Western Texas Intermediate (WTI), the US crude oil benchmark traders, prolong their pain as WTI drops to new four-week lows of $77.68 per barrel, cour

tesy of weakening business activity worldwide, as reported by S&P Global PMIs. That, alongside a drop in US crude inventories, were headwinds for Oil prices. WTI trades at $78.90 per barrel, down 0.54%.S&P Global revealed PMIs worldwide, which showed that manufacturing and business services activity is deteriorating. Japan, the, the UK, and the US reported that PMI declined more than expected, mainly in Germany.

US gasoline inventories rose 1.5 million barrels, almost double analysts’ estimates of an 888K barrels drop, according to data from the US Energy Information Administration . At the same time, US crude stockpiles plunged by 6.1 million barrels to 433.5 million barrels last week. Sources cited by Reuters said, “While refiners continue to run at a high rate and snap up oil inventories, fuel demand hasn’t been very strong due to tough economic conditions.”The US Dollar IndexAside from this, market participants get ready for the Federal Reserve Chair Jerome Powell’s speech on Friday. Investors estimate theWTI Price Analysis: Technical outlook

The US crude oil benchmark daily chat portrays the pair turning bullish as a golden cross emerges, suggesting that further upside is expected. Also, Wednesday’s price action, forming a hammer preceded by a downtrend, gives WTI buyers two signals to step in. However, a daily close above $80.00 per barrel is needed to reinforce the bias. In that outcome, WTI’s first resistance would be the current week’s high of $82.13, followed by the year-to-date high of $84.85.

standing below $80.00, sellers could drag down prices and challenge the confluence of the 50/200-day Simple Moving Average at around $76.10/36.

México Últimas Noticias, México Titulares

Similar News:También puedes leer noticias similares a ésta que hemos recopilado de otras fuentes de noticias.

WTI dips below the $80.00 mark amid the fear of higher interest rates, China’s economic woesWestern Texas Intermediate (WTI), the US crude oil benchmark, is trading around the $79.98 mark so far on Tuesday. WTI prices remains under pressure f

WTI dips below the $80.00 mark amid the fear of higher interest rates, China’s economic woesWestern Texas Intermediate (WTI), the US crude oil benchmark, is trading around the $79.98 mark so far on Tuesday. WTI prices remains under pressure f

Leer más »

WTI remains under pressure below the $80.00 mark, eyes on US PMIWestern Texas Intermediate (WTI), the US crude oil benchmark, is trading around the $79.65 mark so far on Wednesday. WTI prices remain under selling p

WTI remains under pressure below the $80.00 mark, eyes on US PMIWestern Texas Intermediate (WTI), the US crude oil benchmark, is trading around the $79.65 mark so far on Wednesday. WTI prices remain under selling p

Leer más »

Near record-heat continues, “Harold” moves into South TexasNear record heat continues in North Texas while Tropical Storm Harold affects South Texas

Near record-heat continues, “Harold” moves into South TexasNear record heat continues in North Texas while Tropical Storm Harold affects South Texas

Leer más »

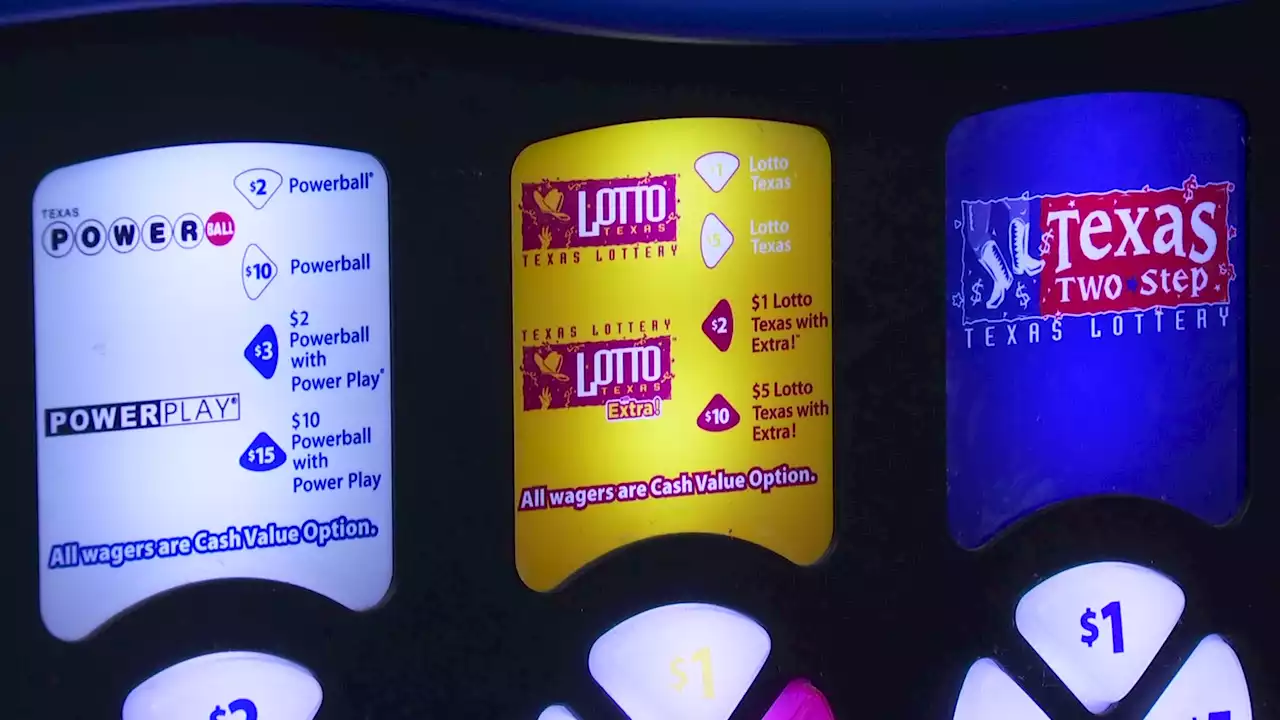

North Texan claims $8 million Lotto Texas® JackpotA North Texas resident claimed a Lotto Texas® jackpot prize worth an estimated annuitized $8 million.

North Texan claims $8 million Lotto Texas® JackpotA North Texas resident claimed a Lotto Texas® jackpot prize worth an estimated annuitized $8 million.

Leer más »