Wall Street’s hope has been that slowing inflation could get the Fed to take it easier on rates, while a small cadre of stocks soared to incredible heights amid a frenzy around artificial-intellige…

Another drop for stocks on Friday helped drag Wall Street to its first losing week in the last six.

Europe’s economy appears to be weaker than expected, according to a preliminary report measuring manufacturing and services businesses. That added to the week’s hesitance in markets, caused by a crank higher in interest rates by central banks around the world as they try to get high inflation under control. High rates drive down inflation by slowing the economy, which raises the risk of a recession.

Much of the exuberance was because the U.S. economy had managed to avoid a recession, even though the Fed hiked rates at a breakneck pace since early 2022. The job market in particular has remained remarkably solid. “Early in the hiking cycle, the focus was on avoiding a recession,” he said. “However, with persistently high inflation, the focus has shifted from erring on the side of doing too little to doing too much.”

A slower economy could mean pressure on demand for energy, and the price for a barrel of benchmark U.S. oil fell 35 cents to $69.16 after paring earlier, sharper losses. Brent crude, the international standard, dipped 29 cents to $73.85 per barrel. On the winning side of the stock market Friday was CarMax. It jumped 10.1% after reporting much stronger profit for the latest quarter than analyst expected.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

Wall Street opens lower as hawkish Fed saps market moodWall Street's main indexes opened lower on Friday as investor sentiment remained damp due to the hawkish interest-rate outlook by Federal Reserve Chair Jerome Powell in his two-day congressional testimony.

Wall Street opens lower as hawkish Fed saps market moodWall Street's main indexes opened lower on Friday as investor sentiment remained damp due to the hawkish interest-rate outlook by Federal Reserve Chair Jerome Powell in his two-day congressional testimony.

Leer más »

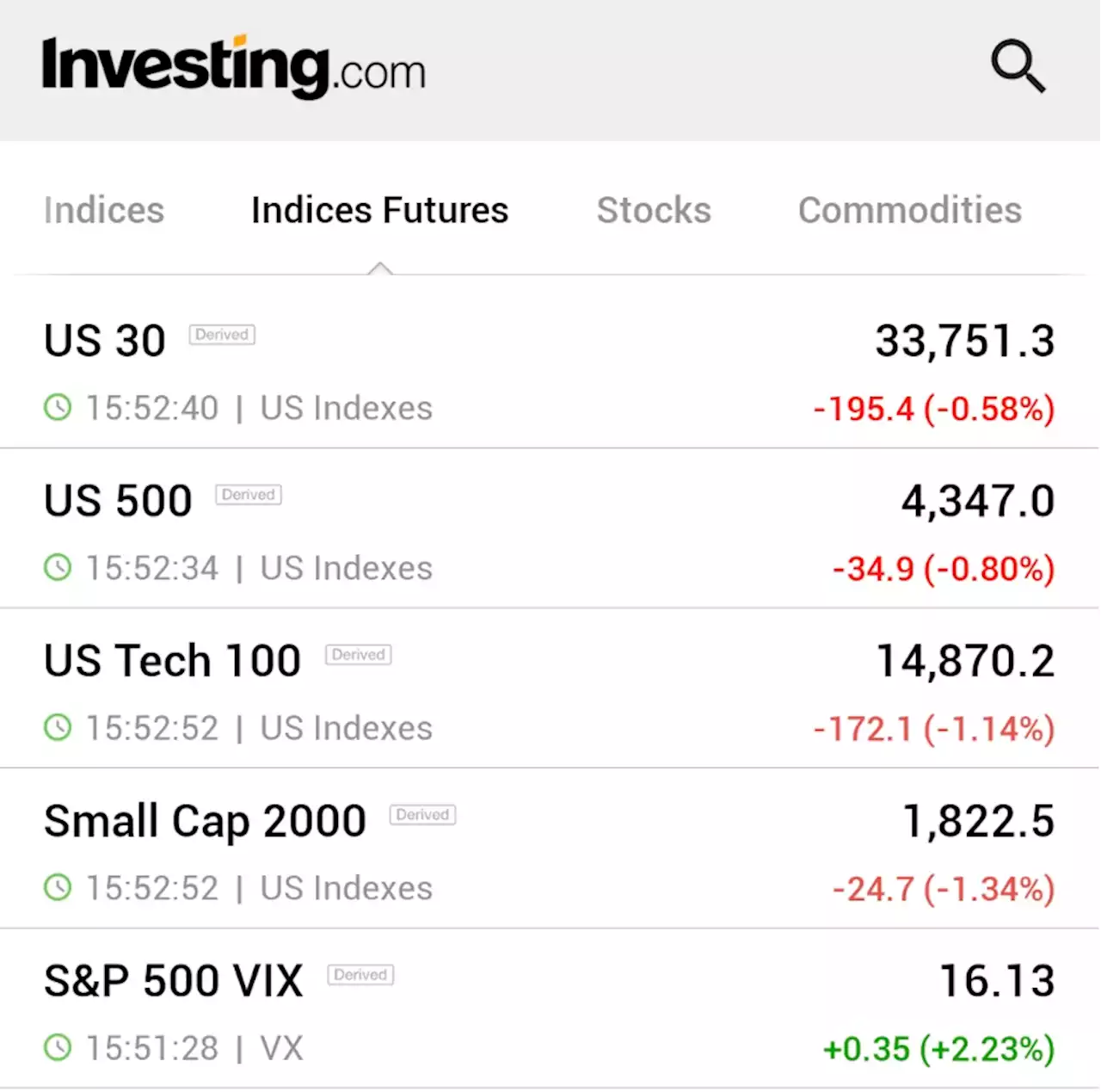

Wall St falls as hawkish Fed comments sap risk appetite By Reuters⚠️BREAKING: *U.S. STOCK FUTURES TUMBLE ON RATE HIKE WORRIES, GROWTH FEARS $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Wall St falls as hawkish Fed comments sap risk appetite By Reuters⚠️BREAKING: *U.S. STOCK FUTURES TUMBLE ON RATE HIKE WORRIES, GROWTH FEARS $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Leer más »

Wall St falls as hawkish Fed comments sap risk appetiteWall Street's main indexes fell on Friday and were set for weekly declines as hawkish comments from Federal Reserve officials fueled worries of interest rates staying higher for longer.

Wall St falls as hawkish Fed comments sap risk appetiteWall Street's main indexes fell on Friday and were set for weekly declines as hawkish comments from Federal Reserve officials fueled worries of interest rates staying higher for longer.

Leer más »

First 'Dumb Money' Trailer: GameStop Breaks Wall StreetThe first Red Band trailer for DumbMoney sees Paul Dano, Shailene Woodley, Pete Davidson, and more stunning Wall Street with the short squeeze of a lifetime. Watch it now:

First 'Dumb Money' Trailer: GameStop Breaks Wall StreetThe first Red Band trailer for DumbMoney sees Paul Dano, Shailene Woodley, Pete Davidson, and more stunning Wall Street with the short squeeze of a lifetime. Watch it now:

Leer más »

Paul Dano takes on Wall Street in first trailer for Dumb MoneyDumb Money’s first trailer has us rooting for amateur Reddit investors

Paul Dano takes on Wall Street in first trailer for Dumb MoneyDumb Money’s first trailer has us rooting for amateur Reddit investors

Leer más »

This Wall Street bank's stock is expected to double over the next year, Jefferies saysJefferies' analysts suggest that large-scale share buy backs of about $4.7 billion over the next three years could help push up the global lender's stock price.

This Wall Street bank's stock is expected to double over the next year, Jefferies saysJefferies' analysts suggest that large-scale share buy backs of about $4.7 billion over the next three years could help push up the global lender's stock price.

Leer más »