Will the Supreme Court find that the parties in challenging the Biden administration’s student debt relief plan don’t have standing to sue? Here are some key issues to watch as $20,000 in student-debt relief per borrower will be on line this week.

Earlier this month, Sottosanto finished paying off his private student loans, which once totaled roughly $30,000 a step he said he could only afford to take because of the pandemic-era freeze on payments, collections and interest on the other portion of his student debt, the $16,900 he owes the federal government.

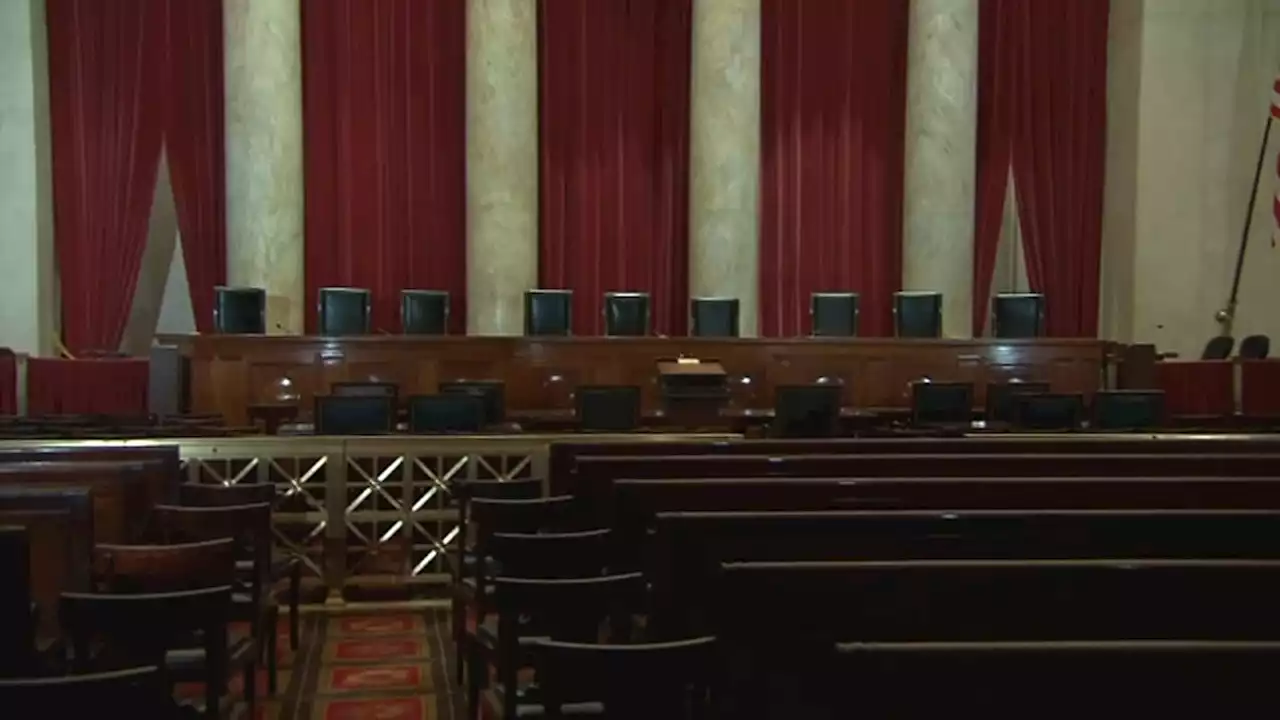

But if the Supreme Court knocks down the debt cancellation program, Sottosanto said he’ll have to continue to delay his plans to secure the stability he thought would come with a college degree. Though the court likely won’t issue its decision until June, borrowers and court watchers may get a sense of how the justices are thinking about the two major legal questions at issue in the suits when the attorneys present their oral arguments to the nine Supreme Court justices on Tuesday.

Their suit is backed by the Job Creators Network, an organization launched by Bernard Marcus, the co-founder of Home Depot and a supporter of former President Donald Trump. Bray and William Baude, a professor at the University of Chicago Law School, wrote in a friend of the court brief that Missouri and the other states don’t meet that standard. For example, the states have argued that the debt-relief plan could cost MOHELA revenue it receives through servicing federal student loans and that could put the organization at risk of not paying on a debt it owes to Missouri. But, as Bray and Baude’s brief notes, MOHELA hasn’t paid on that debt in years.

It’s possible that some of the justices may want to “get creative” in how they decide whether the states have standing, said Christopher Walker, a professor at the University of Michigan School of Law. Roberts is particularly sensitive to situations where it appears the government is playing games with procedural rules, he said. He cited Roberts’ criticism in two cases of Trump administration officials searching for legal justification to take actions that were more about policy or politics.

“One of the reasons we’ve had such a sense of stalemate for executive action over the last six years is this ability of state attorneys general of the opposite party to stop any major initiative by the president whether it’s a Republican or a Democrat,” Bray said. If, however, the justices do find the plaintiffs have the right to sue then they can consider the merits of the case or whether the law gives the Biden administration the power to cancel student debt.

“When courts normally engage in statutory interpretation they’re looking for what’s the most likely or what’s the best interpretation,” Rubenstein said. When the major questions doctrine comes into play, the question changes, he added. “You’re not looking for the best interpretation, you’re looking at whether Congress clearly authorized” the agency policy.

Will the justices spend most of their time talking about standing or the merits? Tuesday’s session won’t provide any clarity for student loan borrowers about the future of the Biden administration’s debt relief program, but they might get a sense of how the justices are thinking about these questions.

“Do the justices think of this case as a one off or as a part of a larger disturbing trend? And if they think of it as a larger disturbing trend, which one of two trends do they think of?” he said. “Do they think of it in terms of executive overreach to do things, big things that are not authorized by Congress? Or do they see it as part of a broader disturbing trend of states suing the federal government with fairly tenuous standing claims while seeking very, very broad remedies.

Leigh Buettler, who follows updates on student loan news through the Student Debt Crisis Center, said she has found this kind of advocacy “exciting and empowering.” She added that it gives her some hope for a better future for student loan borrowers, regardless of the Supreme Court’s decision. And indeed, advocacy groups have pledged that if the court strikes down this debt relief plan they’ll push the Biden Administration to find another way to cancel student debt.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

$20 million gift to SMU supports engineering researchThe funds will support research, provide financial assistance to doctoral students and pay for undergraduate scholarships, as well as endow the school’s dean...

$20 million gift to SMU supports engineering researchThe funds will support research, provide financial assistance to doctoral students and pay for undergraduate scholarships, as well as endow the school’s dean...

Leer más »

SMU Lyle School of Engineering Receives $20 Million GiftSMU has received a $20 million gift earmarked for the Lyle School of engineering from philanthropists Richard and Mary Templeton.

SMU Lyle School of Engineering Receives $20 Million GiftSMU has received a $20 million gift earmarked for the Lyle School of engineering from philanthropists Richard and Mary Templeton.

Leer más »

How the Supreme Court could reshape the internet as you know it'Would Google collapse, and the internet be destroyed,' Justice Alito asked a Google attorney on Tuesday, 'if YouTube and therefore Google were potentially liable' for the content its users posted?

How the Supreme Court could reshape the internet as you know it'Would Google collapse, and the internet be destroyed,' Justice Alito asked a Google attorney on Tuesday, 'if YouTube and therefore Google were potentially liable' for the content its users posted?

Leer más »

Supreme Court Justice Thomas Moore Has Personal Experience With Student LoansThe Supreme Court won’t have far to look for a personal take on the “crushing weight” of student debt that underlies the Biden administration’s college loan forgiveness plan.

Supreme Court Justice Thomas Moore Has Personal Experience With Student LoansThe Supreme Court won’t have far to look for a personal take on the “crushing weight” of student debt that underlies the Biden administration’s college loan forgiveness plan.

Leer más »

Supreme Court to hear GOP state challenge to pandemic-related Biden student loan debt relief planThe U.S. Supreme Court is set to hear oral arguments Tuesday pertaining to GOP-led states aiming to block President Biden's student debt forgiveness plan.

Supreme Court to hear GOP state challenge to pandemic-related Biden student loan debt relief planThe U.S. Supreme Court is set to hear oral arguments Tuesday pertaining to GOP-led states aiming to block President Biden's student debt forgiveness plan.

Leer más »