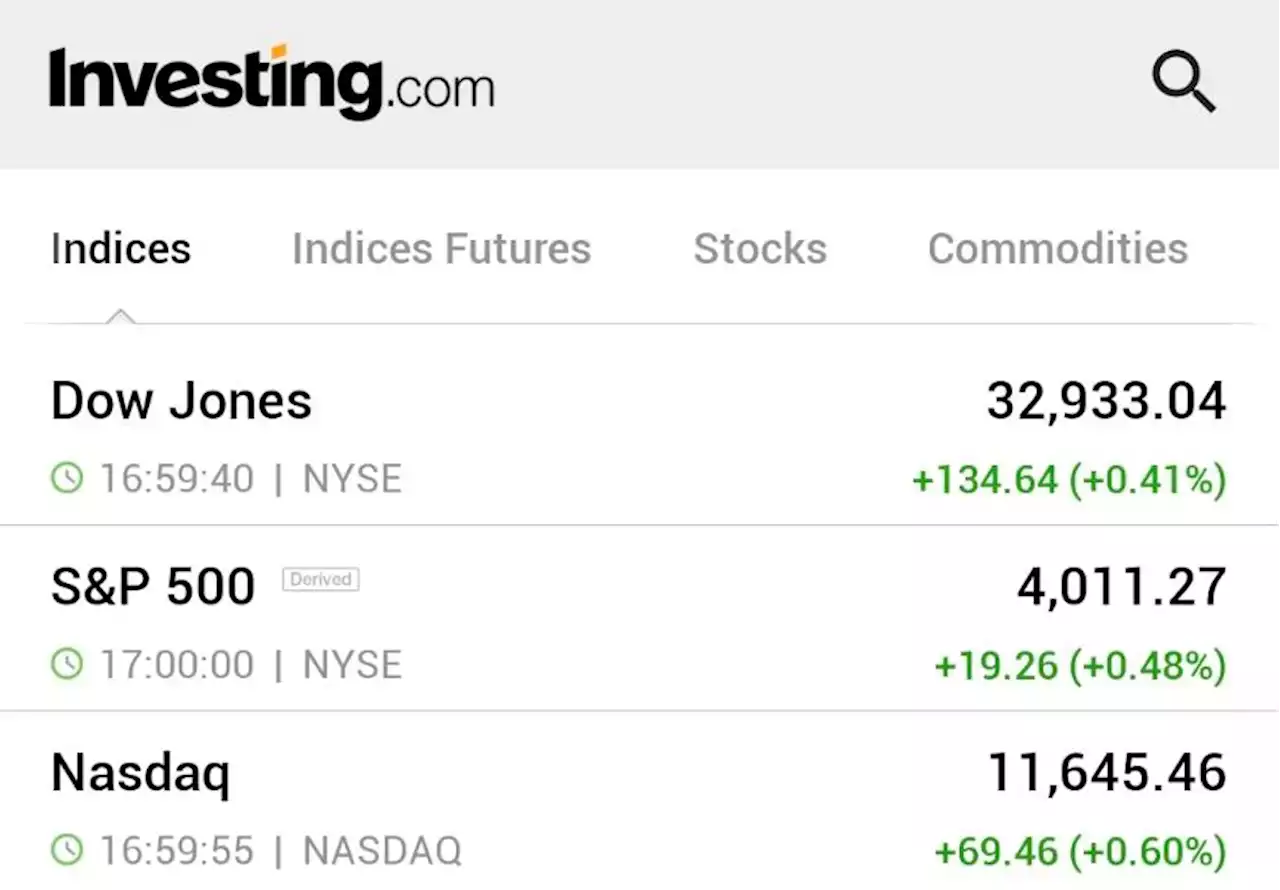

The S&P 500 sank on Friday, bringing the weekly loss to 4.5%. After a big rebound in January, the benchmark index is now clinging to a 0.6% gain for 2023.

On Friday, markets appeared to be dialing down their expectations for Fed hawkishness, pricing in a 40% chance that the central bank will raise rates by 50 basis points at their March 21-22 meeting, according to CME's Fedwatch tool. Those odds stood at around 70% as recently as Thursday, but abated on Friday after investors saw the employment data and gained more clarity on the extent of SVB’s troubles.

While moderation of annual inflation from a peak of 9% last year to current levels was the "easy move", going from 6% to 3% will be more difficult, said John Lynch, chief investment officer for Comerica Wealth Management.Markets have been more volatile on average on CPI days over the past year, with the S&P 500 moving an average of 1.8% in either direction on those days against an average 1.2% daily move overall in that time frame.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

![]() A major inflation report and fallout from Silicon Valley Bank hang over markets in week aheadFebruary's consumer inflation report should be a big driver for markets in the week ahead, as investors watch the fallout from the Silicon Valley Bank shutdown.

A major inflation report and fallout from Silicon Valley Bank hang over markets in week aheadFebruary's consumer inflation report should be a big driver for markets in the week ahead, as investors watch the fallout from the Silicon Valley Bank shutdown.

Leer más »

USD/MXN fades bounce off September 2017 levels ahead of Mexican inflationUSD/MXN eases to 17.96 during early Thursday, after a failed attempt to recover from the lowest levels since September 2017, tested the previous day.

USD/MXN fades bounce off September 2017 levels ahead of Mexican inflationUSD/MXN eases to 17.96 during early Thursday, after a failed attempt to recover from the lowest levels since September 2017, tested the previous day.

Leer más »

Markets on Edge Ahead of Jobs and Inflation ReportsInvestors are eagerly, and nervously, looking forward to data reports due over the next few days amid worries that a hot economy could translate to tighter monetary policy

Markets on Edge Ahead of Jobs and Inflation ReportsInvestors are eagerly, and nervously, looking forward to data reports due over the next few days amid worries that a hot economy could translate to tighter monetary policy

Leer más »

Wall St opens higher ahead of payrolls data By Reuters⚠️BREAKING: *WALL ST OPENS HIGHER AFTER JOBLESS CLAIMS RISE MORE THAN EXPECTED - $DIA $SPY $QQQ 🇺🇸🇺🇸

Wall St opens higher ahead of payrolls data By Reuters⚠️BREAKING: *WALL ST OPENS HIGHER AFTER JOBLESS CLAIMS RISE MORE THAN EXPECTED - $DIA $SPY $QQQ 🇺🇸🇺🇸

Leer más »

Asian stocks follow Wall St lower ahead of US jobs updateAsian stock markets have followed Wall Street lower ahead of an update on United States employment amid worries about possible further interest rate hikes

Asian stocks follow Wall St lower ahead of US jobs updateAsian stock markets have followed Wall Street lower ahead of an update on United States employment amid worries about possible further interest rate hikes

Leer más »

Asian markets follow Wall Street lower ahead of U.S. jobs updateAsian stock markets followed Wall Street lower Friday ahead of an update on U.S. employment amid worries about possible further interest rate hikes

Asian markets follow Wall Street lower ahead of U.S. jobs updateAsian stock markets followed Wall Street lower Friday ahead of an update on U.S. employment amid worries about possible further interest rate hikes

Leer más »